Wake up, will ya pal? If you’re not inside, you’re outside, OK? And I’m not talking a $400,000 a year working Wall Street stiff flying first class and being comfortable, I’m talking about liquid. Rich enough to have your own jet. Rich enough not to waste time. Fifty, a hundred million dollars buddy. A player, or nothing.

-Gordon Gekko

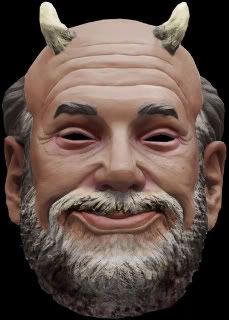

In the movie that would serve as a blueprint for the future lives of young turks shat out of the womb of 1980s Reagan eat the poor capitalism a young broker named Bud Fox (played by Charlie Sheen) engages in a bit of trickery to manipulate stock prices by invoking the magic words “Blue Horeshoe loves Anacot Steel” over the phone to players and media hacks. The movie was Oliver Stone’s Wall Street and the young Fox was in the process of selling his soul to the canny devil in suspenders who would become an iconic cultural figure. The seducer was big time corporate raider Gordon Gekko (Michael Douglas) whose amorality and worldview rooted in the dogma that “greed is good” would serve as the role model for the very large scale looters, charlatans, thugs, hedge fund hyenas and money grubbing sociopaths who are responsible for the global financial collapse. Through their avarice, their blood-sucking vampirism and their relentless pursuit of zero sum game, fuck you capitalism they have killed the goose that laid the golden egg, beggared millions and first built and then destroyed trillions of dollars in fairy tale wealth that never existed in the first place other than in numbers in a computer. The smart ones cashed out and put their money into real assets, gold, real estate, commodities, off-shore bank accounts that would allow the chiselers to evade taxes on their ill-gotten gains.