Well, OK, I’m summarizing. I was startled to read at Agent Orange that Summers was a progressive thinker because Summers recognizes the massive increase in economic inequality that has taken place over the past three or four decades:

Well, OK, I’m summarizing. I was startled to read at Agent Orange that Summers was a progressive thinker because Summers recognizes the massive increase in economic inequality that has taken place over the past three or four decades:

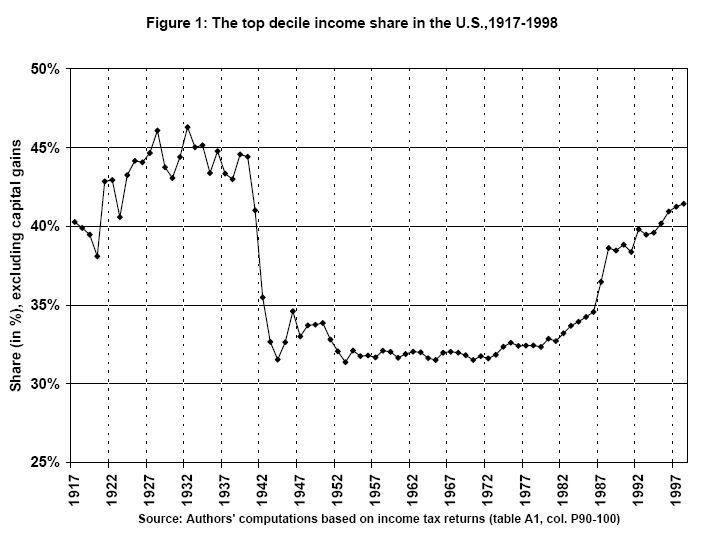

It would be, however, a serious mistake to suppose that our only problems are cyclical or amenable to macroeconomic solutions. Just as evolution from an agricultural to an industrial economy had far reaching implications for society, so too will the evolution from an industrial to a knowledge economy. Witness structural trends that predate the Great Recession and will be with us long after recovery is achieved: The most important of these is the strong shift in the market reward for a small minority of persons, relative to the rewards available to everyone else. In the United States, according to a recent CBO study, the incomes of the top 1 percent of the population have, after adjusting for inflation, risen by 275 percent from 1979 to 2007. At the same time, incomes for the middle class (in the study, the middle 60 percent of the income scale) grew by only 40 percent. Even this dismal figure overstates the fortunes of typical Americans; the number unable to find work or who have abandoned the job search has risen. In 1965, only 1 in 20 men between ages 25 and 54 was not working. By the end of this decade it will likely be 1 in 6-even if a full cyclical recovery is achieved.

…

There is no issue that will be more important to the politics of the industrialized world over the next generation than its response to a market system that distributes rewards increasingly inequitably and generates growing disaffection in the middle class. …

Suppose that you were a political party devoted to the interests of the top 1% wealthiest in the country. And suppose that either you or your puppeteers knew that public debt is private wealth. And suppose that it was politically convenient to attack programs that provide no benefit to the top 1% as generating public debt. What would you do?

Suppose that you were a political party devoted to the interests of the top 1% wealthiest in the country. And suppose that either you or your puppeteers knew that public debt is private wealth. And suppose that it was politically convenient to attack programs that provide no benefit to the top 1% as generating public debt. What would you do? I’m not going to tell you who to vote for. Its a fraught political calculus, whether to vote for a wing of an establishment that is committed to the slow destruction of the US national economy and the slow onset of catastrophic climate chaos simply because the other wing of the establishment is committed to the rapid destruction of the US national economy and the rapid onset of catastrophic climate chaos.

I’m not going to tell you who to vote for. Its a fraught political calculus, whether to vote for a wing of an establishment that is committed to the slow destruction of the US national economy and the slow onset of catastrophic climate chaos simply because the other wing of the establishment is committed to the rapid destruction of the US national economy and the rapid onset of catastrophic climate chaos. I am just an economist of small political brain, so I am not going to tell you whether to vote Democratic or Communist Party or Green Party or Progressive Party or WAS(fr)P {White Anglo Saxon (former republican) Party, eg, Chaffee & Crist} or whatever fringe or protest party you can find. If you’ve got a Clown Party to vote for, vote for them.

I am just an economist of small political brain, so I am not going to tell you whether to vote Democratic or Communist Party or Green Party or Progressive Party or WAS(fr)P {White Anglo Saxon (former republican) Party, eg, Chaffee & Crist} or whatever fringe or protest party you can find. If you’ve got a Clown Party to vote for, vote for them. Rachel Maddow

Rachel Maddow

… or perhaps that should be, so we no longer need a memorial day for the US economy.

… or perhaps that should be, so we no longer need a memorial day for the US economy. Betwixt and Between, I find myself. I observe the validity of D00m.P0rn shrill warnings about the future … when seen as possible outcomes rather than when seen as certainties. Yet I also see the potential for better outcomes.

Betwixt and Between, I find myself. I observe the validity of D00m.P0rn shrill warnings about the future … when seen as possible outcomes rather than when seen as certainties. Yet I also see the potential for better outcomes. The

The  The problem with the

The problem with the