We have been told that Wall Street Investment firms are “Too big to Fail” — But that does NOT Mean they are “Too Big for Accountability”!

The Question boils down to,

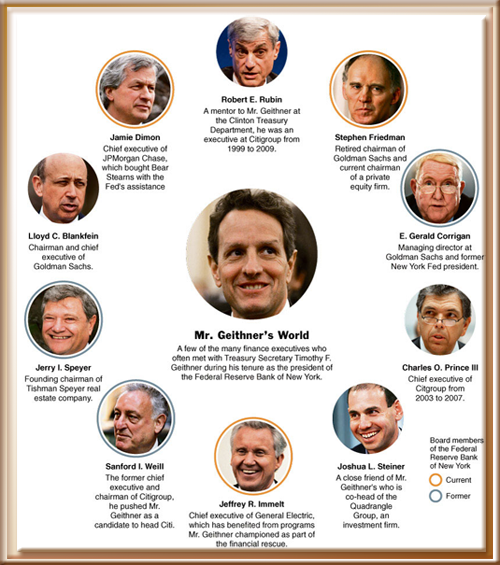

Who Does the Congress Represent anyways —

The American People, or the Global Bankers (and their Lobbyists) ?

And Will the People bother to care about Wall Street Regulation this time around?

Since I’m assuming we will, here’s some essential background on the Wall Street Meltdown mess:

Credit Default Swap (CDS)

What Does Credit Default Swap (CDS) Mean?

A swap designed to transfer the credit exposure of fixed income products between parties.

http://www.investopedia.com/te…

CDS’s are an easy way to transfer Credit Risk — Check!

Writing in the the current print issue of

Writing in the the current print issue of