A funny thing happened on the way to peace and prosperity – we was robbed.

Feb 11 2009

Feb 08 2009

The disparity in wealth in this country is obscene, and the failure to restrain the mindless and monumental greed that led to it has been our downfall.

The income of the 400 wealthiest Americans swelled in 2006, soaring nearly 23 percent from the previous year, to an average of $263 million, according to data released Thursday by the Internal Revenue Service. Since 1996, this group has nearly doubled its share of all income earned in the United States.

The top 400 paid just more than $18 billion in federal income taxes in 2006, or an average of $45 million, on a record $105 billion in total income – the lowest effective tax rate in the 15 years since the agency began releasing such data.

Jan 03 2009

cross-posted from The Dream Antilles

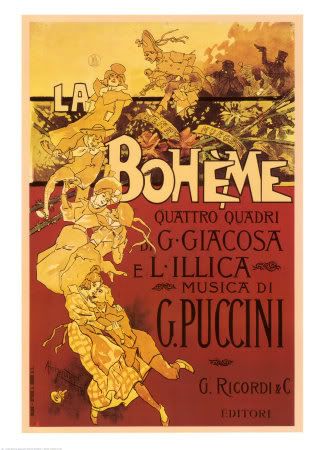

Well, not really. On my drive home from running errands, I heard part of the Metropolitan Opera’s Saturday broadcast of La Boheme. It amazes me that an Opera set in 1830 and written in 1896, would have a setting that is so very timely in 2009.

Please join me in the nosebleed seats.

Dec 02 2008

Well, it’s all coming out now. The Bush administration was warned about the potential problems with the housing bubble and loans being made, considered regulation, but backed off under pressure from, guess who? Yes, the very banks being bailed out now.

Accountability means one thing for working people and another for the investment class.

WASHINGTON – The Bush administration backed off proposed crackdowns on no-money-down, interest-only mortgages years before the economy collapsed, buckling to pressure from some of the same banks that have now failed. It ignored remarkably prescient warnings that foretold the financial meltdown, according to an Associated Press review of regulatory documents.

“Expect fallout, expect foreclosures, expect horror stories,” California mortgage lender Paris Welch wrote to U.S. regulators in January 2006, about one year before the housing implosion cost her a job.

Also on Daily Kos: http://www.dailykos.com/story/…

Nov 28 2008

Original article via Socialist Appeal (US):

Many workers are concerned about the present crisis of U.S. capitalism and how it affects them. Therefore, Socialist Appeal thought it might be helpful to explain some basics about capitalism and why we believe that socialism is the only solution to the crisis.

Nov 24 2008

(Cross-posted from Daily Kos)

Our economic situation has been all over the news. Banks are failing, credit is contracting, the auto industry is crying for a bailout. Clearly, the U.S. economy has gotten derailed, and we’re now faced with the unenviable task of getting it back on track. The trouble is, we don’t know which track is the right track.

Or do we?

Suppose there exists a valid interpretation of economic forces and outcomes, one that explains our current situation, yet one that no one will acknowledge, even to knock down.

About 12 years ago I picked up Cities and the Wealth of Nations: Principles of Economic Life by Jane Jacobs (better known as the author of The Death and Life of Great American Cities) at a used bookstore in upstate New York. Jacobs wrote this book in 1983, in response the emergence of stagflation. As an informed and educated layperson, she examined economic history with a critical eye and an urbanist’s heart, looking for the laws that explained what was going on — which the economic theories of the time did not.

Nov 15 2008

An associate of mine still believes that his stocks portfolio is safe (it will come back) even as he witnesses his business failing due to the credit freeze…but that is so American “it can’t happen here, it can’t happen to me,”… even though it is and right in front of our eyes.

And that is perhaps the most amazing trick as well as the biggest crime: making people believe that something works to their advantage, while in reality it drives them into debt-riddled poverty. People have this remarkable talent to fool themselves, to see only what they wish to see, and it can be a gift from heaven. But that’s not always a given.

Nov 14 2008

A recession is when your neighbor loses his job. A depression is when you lose yours.

Old joke.

But who is laughing now?

Oct 16 2008

The ongoing economic meltdown is terrifying, but at the same time many of us have no real idea of what’s rolling down the pike at us.

There are many aspects of the crisis and the coming recession which are impossible to predict. One impact though, will be unavoidable: crippling budget crises at the state and municipal levels, driven by falling real estate values, layoffs, business closings, increased borrowing costs and recession.

What Happens When the Banks Don’t Lend

To get a sense of what this could look like, it is instructive to look at what happened to New York City starting in 1975, when bank credit dried up and a fiscal crisis kicked in that was to last more than a decade. Remember that this was a budget crisis isolated to a single city, rather than the generalized collapse of the banking system we are seeing now.

The immediate background is that by the early ’70s, the City’s budget was deep in the red, kept going with fiscal jiggery-pokery especially in Mayor Lindsay’s second administration and under his successor, Mayor Beame. The back story is more complex of course, having much to do with federal policy since the Eisenhower administration which directed resources to suburbanization at the expense of city and country–money for interstates, not mass transit and railroads, subsidizing vast auto-dependent tracts of single houses on what had been farmland–you know the deal.

What plunged the City into crisis was the large banks refusing, collectively, in March, 1975 to extend credit to New York any longer, declining to roll over loans and boycotting the City’s bond auctions. The Beame administration moved to lay off 25,000 city workers and defer contractual raises for others, cut services, increase the transit fare and institute tuition in the City College of New York system.

For months there was a political war over how things would get resolved, with highway workers, cops and other city employees staging militant demonstrations and threatening an October general strike. The NY State government stepped in with aid but the federal government refused until massive pressure from the financial industry was brought to bear.

With everyone staring into the abyss of bankruptcy (and the possibility of a judge writing off the bonds the banks still held or canceling union contracts), the municipal unions made a devil’s pact with the banks, the details of which I leave for another post.

“The Bronx Is Burning”

What I want to remind people of is what happened to NYC once the austerity, service cuts, layoffs, tighter credit, tax hikes and the rest of the bank-sponsored “rescue package” kicked in.

Garbage piled up in the streets, and law enforcement abandoned whole neighborhoods. The public education system, already jolted by the refusal in the ’60s of Blacks and Latina/os to accept a two-tier, heavily segregated system, now faced serious cuts. Class sizes ballooned. “Non-essential” programs like art and music education and vocational training disappeared.

The Transit Authority adopted a policy of “deferred maintenance”–only fixing things when they broke down completely. One leader of the militant opposition within Transport Workers Union, Local 100 at the time, Arnold Cherry, pointed out whenever he spoke that every housewife knows that if you don’t empty the crumbs out of the toaster, eventually it stops working. Not TA management, though–the system veered toward total collapse in the early ’80s.

Meanwhile, landlords in “bad neighborhoods” emulated the Transit Authority, milking their aging apartment buildings for every dime in rent they could collect while “deferring” maintenance, laying off supers, ignoring heating oil bills, and finally abandoning the buildings themselves rather than pay city taxes. Or, given a chance, burning them down to collect the insurance.

This was seared into the national consciousness in the famous blimp shot of a five-alarm fire in the South Bronx during the 1977 World Series while Howard Cosell intoned, “There it is, ladies and gentlemen, the Bronx is burning.” As much as 40% of the housing stock in the borough was destroyed during these years, feeding an impossible-to-ignore homeless population and pumping up rents for vacant apartments in surviving buildings. (The City, meanwhile, was closing firehouses as a money-saving measure.)

Huge cuts in the NYC medical system on top of deteriorating social conditions laid the ground work for what Nick Freudenberg and his co-authors identify as a deadly “syndemic”: the three interlinked epidemics of TB, murder and HIV infection.

Even after the emergency financial aid was paid back, and the City’s budget was balanced and the banks decided they would once again buy long term bonds issued by the city (1981) , the Emergency Financial Control Board kept austerity policies in place and the damage they did to millions of people reverberated through the decade and up to the present. To cite only one example, the City College system which had boasted free tuition for NYC residents before the crisis, now costs upwards of $2000 a semester.

What It Means

I could go on. There are a lot of particular lessons to learn from the New York City fiscal crisis, and how various social forces responded and what kinds of popular resistance developed and worked.

But lesson number one is that this kind of crisis is on the agenda right now, in cities around the country, and once it erupts, there is no quick bounceback. Start trying to size up the situation where you live and figure out who your allies are going to be in the coming years.

Crossposted from Fire on the Mountain.

Oct 10 2008

cross posted from The Dream Antilles

The answer is Nothing. Nada. Zilch. Zippo. Zero. They haven’t got a clue. They are going to let it all come down, however it comes.

Permit me some extreme grouchiness. And anger. And despair.

People I know were evicted today from their home in the wake of not being able to pay their mortgage. A long legal battle ended. They lost. The Sheriffs were there. There was the cliche, the spectacle of having the young children sit on the curb while the furniture was deposited on the lawn. I don’t have $30,000+ to loan them to stop it. Nor do their friends or family. And I don’t see Congress or anybody else stepping in to do anything about this. Maybe later on, when they’ve moved out and lost their home and are living somewhere else. Maybe then there will be some “relief.” For somebody else. I wish they lived in Chicago, but they don’t.

Oct 09 2008

The stock market has just dropped 7.3%. So far this month, the Dow has fallen nearly 25%. In October 1929, it dropped 20%. The market has already exceeded the crash of 1929.

Don’t like relying upon the Dow? In the crash of 1987, the Standard and Poor’s 500-stock index dropped 20.5%. So far, in the last eight days, the S&P 500 is down 22%.

I have no words. The TED spread is an unbelievable 4.23 – over double the average of the last year, meaning that the premium to borrow money is so high that it is nearly impossible for any entity to do so. Nearly 1 in 6 homeowners – almost 20%! – owe more on their mortgage that their homes are worth.

This isn’t even supposed to be possible. Safeguards instituted after the crash of 1987 are supposed to stop trading entirely before these kinds of drops happen. It beggars belief.

Like I said, I have no words. But you need to pay attention to this. One day you’ll tell your grandkids about how you were there during the crash of 2008.

Sep 22 2008

The various merits and demerits of the proposal to create a fund for the acquisition of toxic securities and derivatives by the Federal government compose a huge list. But one of the key provisions of the bill as currently proposed makes it unpalatable for any reason:

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

Under no circumstances ought we allow this provision to become law. Yves Smith:

This puts the Treasury’s actions beyond the rule of law. This is a financial coup d’etat, with the only limitation the $700 billion balance sheet figure. The measure already gives the Treasury the authority not simply to buy dud mortgage paper but other assets as it deems fit. There is no accountability beyond a report (contents undefined) to Congress three months into the program and semiannually thereafter. The Treasury could via incompetence or venality grossly overpay for assets and advisory services, and fail to exclude consultants with conflicts of interest, and there would be no recourse. Given the truly appalling track record of this Administration in its outsourcing, this is not an idle worry.

But far worse is the precedent it sets. This Administration has worked hard to escape any constraints on its actions, not to pursue noble causes, but to curtail civil liberties: Guantanamo, rendition, torture, warrantless wiretaps. It has used the threat of unseen terrorists and a seemingly perpetual war on radical Muslim to justify gutting the Constitution. The Supreme Court, which has been supine on many fronts, has finally started to push back, but would it challenge a bill that sweeps aside judicial review?

I urge you to read Smith’s entire post on why this ought to be opposed. FWIW, economists from such disparate backgrounds as Paul Krugman, Tyler Cowen, and Bryan Caplan all agree this proposal is awful in its current form (Caplan, an anarcho-capitalist, has opposed all government bailouts).