On Sunday Greek voters went to the polls to vote on a simple referendum on a bail out deal proposed by the country’s international creditors, which demanded new austerity measures in return for emergency funds. A simple yes or no. The voters gave a resounding NO to the deal.

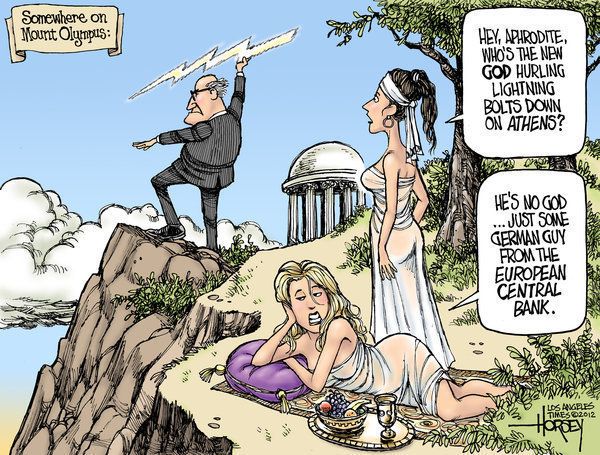

The win for the “no” camp constituted a major victory for Greek Prime Minister Alexis Tspiras, who had campaigned heavily against the deal put forward by the European Central Bank, the International Monetary Fund and the European Commission. But it also raised uncertainty about the country’s financial future and its place in the eurozone.

“Even in the most difficult circumstances, democracy can’t be blackmailed — it is a dominant value and the way forward,” Tsipras tweeted on Sunday night, adding that Greece intends to restart negotiations with Europe next week.

A final tally of votes indicated that 61.31 percent of voters decided against the bailout deal. More than 60 percent of Greeks participated in the vote, well over the 40 percent turnout needed for the referendum to be valid.

Needless to say the responses to the vote and PM Tspiras’ decision to attempt to negotiate better terms cams fast and furious. First, Greece’s radical and outspoken Finance Minister Yanis Varoufakis resigned, stating that he had been made aware that his “style” was considered disruptive:

Mr. Varoufakis, an academic with no political experience before he joined the leftist Tsipras government, had consistently argued that Greece desperately needed debt relief more than anything else. While that view was shared by many economists, he quickly became a lightning rod among Greece’s creditors for his aggressive negotiating style and heated language. Before the referendum vote, he had publicly accused the creditors of “terrorism” against his country.

With Mr. Varoufakis gone, Greece’s eurozone creditors may be more willing to continue negotiations on a further aid package. His departure, apparently at the urging of Mr. Tsipras, could be seen as a concession to the sensibilities of other eurozone leaders. But the next few days could determine whether the gulf between Greece and its creditors is now too wide to bridge.

You can read his resignation statement here. He has been replaced by Euclid Tsakalotos, another academic economist, but not as vocal as Mr. Varoufakis and, apparently, more acceptable to Eurogroup participants.

Next came the markets’ reactions, not drastic but not good, either:

Global stock markets mostly dropped on Monday but did not plunge, as investors reacted with muted dismay to the results of the Greek referendum and showed nervousness about steep declines in China’s stock market over the past three weeks. [..]

At midday in New York, stocks were just below break-even. The Dow Jones industrial average was down 0.2 percent, while the Standard & Poor’s 500-stock index was off 0.3 percent.

The euro ticked down 0.4 percent to $1.1033.

Oil prices also fell on Monday, as traders placed bets that recent events could lead to slower global economic activity and weaker demand. [..]

In Asia on Monday, the Shanghai market jumped sharply in early trading as the Chinese government poured money into brokerage firms to help them and their customers buy shares. The market leapt 7.8 percent at the start, but it surrendered half of those gains in the first 10 minutes of trading and closed 2.4 percent higher. The smaller Shenzhen stock market also started strongly but fell 2.7 percent by the end of trading.

And the vote has only served to harden German Chancellor Angela Merkel’s stand:

The German government signaled a tough line towards Greece on Monday, saying it saw no basis for new bailout negotiations and insisting it was up to Athens to move swiftly if it wanted to preserve its place in the euro zone.

With opinion towards Greece hardening in Germany’s ruling coalition following the landslide rejection of European bailout terms in a Sunday referendum, the government indirectly raised the prospect of a Greek exit from the currency bloc.

Chancellor Angela Merkel’s spokesman said it was up to Athens to act so that it could remain in the currency bloc, and Vice Chancellor Sigmar Gabriel went further by saying the Greek government needed to improve on its previous proposals. [..]

Pressed on what concessions Berlin might be willing to make to Tsipras, a finance ministry spokesman dismissed the idea of a debt restructuring sought by Athens and favored by the International Monetary Fund (IMF).

Economic and political pundits responded as well:

Thomas Piketty: Germany Shouldn’t Be Telling Greece To Repay Debt

Thomas Piketty isn’t mincing words when it comes to the Greek debt crisis.

In an interview with German newspaper Die Ziet last month (and translated recently by business analyst Gavin Schalliol), the leading French economist pummeled Germany for its hypocrisy in demanding debt repayment from Greece. [..]

Greece on Sunday voted a resounding “no” on a bailout plan proposed by its creditors, making its continued membership in the eurozone more tenuous. German Chancellor Angela Merkel and French President Francois Hollande will hold an emergency summit on Tuesday to discuss the crisis.

But Piketty, who penned the blockbuster 2013 book on income inequality Capital in the Twenty-First Century, slammed conservatives who favor the economic austerity measures Germany and France are demanding of Greece, saying they demonstrate a “shocking ignorance” of European history.

“Look at the history of national debt: Great Britain, Germany, and France were all once in the situation of today’s Greece, and in fact had been far more indebted,” Piketty said. “The first lesson that we can take from the history of government debt is that we are not facing a brand new problem.”

Germany, Piketty continued, has “no standing” to lecture other nations about debt repayment, having never paid back its own debts after both World Wars (pdf).

Nobel Prize winning economist and New York Times columnist, Paul Krugman, also “cheered” the vote:

The truth is that Europe’s self-styled technocrats are like medieval doctors who insisted on bleeding their patients – and when their treatment made the patients sicker, demanded even more bleeding. A “yes” vote in Greece would have condemned the country to years more of suffering under policies that haven’t worked and in fact, given the arithmetic, can’t work: austerity probably shrinks the economy faster than it reduces debt, so that all the suffering serves no purpose. The landslide victory of the “no” side offers at least a chance for an escape from this trap.

Renowned dissident Noam Chomsky spoke with [Democracy Now! ]’s Amy Goodman back in March aboutGreece and Spain the “savage response” to taking on austerity calling it a “class war.”

The “what next” is still very unknown. From Yves Smith at naked capitalism

After the momentous “No” vote in support of the Greek ruling coalition Greece’s lenders and most important, the Eurozone leaders of the countries that have made 60% of Greece’s outstanding loans, are officially still figuring out what to do. Merkel is going to Paris to confer with Hollande today. The Eurogroup has set a meeting for tomorrow at 1:00 PM

However, despite the responses of media outlets and many pundits that the Eurocrats will have to beeat a retreat and offer Greece concessions, it’s not clear that this event strengthens the Greek government’s hand with its counterparties. Remember, Tsipras enjoyed popularity ratings of as high as 80% and has always retained majority support in polls. And it’s all too easy to forget that “the creditors” are not Merkel, Hollande, Lagarde and Draghi. The biggest group of “creditors” are taxpayers of the 18 other countries of the Eurozone. The ugly design of the Eurozone means that the sort of relief that Greece wants most, a reduction in the face amount of its debt (as opposed to the sort of reduction they’ve gotten, which is in economic value, via reductions in interest rates and extensions of maturities) puts the interest of those voters directly at odds with those in Greece. Our understanding is that a reduction in principal amount, under the perverse budgetary and accounting rules of the Eurozone, would result in those losses showing up as losses for budget purposes, now. They would need to be funded by increased taxes. Thus a reduction in austerity for Greece, via a debt writeoff, simply transfers austerity from Greece to other countries. It’s not hard to see why they won’t go for that. And Eurozone rules require unanimous decisions.

Even though the ruling coalition had said it wanted to restart negotiations immediately upon getting a “no” vote, the lenders have asked Greece to send a new proposal, apparently deeming the one it submitted on June 30 to be out of date. It’s doubtful anything will happen before the Eurogroup meeting tomorrow.

The heads of state of the EuroZone countries met in Brussels today for a two day summit to try to come to an agreement on

The heads of state of the EuroZone countries met in Brussels today for a two day summit to try to come to an agreement on  The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.

The economic crisis in Europe and the austerity response to it which has spread from Greece to other countries in Europe has dominated the news now for weeks. This past weekend the leaders of the G-8 met at Camp David where it was the main topic for discussion. While President Obama’s statement that encourages stimulus and growth as solutions to the EU problem, he did not discount austerity as one of the driving policies that has extended the downturn and caused social upheaval in Greece and now Spain. The reporting in the traditional mainstream media has been particularly lacking ion balanced analysis and, in some cases, some pretty sloppy and biased reporting.