Author's posts

Feb 16 2012

Keith Olbermann: Nancy Brinker Must Go

Adapted from The Stars Hollow Gazette

KEITH OLBERMANN: And now, as promised, a brief Special Comment on the resignation of Karen Handel from Susan G. Komen for the Cure.

There is no avoiding the simple fact that a week had passed since Ms. Handel decided that the Komen organization should collaborate with the witch hunt that the nation’s right wing has directed against Planned Parenthood. In the time until Ms. Handel’s exit this morning, Komen’s only real actions had been a mealymouthed partial reversal about a rule change it had first denied, a new-new policy to replace the new policy – a spineless convenience by which Komen has still not really committed to continuing its funding of Planned Parenthood and, perhaps more importantly, by which it has not committed to staying out of this dangerous, ideological game which will kill some freedoms and which could kill some women.

Komen could not do that by itself, of course.

If it never gave another dollar to Planned Parenthood, it would be doing the latter organization a fundraising favor, because it has raised the consciousness of many to whom the reality was not yet clear, that one of vote-getting machines in this country was zeroing in on Planned Parenthood as the scapegoat for all the evils which that vote-getting machine exaggerates – to whip up paranoia and political power among the easily led of this nation. Those who were thus awakened will find – or rather, fund – Planned Parenthood in ways Komen never has, and never could.

But the real issue here is the Komen organization’s attempt to hide its new partnership with that most base of political advocacy groups – the guttersnipe purveyors of hate, and fear and revenge fantasies – by couching as apolitical the most intense kind of political involvement; the willingness to participate in guilt by association; to echo the infamous call of investigation; to shun affiliation with a group or an individual purely to amplify suspicion and doubt and paranoia about that group or individual.

All of the dark periods of American history have begun with acts like Komen’s and excuses like Komen’s.

Planned Parenthood’s extraordinary services for men and women – 97 percent of which have had nothing to do with abortion – were to Komen’s advantage, until one Florida congressman decided to try to get himself re-elected by launching a specious investigation of Planned Parenthood.

And recall what we’re dealing with. Planned Parenthood’s opponents will believe anything and say anything. Remember well that tragic, comical story from yesterday about the Louisiana congressman who posted to Facebook, with horrified comments accompanying it, the story of an $8 billion Planned Parenthood “Abortion-Plex” being built in Kansas, without ever noting – perhaps without even caring – that the story was, in fact, from the satirical website The Onion. These are the people with whom Susan G. Komen for the Cure got into bed.

Ms. Handel’s resignation changes nothing of this. Komen’s statement today continues to lie about its own motives, to insist its attack on Planned Parenthood was, “Not based on anyone’s political beliefs or ideology,” and to speak only of, “Mistakes in how we have handled recent decisions.”

Komen – specifically its president, Susan Komen’s own sister Nancy Brinker – has still not told the truth nor explained how she will again make this organization worthy of the donations from, and participation in and by, the women and men of this country who had put women’s health and valuable organizations like Komen and Planned Parenthood above politics.

Mrs. Brinker has dishonored both her sister’s memory and this essential cause. Until she acts, either by correcting what she acquiesced to, or by leaving the organization to somebody who truly cares, until she does one or the other – since are a thousand generous organizations which perform what Komen performs – Komen does not deserve a dollar in donations from a shocked public. Karen Handel is gone. Komen’s corruption remains.

Feb 16 2012

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History February 15 by TheMomCat

- Punting the Pundits by TheMomCat

These featured articles-

- The Mortgage Settlement: More Jokes by TheMomcat

- Ladies’ Day by ek hornbeck

- Doggies by ek hornbeck

This is an Open Thread

Feb 15 2012

“America’s Lawless Empire: The Constitutional Crimes of Bush and Obama,”

Cross posted from The Stars Hollow Gazette

Constitutional lawyer Bruce Fein and former presidential candidate and consumer advocate, Ralph Nader visited Harvard Law School to discuss the constitutional crimes of Presidents George W. Bush and Barack H.Obama It is well worth the hour to watch if you love this country and respect the Constitution and our laws.

February 10, 2012

Ralph Nader ’58 and Bruce Fein ’72 visited Harvard Law School for a talk sponsored by the HLS Forum and the Harvard Law Record. At the event, “America’s Lawless Empire: The Constitutional Crimes of Bush and Obama,” both men discussed what they called lawless, violent practices by the White House and its agencies that have become institutionalized by both political parties. [..]

Both men took issue with the National Defense Authorization Act, which sets the budget and policies of the Department of Defense and generally expands the power of the government to fight the war on terror. The Act permits, among other practices, the indefinite detention of terrorism suspects without trial. Fein encouraged those in attendance to contact their members of congress about repealing it.

Bruce Fein has been my “hero” since he called for the simultaneous impeachment of both Bush and Cheney as a requirement of congress mandated by the Constitution and then drafted articles of impeachment of Barack Obama for the same reasons. The Constitution and its enforcement is not a spectator sport.

Feb 15 2012

The Mortgage Settlement: They All Lied

Cross posted from The Stars Hollow Gazette

Yes, they all lied, the the government and the state attorneys general, Schneiderman, too. The 49 state mortgage settlement that is not written but was reached is not the narrow settlement that these actors would have you believe. In the Mortgage Settlement Executive Summary Section VII states:

The proposed Release contains a broad release of the banks’ conduct related to mortgage loan servicing, foreclosure preparation, and mortgage loan origination services. Claims based on these areas of past conduct by the banks cannot be brought by state attorneys general or banking regulators.

The Release applies only to the named bank parties. It does not extend to third parties who may have provided default or foreclosure services for the banks. Notably, claims against MERSCORP, Inc. or Mortgage Electronic Registration Systems, Inc. (MERS) are not released.

What does that mean? According to Yves Smith at naked capitalism it translates to a complete get out of jail free card

This is sufficiently general so that it is hard to be certain, but It certainly reads as if it waives chain of title issues and liability related to the use of MERS. That seems to be confirmed by the fact that made by local recorders for fees are explicitly preserved (one would not think they would need to be preserved unless they might otherwise be assumed to be waived). This is exactly the sort of release we feared would be given in a worst case scenario. The banks have gotten a huge “get out of jail free” card of bupkis.

Yves also quotes Frederick Leatherman who for a recap:

In one of his articles yesterday at Firedoglake, David Dayen mentioned that the settlement agreement has not been reduced to writing.

That is astonishing.

Let me repeat. That. Is. Astonishing.

The biggest problem with settlement agreements in particular, and all agreements in general, is reaching a so-called ‘meeting of the minds’ regarding the details and ‘chiseling them into stone’ by reducing them to writing. As I used to warn my clients when I was practicing law, we do not have an agreement until it has been reduced to writing, thoroughly reviewed, and signed by each of the parties. That has obviously not happened in this case.

Experience has taught us that humans dealing in good faith make mistakes, no matter how careful they are, and the potential for mistakes, misunderstandings and subsequent disagreements about the terms of an agreement cannot be overestimated. That potential becomes a certainty when one or more parties to an agreement is dealing in bad faith.

That, my friends, is why we have a law called the Statute of Frauds, which requires that certain types of agreements be in writing or they are invalid and unenforceable.

Yves take on Schneiderman and Biden’s involvement:

While the full terms have not been agreed upon, this seems to call into question the claim that Schneiderman got a carve-out for his MERS suit (and Biden had separately insisted that he had wanted to be able to add banks to his case against MERS).

But even with all these caveats, it’s hard to read the executive summary, which no doubt was vetted by the bank, Administration and AG sides, as meaning other than what it intends to mean: that the banks have been released of the meteor-wiping-out-the-dinosaurs-and-the-MBS-market liability they were most afraid of, that of the monstrous mess they made in their failure to convey notes as stipulated in their own contracts, and with their failure to use MERS as a mere registry, rather than a substitute for local recording offices. That in turns means that various cheerleaders for this deal, such as Mike “Settlement Release Looks Tight” Lux and Bob Kuttner have badly misled readers in their assertions that the release was narrow and the deal is good for homeowners.

The Obama administration and its advocates would have us believe that this agreement is going to help underwater homeowners and those who have been victims of foreclosure fraud. I’m not going to be delicate about this, it’s a bold faced lie. To make matters even worse Pimco’s analysis points out how this will damage pensions:

The government’s deal with banks over their foreclosure practices after 16 months of investigations is cheap for the loan servicers while costly for bond investors including pension funds, according to Pacific Investment Management Co.’s Scott Simon.

In what the U.S. called the largest federal-state civil settlement in the nation’s history, five banks including Bank of America Corp. and JPMorgan Chase & Co. yesterday committed $20 billion in various forms of mortgage relief plus payments of $5 billion to state and federal governments.

“This was a relatively cheap resolution for the banks,” said Simon, the mortgage head at Pimco, which runs the world’s largest bond fund. “A lot of the principal reductions would have happened on their loans anyway, and they’re using other people’s money to pay for a ton of this. Pension funds, 401(k)s and mutual funds are going to pick up a lot of the load.”

If anyone expects that that new panel with New York’s Attorney General Eric Schneiderman is going to ease the housing crisis and hold the banks accountable, I have some really cheap bridges for sale in California and New York.

Feb 15 2012

On This Day In History February 15

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

February 15 is the 46th day of the year in the Gregorian calendar. There are 319 days remaining until the end of the year (320 in leap years).

On this day in 1903, toy store owner and inventor Morris Michtom places two stuffed bears in his shop window, advertising them as Teddy bears. Michtom had earlier petitioned President Theodore Roosevelt for permission to use his nickname, Teddy. The president agreed and, before long, other toy manufacturers began turning out copies of Michtom’s stuffed bears, which soon became a national childhood institution.

The name Teddy Bear comes from former United States President Theodore Roosevelt, whose nickname was “Teddy”. The name originated from an incident on a bear-hunting trip in Mississippi in November 1902, to which Roosevelt was invited by Mississippi Governor Andrew H. Longino. There were several other hunters competing, and most of them had already killed an animal. A suite of Roosevelt’s attendants, led by Holt Collier, cornered, clubbed, and tied an American Black Bear to a willow tree after a long exhausting chase with hounds. They called Roosevelt to the site and suggested that he should shoot it. He refused to shoot the bear himself, deeming this unsportsmanlike, but instructed that the bear be killed to put it out of its misery, and it became the topic of a political cartoon by Clifford Berryman in The Washington Post on November 16, 1902. While the initial cartoon of an adult black bear lassoed by a white handler and a disgusted Roosevelt had symbolic overtones, later issues of that and other Berryman cartoons made the bear smaller and cuter.

Morris Michtom saw the drawing of Roosevelt and the bear cub and was inspired to create a new toy. He created a little stuffed bear cub and put it in his shop window with a sign that read “Teddy’s bear,” after sending a bear to Roosevelt and receiving permission to use his name. The toys were an immediate success and Michtom founded the Ideal Novelty and Toy Co.

At the same time in Germany, the Steiff firm, unaware of Michtom’s bear, produced a stuffed bear from Richard Steiff‘s designs. They exhibited the toy at the Leipzig Toy Fair in March 1903 and exported 3,000 to the United States.

By 1906 manufacturers other than Michtom and Steiff had joined in and the craze for “Roosevelt Bears” was such that ladies carried them everywhere, children were photographed with them, and Roosevelt used one as a mascot in his bid for re-election.

American educator Seymour Eaton wrote the children’s book series The Roosevelt Bears, while composer John Bratton wrote “The Teddy Bear Two Step” which, with the addition of Jimmy Kennedy‘s lyrics, became the song “The Teddy Bears’ Picnic”.

Early teddy bears were made to look like real bears, with extended snouts and beady eyes. Today’s teddy bears tend to have larger eyes and foreheads and smaller noses, babylike features that make them more attractive to buyers because they enhance the toy’s cuteness, and may even be pre-dressed.

Feb 14 2012

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History February 14 by TheMomCat

- Punting the Pundits by TheMomCat

These featured articles-

We welcome our newest contributor, thatsdrfreak to our Stars Hollow family

- “Ex-Gay”: Dan Savage ‘Should Be Arrested’ by thatsdrfreak

- The Mortgage Settlement: They All Lied by TheMomCat

- “America’s Lawless Empire: The Constitutional Crimes of Bush and Obama,” by TheMomCat

Join us tonight at 8 PM EST for the Live Blog of the second night of the Westminster Dog Show and the awarding of Best in Show.

This is an Open Thread

Feb 14 2012

Greece Is Burning

Cross posted from The Stars Hollow Gazette

ATHENS – After violent protests left dozens of buildings aflame in Athens, the Greek Parliament voted early on Monday to approve a package of harsh austerity measures demanded by the country’s foreign lenders in exchange for new loans to keep Greece from defaulting on its debt.

Though it came after days of intense debate and the resignation of several ministers in protest, in the end the vote on the austerity measures was not close: 199 in favor and 74 opposed, with 27 abstentions or blank ballots. The Parliament also gave the government the authority to sign a new loan agreement with the foreign lenders and approve a broader arrangement to reduce the amount Greece must repay to its bondholders. [..]

But the chaos on the streets of Athens, where more than 80,000 people turned out to protest on Sunday, and in other cities across Greece reflected a growing dread – certainly among Greeks, but also among economists and perhaps even European officials – that the sharp belt-tightening and the bailout money it brings will still not be enough to keep the count

The killing of Greece

By Delusional Economics

What makes the situation completely surreal are the numbers. Greek debt in 2008 was approximately 260bn Euro. The first bailout was 110bn, the current one, that appears to be tearing the country apart, is 130bn. Add in the PSI+ haircut of approximately 100bn ( after sweetener deduction ) and you realized that Europe could have simply paid the entire bill in 2008 and saved itself 80bn Euro. Ok, that is an oversimplification of the problem but you can see my point.

However now, after 340bn Euros, Greece is still has an unmanageable debt, is in a far worse position than it was 3 years ago and it appears the country itself is coming apart at the seams.

So basically the Greek politicians and the other Eurocrats took a quarter of a billion euro problem and turned it into a existential trillion Euro one. Worst still their refusal to work cooperatively and misguided policies based around “expansionary fiscal contraction” have plunged Greece into a depression which threatens contagion to other weak economies. Yet at this point I can see absolutely no data suggesting the country is in any way more competitive than it was 3 years ago.

Greece – A Default is Better Than the Deal on Offer

By Marshall Auerback

Pick your poison. In the words of Greek Finance Minister Evangelos Venizelos, the choice facing Greece today in the wake of its deal with the so-called “Troika” (the ECB, IMF, and EU) is “to choose between difficult decisions and decisions even more difficult. We unfortunately have to choose between sacrifice and even greater sacrifices in incomparably more dearly.” Of course, Venizelos implied that failure to accept the latest offer by the Troika is the lesser of two sacrifices. And the markets appeared to agree, selling off on news that the deal struck between the two parties was coming unstuck after weeks of building up expectations of an imminent conclusion.

In our view, the market’s judgment is wrong: an outright default might ultimately prove the better tonic for both Greece and the euro zone.

The only questions that remain to be resolved are these: have all of the parties begun preparations to mitigate the ultimate impact of an outright default by Athens? And will the ECB be sufficiently aggressive in combating the inevitable speculative attacks on the other members of the euro zone periphery, which are almost certain to ensue, once Greece is “resolved” one way or the other.

Greek Bailout Deal, With More Austerity, Poised to Pass Parliament Amid Riots

I’m curious what record unemployment and poverty, bonfires and 100,000 protesters in front of Parliament is, then, if not uncontrollable economic chaos and a social explosion. And Papademos added, strangely, that the deal would allow Greece to return to economic growth in late 2013. I don’t know where this claim was pulled from. Austerity has only brought a deeper recession – and a higher debt-to-GDP ratio – thus far.

About 20 members of the coalition of parties – which control 236 of the 300 seats in Parliament – said they would not agree to the deal. But this leaves a healthy cushion for success. Three members of the Socialists resigned from their party after the bailout terms were announced.

European finance ministers would not agree to bailout terms until Greece passed them first in the Parliament, as they have run out of patience with the Greek’s ability to abide by prior deals. The deal would pave the way for a work-out with Greece’s creditors that would include a nearly 70% haircut on existing debt. European leaders hope this will be seen as a “voluntary” reduction and not a default event that would trigger credit default swaps, but leading rating agencies have already said they won’t see it that way.

Yes, this is a mess with wide ranging global impact.

Feb 14 2012

On This Day In History February 14

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

February 14 is the 45th day of the year in the Gregorian calendar. There are 320 days remaining until the end of the year (321 in leap years).

On this day in 1884, future President Theodore Roosevelt’s wife and mother die, only hours apart.

Roosevelt was at work in the New York state legislature attempting to get a government reform bill passed when he was summoned home by his family. He returned home to find his mother, Mittie, had succumbed to typhoid fever. On the same day, his wife of four years, Alice Lee, died of Bright’s disease, a severe kidney ailment. Only two days before her death, Alice Lee had given birth to the couple’s daughter, Alice.

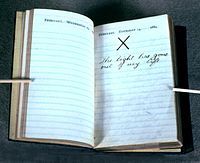

Roosevelt left his daughter in the care of his sister, Anna “Bamie/Bye” in New York City. In his diary he wrote a large X on the page and wrote “the light has gone out of my life.”

A short time later, Roosevelt wrote a tribute to his wife published privately indicating that:

She was beautiful in face and form, and lovelier still in spirit; As a flower she grew, and as a fair young flower she died. Her life had been always in the sunshine; there had never come to her a single sorrow; and none ever knew her who did not love and revere her for the bright, sunny temper and her saintly unselfishness. Fair, pure, and joyous as a maiden; loving , tender, and happy. As a young wife; when she had just become a mother, when her life seemed to be just begun, and when the years seemed so bright before her-then, by a strange and terrible fate, death came to her. And when my heart’s dearest died, the light went from my life forever

To the immense disappointment of his wife’s namesake and daughter, Alice, he would not speak of his wife publicly or privately for the rest of his life and made no mention of her in his autobiography.

Feb 13 2012

The Mortgage Settlement: Not Settled Yet

Cross posted from The Stars Hollow Gazette

So one has yet seen the final agreement between the banks and the state attorneys general and it may be awhile before we do. And as Yves Smith at naked capitalism stated “You know it’s bad when banks are the most truthful guys in the room“:

Remember that historical mortgage settlement deal that was the lead news story on Thursday? It has been widely depicted as a done deal. The various AGs who had been holdouts said their concerns had been satisfied.

But in fact, Bank of America’s press release said that the deal was “agreements in principle” as opposed to a final agreement. The Charlotte bank had to be more precise than politicians because it is subject to SEC regulations about the accuracy of its disclosures. And if you read the template for the AG press release carefully, you can see how it finesses where the pact stands. And today, American Banker confirmed that the settlement pact is far from done, and the details will be kept from the public as long as possible, until it is filed in Federal court (because it includes injunctive relief, a judge must bless the agreement).

This may not sound all that important to laypeople, but most negotiators and attorneys will react viscerally to how negligent the behavior of the AGs has been. The most common reaction among lawyers I know who been with white shoe firms (including former partners) is “shocking”.

In fact as the American Banker points out the document does not exist:

More than a day after the announcement of a mammoth national mortgage servicing settlement, the actual terms of the deal still aren’t public. The website created for the national settlement lists the document as “coming soon.”

That’s because a fully authorized, legally binding deal has not been inked yet.

The implication of this is hard to say. Spokespersons for both the Iowa attorney general’s office and the Department of Justice both told American Banker that the actual settlement will not be made public until it is submitted to a court. A representative for the North Carolina attorney general downplayed the significance of the document’s non-final status, saying that the terms were already fixed. [..]

Other sources who spoke with American Banker raised doubts that everything is yet in place. A person familiar with the mortgage servicing pact says that a settlement term sheet does not yet exist. Instead, there are a series of nearly-complete documents that will be attached to a consent judgment eventually filed with the court. That truly final version will include things such as servicing standards, consumer relief options, legal releases, and enforcement terms. There will likely be separate state and a federal versions of the release.

Some who talked to American Banker said that the political pressure to announce the settlement drove the timing, in effect putting the press release cart in front of the settlement horse.

Whatever the reason for the document’s continued non-appearance, the lack of a public final settlement is already the cause for disgruntlement among those who closely follow the banking industry. Quite simply, the actual terms of a settlement matter. [..]

“The devil’s in the details,” says Ron Glancz, chairman of law firm Venable LLP’s Financial Services Group. “Until you see the document you’re never quite sure what your rights are.”

“It’s frustrating,” agrees Stern Agee analyst John Nadel. “But it’s not unlike anything else that’s been going on in financial reform generally, is it?” [..]

“It is hard for me to believe that they would have gone public in the way that they did if they didn’t have it all worked out. But it is unusual that we don’t have a copy of the settlement yet,” says Diane Thompson, an attorney for the National Consumer Law Center.

A spokesperson from the South Carolina AG’s office told American Banker that when the agreement is finalized it would be posted to this website “nationalmortgagesettlement.com,” which raised some eyebrows. David Dayen at FDL News Desk questioned why .com and not .org? Dayen also pointed out that by not having all the details ironed out is “just a shocking abdication of responsibility”:

This is incredible. The Administration, the AGs, everyone involved in this made a big show of an agreement reached on foreclosure fraud. But there is no piece of paper with the agreement on it. There’s no term sheet. There are just agreements in principle.

There’s a HUGE difference between an agreement in principle and the actual terms. I mean night and day. The Dodd-Frank bill was for all intents and purposes an agreement in principle. It left to the federal regulators to write hundreds of rules. And we have seen how that process of implementation has faltered on several key points. But the Administration wanted to announce a “big deal,” the details be damned. And they got buy-in from the AGs. Everyone else stayed silent.

Yves Smith appeared with Amy Goodman and Juan Gonzalez on Democracy Now to discuss just how bad this deal is.

The U.S. Justice Department has unveiled a record mortgage settlement with the nation’s five largest banks to resolve claims over faulty foreclosures and mortgage practices that have indebted and displaced homeowners and sunk the nation’s economy. While the deal is being described as a $25 billion settlement, the banks will only have to pay out a total of $5 billion in cash between them. We speak to one of the settlement’s most prominent critics, Yves Smith, a longtime financial analyst who runs the popular finance website, “Naked Capitalism.” “The settlement, on the surface, does look like it is helping homeowners,” Smith says. “But in fact, the bigger part that most people don’t recognize is the way it actually helps the banks with mortgages on their own books. … The real problem is that this deal is just not going to give that much relief.”

Yes, this could be a lot worse and won’t address the needs of the underwater homeowners or those who lost their homes through fraud.

Feb 13 2012

On This Day In History February 13

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

February 13 is the 44th day of the year in the Gregorian calendar. There are 321 days remaining until the end of the year (322 in leap years).

On this day in 1633, Italian philosopher, astronomer and mathematician Galileo Galilei arrives in Rome to face charges of heresy for advocating Copernican theory, which holds that the Earth revolves around the Sun. Galileo officially faced the Roman Inquisition in April of that same year and agreed to plead guilty in exchange for a lighter sentence. Put under house arrest indefinitely by Pope Urban VIII, Galileo spent the rest of his days at his villa in Arcetri, near Florence, before dying on January 8, 1642.

Galileo Galilei (15 February 1564 – 8 January 1642), commonly known as Galileo, was an Italian physicist, mathematician, astronomer and philosopher who played a major role in the Scientific Revolution. His achievements include improvements to the telescope and consequent astronomical observations, and support for Copernicanism. Galileo has been called the “father of modern observational astronomy”, the “father of modern physics”, the “father of science”, and “the Father of Modern Science”. Stephen Hawking says, “Galileo, perhaps more than any other single person, was responsible for the birth of modern science.”

The motion of uniformly accelerated objects, taught in nearly all high school and introductory college physics courses, was studied by Galileo as the subject of kinematics. His contributions to observational astronomy include the telescopic confirmation of the phases of Venus, the discovery of the four largest satellites of Jupiter (named the Galilean moons in his honour), and the observation and analysis of sunspots. Galileo also worked in applied science and technology, inventing an improved military compass and other instruments.

Galileo’s championing of Copernicanism was controversial within his lifetime, when a large majority of philosophers and astronomers still subscribed to the geocentric view that the Earth is at the centre of the universe. After 1610, when he began publicly supporting the heliocentric view, which placed the Sun at the centre of the universe, he met with bitter opposition from some philosophers and clerics, and two of the latter eventually denounced him to the Roman Inquisition early in 1615. In February 1616, although he had been cleared of any offence, the Catholic Church nevertheless condemned heliocentrism as “false and contrary to Scripture”, and Galileo was warned to abandon his support for it-which he promised to do. When he later defended his views in his most famous work, Dialogue Concerning the Two Chief World Systems, published in 1632, he was tried by the Inquisition, found “vehemently suspect of heresy”, forced to recant, and spent the rest of his life under house arrest.

Feb 12 2012

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History February 12 by TheMomCat

These featured articles-

- My Little Town 20120208: The Railroad Tracks by Translator

- Fukushima in Georgia by ek hornbeck

- The Mortgage Settlement: Not Settled Yet by TheMomCat

- In Memoriam: Whitney Houston by TheMomCat

our weekly features-

- Six In The Morning On Sunday by mishima

- Punting the Pundits: Sunday Preview Edition by TheMomCat

- Rant of the Week: Keith Olbermann by TheMomCat

Feb 12 2012

In Memoriam: Whitney Houston

In 1991 at Super Bowl XXV, Whitney gave this flawless performance of the National Anthem that has yet to be matched.

May the Goddess guide her on her journey to the Summerlands. May her family, friends, fans and the world find Peace.

The Wheel Turns. Blessed Be.