The financial news from Europe is getting increasingly distressing.

A new EU report warns that economic conditions in Portugal and Spain could “result in a high ‘snowball’ effect on the government debt.”

French financial group AXA says “there is a fatal flaw in the system and no clear way out.” They are predicting the Eurozone to break in half or completely disintegrate in the next 18 months.

Over 13% of Europe’s investors are betting on a Black Monday-style collapse in stock prices (think 1987).

Tag: banks

Jun 15 2010

Europe’s Black Swans

May 27 2010

Technologically Advanced at One Thing

MAKING MONEY!!!!

And that’s ALL, that’s what the whole business economy is geared to and who pays when they aren’t regulated and that creates huge problems, like the criminal enterprises many have become, everyone does but them and their investors!

And it’s not only what’s going on in the Gulf and oil companies and their so called best of the best…………………………… executives, it’s across the board in every big industry and big business model, MONEY is their only concern and not long term growth, getting as much as they can as quickly as they can and hope for the best and when something happens blame everyone else for their extreme failures!

May 22 2010

Sen. Sanders tells the ugly truth “We’re an Oligarchy and I think it’s getting worse”

THE Question – Is America a Democracy or an Oligarchy?

Sen. Sanders: “Right now, what ends up happening, is Big Money interests, whether in fact it is in oil and energy, whether it’s in prescription drugs . . .”

Dylan Ratigan: “BP”

Sen. Sanders: “Whether it is in banking, these guys have huge amounts of money, and the situation gets worse with the recent Citizens United Supreme Court decision, and anyone who stands up to the big money interests can expect a huge amount of 30 second ads against them. That’s the reality. Are we a Democracy, or are we an Oligarchy where the very powerful special interests exert enormous influence over our Government?”

Ratigan: “What’s your answer to that question?”

Sen. Sanders: “I think we’re an Oligarchy and I think it’s getting worse.”

Much more, plus video and transcript below the fold.

May 08 2010

WIN! Sen. Franken takes on TBTF Crooked Credit Rating agencies!

Remember how crooked accountants like Arthur Anderson helped create the Enron disaster? Well the credit rating oligopoly of the Big Three (Moody’s, Fitch and Standard & Poor’s) is doing almost the same thing, and Senator Al Franken wants to put a stop to it.

As Senator Franken told ABC news

“If a failing student paid their teacher to turn their F into an A, everyone would agree that what the teacher had done was unethical … But right now, investors are being sold a phony bill of goods. We need to protect consumers from the pay-to-play system that rewards Wall Street players at the expense of Main Street.”

Al Franken has an Amendment to the Wall St reform bill that will bring this to an end.

More below the fold

May 07 2010

Senate Saves Too Big To Fail, Orders Another Iceberg

Yippee ! Wall Street is saved !

Senator Sherrod Brown’s (D OH) amendment 3733 on the Financial Stability Act bill, to break up the Big 6 Banks into smaller ones that couldn’t take down the entire nation’s economy if they failed, itself did not pass the vote in the Senate this evening, failing by a spectacular 61 noes to 33 yeas, with 6 senators too timid to approach the subject.

http://www.senate.gov/legislat…

Not all bought and paid for yet:

YEAs — 33 votes

Begich (D-AK)

Bingaman (D-NM)

Boxer (D-CA)

Brown (D-OH)

Burris (D-IL)

Cantwell (D-WA)

Cardin (D-MD)

Casey (D-PA)

Coburn (R-OK)***** Republican

Dorgan (D-ND)

Durbin (D-IL)

Ensign (R-NV)

Feingold (D-WI)

Franken (D-MN)

Harkin (D-IA)

Kaufman (D-DE)

Leahy (D-VT)

Levin (D-MI)

Lincoln (D-AR)

Merkley (D-OR)

Mikulski (D-MD)

Murray (D-WA)

Pryor (D-AR)

Reid (D-NV)

Rockefeller (D-WV)

Sanders (I-VT)

Shelby (R-AL)***** Republican

Specter (D-PA)***** ex Republican

Stabenow (D-MI)

Udall (D-NM)

Webb (D-VA)

Whitehouse (D-RI)

Wyden (D-OR)

_______________________ end of people who don’t like Great Depressions and financial chaos

___________ Begin list of Senators who liked that Citizens United Ruling by the Supreme Court:

NAYs — 61

Akaka (D-HI)

Alexander (R-TN)

Barrasso (R-WY)

Baucus (D-MT) a small, cold, scenic state of tiny population, which votes with Utah. wtf.

Bayh (D-IN) does you wife get more insura/pharma stock options for this ?

Bennet (D-CO)

Bond (R-MO)

Brown (R-MA)

Brownback (R-KS)

Burr (R-NC)

Carper (D-DE) meh. typical.

Chambliss (R-GA)

Cochran (R-MS)

Collins (R-ME)

Conrad (D-ND)

Corker (R-TN)

Cornyn (R-TX)

Crapo (R-ID)

Dodd (D-CT) looking for that Golden Parachute……

Enzi (R-WY)

Feinstein (D-CA) meh.

Gillibrand (D-NY) really, Kirsten, how could you

Graham (R-SC)

Grassley (R-IA)

Gregg (R-NH)

Hagan (D-NC)

Hatch (R-UT)

Hutchison (R-TX)

Inhofe (R-OK)

Inouye (D-HI)

Isakson (R-GA)

Johanns (R-NE)

Johnson (D-SD)

Kerry (D-MA) meh. first no public option, an excise tax, and now this. you still suck.

Klobuchar (D-MN)

Kohl (D-WI)

Kyl (R-AZ)

Landrieu (D-LA) say, how’s the Gulf doing, Ms. Mary of Louisiana?

Lautenberg (D-NJ)

LeMieux (R-FL)

Lieberman (ID-CT) suing Atty General Holder over the tragic Ft Hood shooting information release, too

McCain (R-AZ)

McCaskill (D-MO) midwestern Blew Dawg who thinks she’s a hot shot financial whiz. ya huh. not.

McConnell (R-KY)

Menendez (D-NJ)

Murkowski (R-AK)

Nelson (D-FL)

Nelson (D-NE) at least he’s consistently not on our side

Reed (D-RI)

Risch (R-ID)

Roberts (R-KS)

Schumer (D-NY) wants to be next Majority Leader after making us all get biometric cards. Swell.

Sessions (R-AL)

Shaheen (D-NH)

Snowe (R-ME)

Tester (D-MT) meh. These netroots Dems.

Thune (R-SD)

Udall (D-CO)

Voinovich (R-OH)

Warner (D-VA)

Wicker (R-MS)

__________________ chickenhearts

Not Voting – 6

Bennett (R-UT)

Bunning (R-KY)

Byrd (D-WV) okay, you’re old and frail. pass. barely.

DeMint (R-SC)

Lugar (R-IN)

Vitter (R-LA) you don’t have enough diapers to clean anything up

Apr 30 2010

Photos and Stories from the Labor March on Wall St.

Cross-posted many places including DailyKos.

On Thursday afternoon the AFL-CIO held a rally to protest the banking bailout and demand a peoples’ bailout. There was a call for not just regulating the banks that almost took this nation down but also doing an about face and forcing the bankers to bailout the people.

Do you think Wall Street should pay for the jobs they destroyed?

“People in New York and across the country who did nothing wrong and want to work have paid for the misdeeds of the big banks with their jobs, homes and retirement savings,” said Richard Trumka, the A.F.L.-C.I.O. president.

Do the elected officials of this nation think Wall Street should pay for the jobs they destroyed?

See a few photos and read some people’s stories below.

Apr 21 2010

With Derivatives, you can Bet on anything — Even the Weather!

Introduction To Weather Derivatives

Introduction To Weather Derivatives

by Felix Carabello, Associate Director, Environmental Products, Chicago Mercantile Exchange

Weather: Risky Business

It is estimated that nearly 20% of the U.S. economy is directly affected by the weather, and that the profitability and revenues of virtually every industry – agriculture, energy, entertainment, construction, travel and others – depend to a great extent on the vagaries of temperature. […]

In a 1998 testimony to Congress, former commerce secretary William Daley stated, “Weather is not just an environmental issue; it is a major economic factor. At least $1 trillion of our economy is weather-sensitive.”

[…]

If there were only some way, to “Hedge that Bet” — against the ever present risk of Foul Weather.

No Worries — Where there’s a Market Risk, there’s always a Wall Street Way!

Apr 20 2010

Obligations of Debt — Collateralized

How does your Obligation to make your Mortgage Payments, turn into some unseen Investor’s “Income Stream”?

Easy — thanks to Derivatives and CDO’s (Collateralized Debt Obligation).

For the mere Price of Admission, those unseen Investor’s get to divvy up your Mortgage Payments, among themselves — long as they “promise to pay off” that Debt, WHEN, for whatever reason, you are no longer able to make those Obligatory Payments …

Piece of Cake!

Geesh … WHAT could ever go wrong with this picture?

Apr 14 2010

Europe on the verge of another financial crisis?

The IMF has been making a lot of noise recently, but their biggest move almost managed to slip through completely unnoticed.

The Executive Board of the International Monetary Fund (IMF) today approved a ten-fold expansion of the Fund’s New Arrangements to Borrow (NAB) and the transformation of the Fund’s premier standing credit arrangement into a more flexible and effective tool of crisis management. The NAB will be increased by SDR 333.5 billion (about US$500 billion) to SDR 367.5 billion (about US$550 billion), representing a major increase in the resources available for the Fund’s lending to its members.

This IMF program didn’t even exist until a year ago, when the IMF began issuing SDRs for the first time since the 1970’s. The IMF has only sold SDRs in times of global financial stress.

It makes a person wonder “Why now?” Why is the IMF suddenly tripling its lending facilities? What do they know that we don’t?

To answer that, let’s look at the announcements of the past few weeks.

Feb 25 2010

when is enough ENOUGH? & bite me.

Banks Bet Greece Defaults on Debt They Helped Hide

Bets by some of the same banks that helped Greece shroud its mounting debts may actually now be pushing the nation closer to the brink of financial ruin.

Echoing the kind of trades that nearly toppled the American International Group, the increasingly popular insurance against the risk of a Greek default is making it harder for Athens to raise the money it needs to pay its bills, according to traders and money managers.

cross-posted at dKos

Feb 22 2010

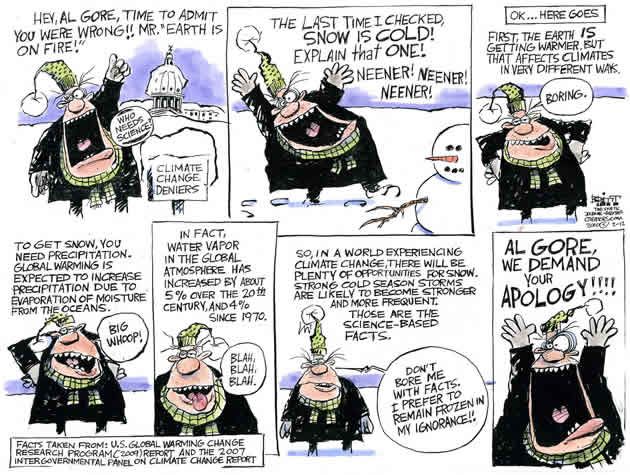

The Week in Editorial Cartoons – Al Gore vs the Denialists

Crossposted at Daily Kos. If you choose to recommend it there, the Rec Button may have been pushed to the bottom after the last diary comment made.

THE WEEK IN EDITORIAL CARTOONS

This weekly diary takes a look at the past week’s important news stories from the perspective of our leading editorial cartoonists (including a few foreign ones) with analysis and commentary added in by me.

When evaluating a cartoon, ask yourself these questions:

1. Does a cartoon add to my existing knowledge base and help crystallize my thinking about the issue depicted?

2. Does the cartoonist have any obvious biases that distort reality?

3. Is the cartoonist reflecting prevailing public opinion or trying to shape it?The answers will help determine the effectiveness of the cartoonist’s message.

:: ::

Chris Britt, see reader comments in the State Journal-Register (Springfield, IL)

Dec 01 2009

Bank of America: Give Me My Money. Now.

Maybe the Internet is the only way to get the ear of a banking corporation so deaf and so greedy that it cannot hear my screaming and thinks it can do whatever it wants with my money. Maybe even this diary won’t work to open their ears and pierce their conscience and cause them to release the money. Maybe Bank of America pwns all of us. I hope it doesn’t, but I suspect it does.

This diary is about my interaction today with B of A. And it’s about why my son cannot get my hands on $4,019 of his own money until after 5 pm on December 7. This diary is being written because, guess what, he needs the $$ before then. It’s his, isn’t it? Well, maybe not. Not until after 5 pm on 12/7.

Join me in the drive through.