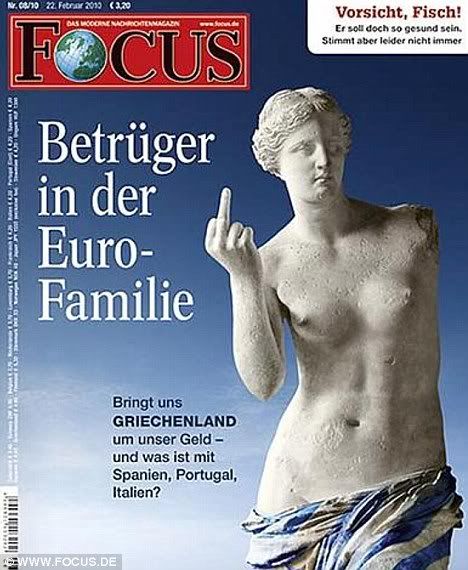

PIIGS is an unfortunate acronym for the relatively poor countries in the EU (Portugal, Ireland, Italy, Greece, and Spain), but the real pigs in Europe are now and forever the Germans.

The top German pigs have been imposing a reasonable facsimile of the neo-con agenda on their unwary population for about a decade of stagnant wages and increasing job-insecurity…

Especially over the past decade, German manufacturers — already juggernauts of industry — became some of the most globally competitive companies. Just as American firms did, they turned to outsourcing and overseas production hubs. They kept salaries down at home, with average wages stagnating in Germany for a decade. Germany still has no uniform minimum wage, and aggressive cost-cutting has resulted in more and more Germans laboring in temporary or contract jobs with lower pay and less job security.

German consumers responded by saving their pfennigs, and German domestic consumption crashed while exports ballooned to a trade surplus of $184.9 billion, second only to Saudi Arabia.

So the benefits of neo-Reaganism in Germany accrued almost entirely to bankers and other billionaires, while the rank-and-file repaired their old cars and appliances, and patched up their pitiful overcoats.

Harharharhar!!!

Even in prosperous countries, almost everybody gets screwed!

Meanwhile the PIIGS used their brand new credit in the Eurozone to borrow piles of money, expand government services, and increase public-sector salaries.

But according to the dogma of globalization, neo-Reaganism’s Democratic twin, all that debt would eventually be repaid by the rising tide of global prosperity, which lifts all boats, turns slumdogs into millionaires, and…

Harharharhar!!!

It never happened! Globalization was bullshit and top-down predation, and while Germany exported BMW’s, Greece exported olives, and went broke.

Now Greek government bonds are about to turn into junk-bonds, and that would set off a godawful chain-reaction, because the forward-thinking Eurozone is about to disallow junk-bonds (rated less than A2) as loan collateral, and German banks are holding a heck of a lot of Greek sovereign debt.

That’s the Trojan Horse in Berlin.

If the Greeks default (and junk-bond status for their bonds would push interest rates so high that default would be more or less inevitable), then German banks (and others) are faced with ugly write-downs, and aren’t you glad to know that this alarming possibility has produced a booming market in credit default swaps!

Bets by some of the same banks that helped Greece shroud its mounting debts may actually now be pushing the nation closer to the brink of financial ruin, Nelson D. Schwartz and Eric Dash report in The New York Times.

Echoing the kind of trades that nearly toppled the American International Group, the increasingly popular insurance against the risk of a Greek default is making it harder for Athens to raise the money it needs to pay its bills, according to traders and money managers.

These contracts, known as credit-default swaps, effectively let banks and hedge funds wager on the financial equivalent of a four-alarm fire: a default by a company or, in the case of Greece, an entire country. If Greece reneges on its debts, traders who own these swaps stand to profit.

“It’s like buying fire insurance on your neighbor’s house — you create an incentive to burn down the house,” said Philip Gisdakis, head of credit strategy at UniCredit in Munich.

Now the Germans want the Greeks (and the rest of the PIIGS) to slash public salaries and services, raise taxes, and turn themselves into globally respectable poverty-zones, and Ireland’s neo-con government has already complied.

“I can’t even keep up with my own debts, never mind the nation’s,” Cullen said, shopping for cut-rate sausage at a discount supermarket he disdained to visit in better times. “I’ve got to spend 30 hours a week taxiing just to break even. Something else has got to give. I can’t give any more.”

Despite the pain its cutbacks are imposing on ordinary people, the conservative Irish government of Prime Minister Brian Cowen has won praise from the European Union and the bond markets for its efforts to cut debt, prices and salaries.

But Greece is resisting, mainly on the basis of a (slightly veiled) threat to default on all those bonds German banks have already swallowed, and it would probably be a very good thing for all of us if all the PIIGS refused to implement the draconian austerity program which the Germans (and their tools at the ECB) want to impose, and a very bad thing if Europe stymies its feeble recovery with a lethal combination of higher taxes and diminished spending.

Tax and don’t spend! What’s not to like? It worked for Hoover!

“This premature fiscal tightening is the route to the Second Great Depression” – or at the very least, a long period of economic stagnation, warned Simon Johnson, a professor at MIT’s Sloan School of Management and a former chief economist at the International Monetary Fund.