Reprint from US UNCUT Daily Kos Site:

On Friday, the San Francisco branch of US Uncut temporarily took over the San Francisco branch of Bank of America.

This is what happened:

<

Now we want you to do the same thing, with or without musical accompaniment – and we’re going to tell you how.

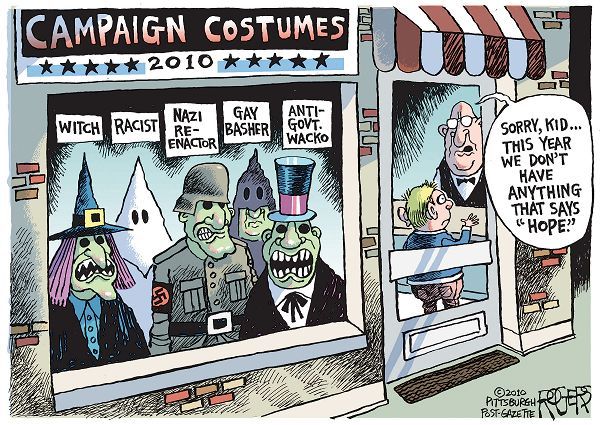

As the video says, the government claims we’re broke, and is slashing necessities for working and retired Americans. Meanwhile, corporate tax cheats like Bank of America and GE rake in billions in profit – and pay back zero in taxes.

Something’s wrong here – and tomorrow, on Tax Day 2011, Americans are going to stand as one and point it out.

We currently have over 100 actions planned for tomorrow. Click here to find your local US Uncut action. Not seeing one nearby that works for you? Then start your own – it’s SUPER easy.

Tomorrow, let’s show the powers that be that Americans are seriously opposed to cutting schools, firefighters, police, healthcare, job creation…and seriously in favor of corporations actually paying their taxes.

Thank you,

The US Uncut Team

P.S. You can learn more here about how the San Francisco action was planned and carried out.