Cross posted from The Stars Hollow Gazette

The 2012 Democratic National Platform talks big about job creation and rebuilding the middle class which has been taking hits since the Reagan tax cuts in 1984. While it touts the fact that the private sector has created jobs and the manufacturing sector is growing, its not enough. Most of the jobs that have been created are low paying. The Democratic Party has done little to debunk the lie that the wealthy corporations and individuals are job creators. By rubber stamping the past policies of giveaways to corporations and extending the Bush/Obama tax cuts, the Democrats have made the problems for the ever shrinking middle class even worse.

In two articles at Common Dreams, writers Paul Buchheit and John Atcheson debunk the “job creators fraud” and lay out the real problem ailing the economy, “corporate welfare”. In Mr. Buchheit’s article, he concisely cuts through the “job creator” nonsense with the facts.

Based on IRS figures, the richest 1% nearly tripled its share of America’s after-tax income from 1980 to 2006. That’s an extra trillion dollars a year. Then, in the first year after the 2008 recession, they took 93% (pdf) of all the new income.

He also notes that the wealthiest 10% own 83% of the financial wealth (pdf) and only pay 15% tax under the premise that they would create jobs. Instead they put that wealth into tax fee accounts overseas (pdf).

Mr. Atcheson breaks it down noting that the 15% tax rate allows the wealthy to avoid some $59 billion in taxes per year and by sheltering profits off shore, “(c)orporations are given $58 billion a year in tax breaks (pdf).” Hedge fund managers are given a tax break that allows them to pay only 15% on their earnings, avoiding at least $2.1 billion in taxes a year. Yet, as he further points out:

We spend $59 billion on social welfare programs, but more than $92 billion on corporate subsidies. According to the Environmental Law Institute, fossil fuel industries alone get more than $70 billion in subsidies, with most going to the oil and gas sector. Yeah, we certainly can’t afford to deprive Exxon of its record profits just to give money to needy kids.

Add to that $1.2 trillion the $9 trillion in low interest and no interest loans from the Federal Reserve and $700 billion bank bailout that these corporations and banks are making huge profits on and paying no taxes. You have, Mr. Buchheit notes, “$10 trillion in misdirected dollars. Just 1/10 of that would create 25 million jobs, one for every unemployed or underemployed worker in America. Or a $45,000 a year job for every college student in the United States.”

These are the facts that Mr. Buchheit’s lays out:

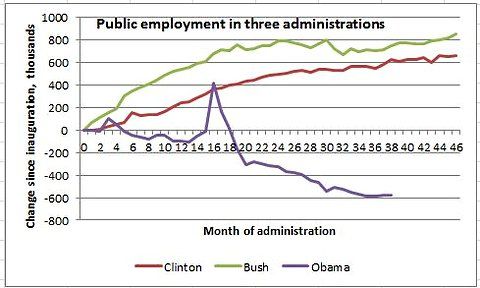

The Wall Street Journal noted in 2009 that the Bush tax cuts led to the “worst track record for jobs in recorded history.” 25 million people remain unemployed or underemployed, with 30 to 50 percent of recent college graduates in one of those categories. Among unemployed workers, nearly 43 percent have been without a job for six months or longer.

For the jobs that remain, most are low-paying, with the only real employment growth occurring in retail sales and food preparation. A recent report by the National Employment Law Project confirms that lower-wage occupations (up to about $14 per hour) accounted for 21 percent of recession losses and 58 percent of recovery growth, while mid-wage occupations (between $14 and $21 per hour) accounted for 60 percent of recession losses and only 22 percent of recovery growth.

The minimum wage is shamefully low, about 30% lower (pdf) than the inflation-adjusted 1968 figure. And the tiny pay can’t be blamed on small business. Two-thirds of America’s low-wage workers, according to another National Employment Law Project (pdf) report, work for companies that have at least 100 employees.

All these job woes persist while productivity has continued to grow, with an 80% increase since 1973 as median worker pay has stagnated. [..]

With the bulk of their assets buried in “low-risk investments (bonds and cash), the stock market, and real estate”, the wealthy are not creating jobs:

… Only 3 percent of the CEOs, upper management, and financial professionals were entrepreneurs (pdf) in 2005, even though they made up about 60 percent of the richest .1% of Americans. A recent study found that less than 1 percent of all entrepreneurs came from very rich or very poor backgrounds. They come from the middle class.

There is ample evidence that more jobs were created when the top marginal tax rates were high.

Instead of cutting our social safety net, as President Obama has agreed to do in his “Grand Bargain”, we need to end the corporate welfare programs and put an end to the lie that if we tax the wealthy less they’ll create jobs.