9:00

FRONTLINE INVESTIGATES THE ROOTS OF THE FINANCIAL CRISIS

FRONTLINE Presents

The Warning

Tuesday, October 20, 2009, at 9 P.M. ET on PBS

In the devastating aftermath of the economic meltdown, FRONTLINE sifts through the ashes for clues about why it happened and examines critical moments when it might have gone much differently.

In The Warning, airing Tuesday, Oct. 20, 2009, at 9 P.M. ET on PBS (check local listings), veteran FRONTLINE producer Michael Kirk (Inside the Meltdown, Breaking the Bank) unearths the hidden history of the nation’s worst financial crisis since the Great Depression. At the center of it all he finds Brooksley Born, who speaks for the first time on television about her failed campaign to regulate the secretive, multi-trillion-dollar derivatives market whose crash helped trigger the financial collapse in the fall of 2008.

http://www.pbs.org/wgbh/pages/…

FRONTLINE | “The Warning” | PBS

http://www.youtube.com/watch?v…

FRONTLINE | “The Warning”: Sneak Peek 1 | PBS

http://www.youtube.com/watch?v…

Brooksley Born tried to Regulate the dangerous OTC Derivatives market —

Greenspan and Rubin stopped her!

Was the Sky really Falling? Was it about to, if Derivatives were left Unchecked?

Credit Crisis Cassandra

Brooksley Born’s Unheeded Warning Is a Rueful Echo 10 Years On

By Manuel Roig-Franzia, Washington Post Staff Writer -May 26, 2009

A little more than a decade ago, Born foresaw a financial cataclysm, accurately predicting that exotic investments known as over-the-counter derivatives could play a crucial role in a crisis much like the one now convulsing America. Her efforts to stop that from happening ran afoul of some of the most influential men in Washington, men with names like Greenspan and Levitt and Rubin and Summers — the same Larry Summers who is now a key economic adviser to President Obama.

She was the head of a tiny government agency who wanted to regulate the derivatives. They were the men who stopped her.

http://www.washingtonpost.com/…

The ‘Oracle of Omaha’, Warren Buffet gave a prophetic pronouncement back in 2003 about derivatives market, seeing the exponential dangers of the new-fangled class of investment, which he called: “financial weapons of mass destruction“.

Buffett warns on investment ‘time bomb’

BBC – 4 March, 2003

The derivatives market has exploded in recent years, with investment banks selling billions of dollars worth of these investments to clients as a way to off-load or manage market risk.

But Mr Buffett argues that such highly complex financial instruments are time bombs and “financial weapons of mass destruction” that could harm not only their buyers and sellers, but the whole economic system.

Contracts devised by ‘madmen’

Derivatives are financial instruments that allow investors to speculate on the future price of, for example, commodities or shares – without buying the underlying investment.

[…]

Some derivatives contracts, Mr Buffett says, appear to have been devised by “madmen”.He warns that derivatives can push companies onto a “spiral that can lead to a corporate meltdown”,

[…]

Derivatives also pose a dangerous incentive for false accounting, Mr Buffett says.The profits and losses from derivatives deals are booked straight away, even though no actual money changes hand. In many cases the real costs hit companies only many years later.

http://news.bbc.co.uk/2/hi/bus…

SO why are these Derivative Bets, SO Dangerous?

Derivatives: Buffet calls them financial Weapons of Mass Destruction

By John Riley, Chief Strategist — 01/18/08

What are Derivatives?

Derivatives are private contracts (bets) between financial institutions. They can be on the direction of commodities, the stock markets or currencies, but the banks’ favorites are interest rates. (You can go to the Comptroller of the Currency website to get their quarterly reports and see for yourself what Wall Street hopes you never see.)

[…]

The scariest part of derivatives is their leverage. Like exchange traded options, derivative contracts can control assets for only a fraction of the contract value. The banks take the leverage to an extreme and have very little in assets backing up their derivative portfolios. According to the Comptroller, the top 25 banks have assets that only amount to about 6% of the Notional Value of their derivatives.

[…]

Derivatives have barely any regulation on them. For years, Congress tried and Greenspan stood in the way. Banks barely mention them in the annual reports except for a footnote.Thanks to the lack of regulation, derivatives have grown dramatically. There has been a 473% increase in the Notional Value of derivatives at the top 25 banks since 1999.

http://www.rapidtrends.com/der…

Amazing, as of the beginning of 2008, the Top 25 banks ONLY HAD 6% Collateral to back up all their over-leveraged Derivative BETS! That includes all those notorious Credit Default Swaps too, tucked in among those Credit Derivatives. The Bankers put only 6% Down, to back up their betting!

In the old days, before Deregulation, betting trading “on margin”, required minimum levels of capital assets on hand to back up, extreme multiples of trading. But with Deregulation, those quaint requirements went out the window.

You got 1 Dollar, and want to bet $40 — No Problem! How about $50? How about $100? Step right up, as long as you have the prestige of an Investment Bank, or a Billion Dollar Hedge Fund, to back you up. … “Your Word is your Bond” — in this unwatched and unregulated OTC arena. Or so we were told.

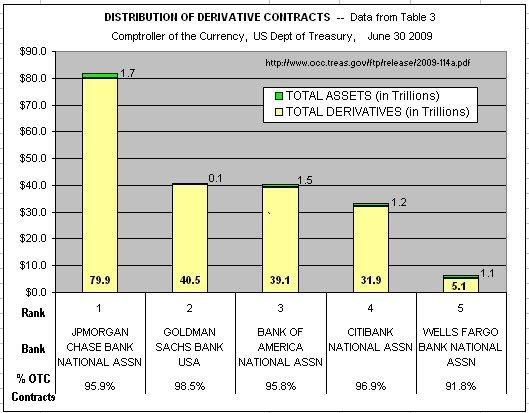

The sheer speculative arrogance of the Top Wall Street Bankers is truly astronomical when you chart it out. The Comptroller of the Currency (pdf), of US Dept of Treasury, has been busy collecting the data, if anyone cares to take the time to chart it out, like I have. (By the way a Trillion, is an awful big number — It’s a Million, Millions!)

The Top 5 Banks — March 2008

The 6th-10th Over-leveraged Banks — March 2008

The 11th-15th sort-of-leveraged Banks — March 2008

The Top 5 Banks vs ALL the Rest of the Banks — March 2008

The Top 5 Banks cornering 96.9% of the Derivatives — March 2008

The NEW Top 5 Banks — June 2009

Data source: Comptroller of the Currency (pdf), of US Dept of Treasury, has issued an updated report as of June 2009.

THAT IS WHY Brooksley Born and Warren Buffet, WARNED about the Toxicity of the Toxic Assets, well ahead of time — TO DO SOMETHING!

AND THAT IS WHY the Greenspan and Company — did ALL they could to Ignore and then Shelf their dire Warnings!

AND THAT IS WHY you should Watch FRONTLINE — this week!

FRONTLINE | “The Warning”: Sneak Peek 2 | PBS

http://www.youtube.com/watch?v…

FRONTLINE INVESTIGATES THE ROOTS OF THE FINANCIAL CRISIS

FRONTLINE Presents

The Warning

Tuesday, October 20, 2009, at 9 P.M. ET on PBS

That’s tomorrow!

SET you DVR’s NOW!

7 comments

Skip to comment form

Author

Frontline Website says, you can watch in online too.

everywhere you can.

The IMF gave ample warning as to the crash, as well. In March of 2008 it told countries to “expect the worst” as far as the coming crash.

So when people high up in governmenet say they weren’t warned? They’re lying.

I mean, you think Hank Paulson somehow missed that? No freaking way.

Hell, if I knew about it, and I wrote about it here:

http://www.dailykos.com/storyo…

You can bet that people whose JOB it is to listen to the IMF knew about it.

Kind of like 9/11. “No one could have imagined ……..!”

Fucking bullshit.

It looks like the total assets and total derivatives in the “new” top five banks is reversed. Your graph shows them with more assets than derivatives instead of remaining frighteningly overleveraged still.

Do I have it right that they leveraged derivatives at only 6% or so, and the value of those derivatives themselves were only a fraction of the assets they controlled (manipulated)?

The Masters of the Universe destroyed the world’s economy with no money down. Wow.