(noon. – promoted by ek hornbeck)

University of Newcastle economist Bill Mitchell (“Professor of Economics” in a University system where Professor means something far more than just “university teacher”) addresses the disconnect between Ben Bernanke’s economic universe and the real world in The Great Moderation myth. This is one of his (typically) long blog posts with the (normal) very high signal to noise ratio combined with (typical) substantial amount of detailed economic discussion which may be off-putting to those with poor tolerance for economic discussion.

University of Newcastle economist Bill Mitchell (“Professor of Economics” in a University system where Professor means something far more than just “university teacher”) addresses the disconnect between Ben Bernanke’s economic universe and the real world in The Great Moderation myth. This is one of his (typically) long blog posts with the (normal) very high signal to noise ratio combined with (typical) substantial amount of detailed economic discussion which may be off-putting to those with poor tolerance for economic discussion.

However, in his post, he has two diagrams which perfectly capture an important element of the disconnect between Bernanke’s world and the real world.

So, two diagrams and a handful of paragraphs on why Bernie Sanders is quite right: we need somebody different from Bernanke as Fed Chairman.

source of image is the linked to piece by Bernie Sanders in the Guardian’s Comment is Free

The diagram above is Bernanke’s world, in which an “anti-inflation” policy temporarily pushes the economy below its “growth path”, and then as inflation is brought down to the target level, the economy is “allowed” to return to its long term growth path. In Bernanke’s world, anti-inflation policies are always and everywhere purely short-term temporary pain for long-term, ongoing gain.

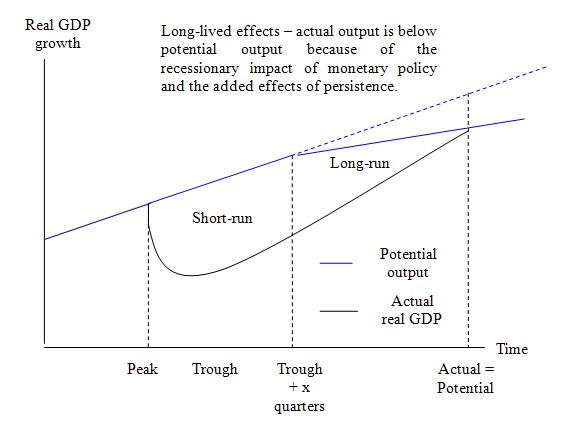

This diagram, by contrast, is how the real world works. In the real world, when we push economic activity down, we discourage real investment in real productive capacity and we pull the long term growth path down as well.

We need a Fed Chairman that does not believe that we live in the fantasy world of the first diagram, with its pre-defined growth path that magically pulls the economy back on track once the deliberately-imposed short term slowdown is finished. Instead, we need a Fed Chairman who lives in the real world of second diagram, who understands that these policies billed as “short term inflation reduction” policies are really about serving the long term interests of a set of vested interests at the expense of the public interest … and who is willing to put that understanding in service to the public interest.

11 comments

Skip to comment form

Author

… does not come anywhere CLOSE to hurting so good.

If I were the CEO of “Globocorp” I would worry about the entitlement sentiments of the minority world population of 300 milllion screaming brats who think they are “free” consuming over 25% of my profit margins when there are 6 billion other far more easily exploitable souls on earth who speak at least two languages and are far more willing to be exploited for money and the interest I make on that non-existent fiat money. I can easily command the world to smite those who don’t endorse my paradigms by molding the public perceptions so as to wipe out people, governments and even thoughts that are counter to the profit margins of “Globocorp”.

Bilderberg group,CFR,Trilateral Commission. World, far before US interests. IMF to Haiti. Raise electric rates, freeze pay for public servants and we will “loan” you 100 million.

it’s a teaching blog too. I take the quiz every week –