(noon – promoted by Nightprowlkitty)

Elizabeth Warren was appointed chair of a newly created Congressional Oversight Panel (COP), which is charged with keeping tabs on the $700 billion bailout of the financial sector – including Troubled Assets Relief Program (TARP).

Warren however, has had some “Trouble” getting straight forward answers … as she explained to the Boston Globe:

Keeping tabs on the bailout

By Elizabeth Warren — April 12, 2009

Elizabeth Warren: There’s a major problem and a minor problem. The minor problem is documentation. I’ve spent four weeks now looking for someone who can give me the details of the stress test so that we can do an independent evaluation of whether the stress test is any good.

We get: “someone will call [you] right back.” Only the call doesn’t come.

The major problem is …

[continuing …]

Elizabeth Warren: The major problem is that Treasury has not articulated its goals. And without that, we can’t have a robust debate about whether they’re headed in the right direction; instead, we’re stuck with this more technical argument about the implementation of the [Term Asset-Backed Securities Loan Facility] or the details of the Capital Acquisition Program. And that misses the central question of, should we be subsidizing failing banks or liquidating them?

When we acquire capital, should we exercise more control over the institutions that take the money or less control? Those are the central policy issues that the American public has a right to participate in.

(emphasis added)

http://www.boston.com/bostongl…

Despite the apparent lack of Transparency, and the unreturned Phone Calls from Treasury, Elizabeth Warren and her Congressional Oversight Panel has manage to piece together their TARP Report anyways:

Congressional Oversight Panel

April Oversight Report — April 7, 2009

Executive Summary (pdf)

Accessing Treasury’s Strategy: Six Months of TARP

[possible solutions]

To deal with a troubled financial system, three fundamentally different policy alternatives are possible:

liquidation, receivership, or subsidization.

The Report discusses the pros and cons of each of those approaches, in the context of History, and previous Financial Crises.

The role for asset-valuation, and its relationship to lack of credit [liquidity], is also discussed, by the Oversight Panel — as it is seen as pivotal to the success, of whichever “Stabilization Strategy” (or combination of) is actually pursued in the long run:

One key assumption that underlies Treasury’s approach is its belief that the system-wide deleveraging resulting from the decline in asset values, leading to an accompanying drop in net wealth across the country, is in large part the product of temporary liquidity constraints resulting from nonfunctioning markets for troubled assets.

The debate turns on whether current prices, particularly for mortgage-related assets, reflect fundamental values or whether prices are artificially depressed by a liquidity discount due to frozen markets – or some combination of the two.

If its assumptions are correct, Treasury’s current approach may prove a reasonable response to the current crisis. Current prices may, in fact, prove not to be explainable without the liquidity factor. … In a liquid market, even under-collateralized assets should not be trading at pennies on the dollar. Prices are being partially subjected to a downward self-reinforcing cycle.

(emphasis added)

The Executive Summary concludes any successful “resolution” for the financial mess, must adhere to these 4 principles, if history is to be any guide:

A review of these historical precedents reveals that each successful resolution of a financial crisis involved four critical elements:

– Transparency. Swift action to ensure the integrity of bank accounting, particularly with respect to the ability of regulators and investors to ascertain the value of bank assets and hence assess bank solvency

– Assertiveness. Willingness to take aggressive action to address failing financial institutions by (1) taking early aggressive action to improve capital ratios of banks that can be rescued, and (2) shutting down those banks that are irreparably insolvent.

– Accountability. Willingness to hold management accountable by replacing – and, in cases of criminal conduct, prosecuting – failed managers.

– Clarity. Transparency in the government response with forthright measurement and reporting of all forms of assistance being provided and clearly explained criteria for the use of public sector funds.

Since Transparency, Accountability, Clarity, seem to fit well within the overall stated goal of the Obama Administration, of conducting an Open, Transparent Government, these 4 “precedents” that Warren is asking for, in regards to all those Billions, is hardly an unreasonable request.

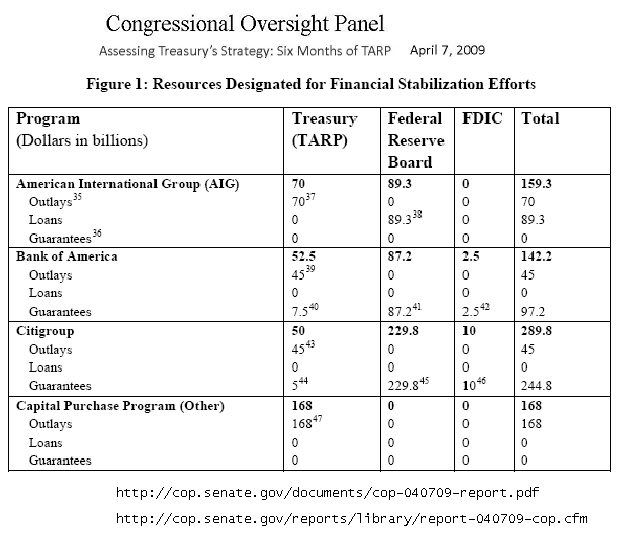

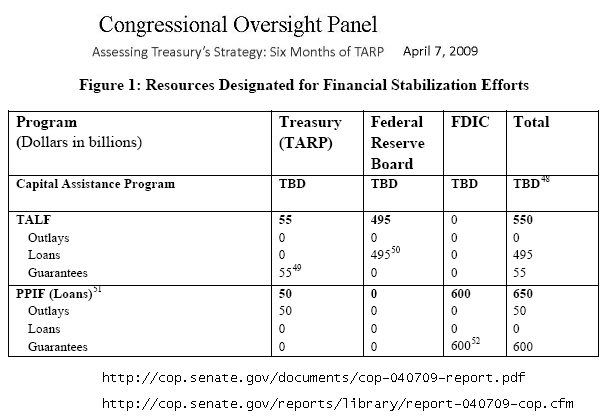

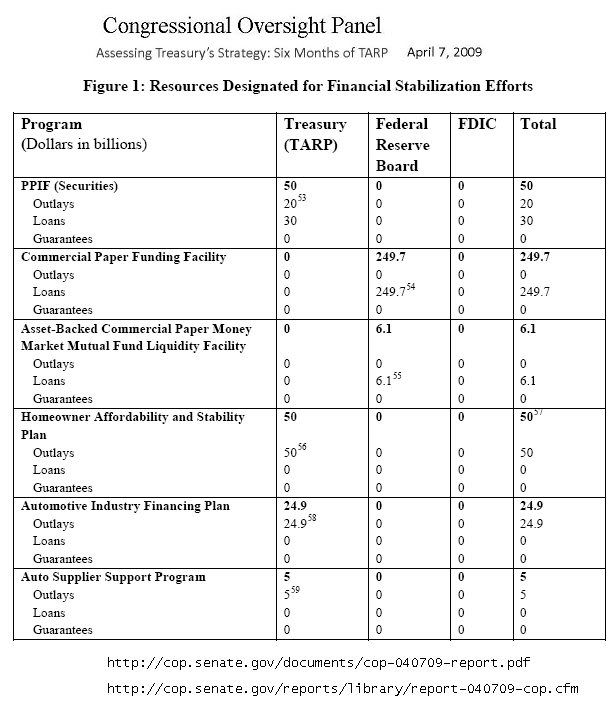

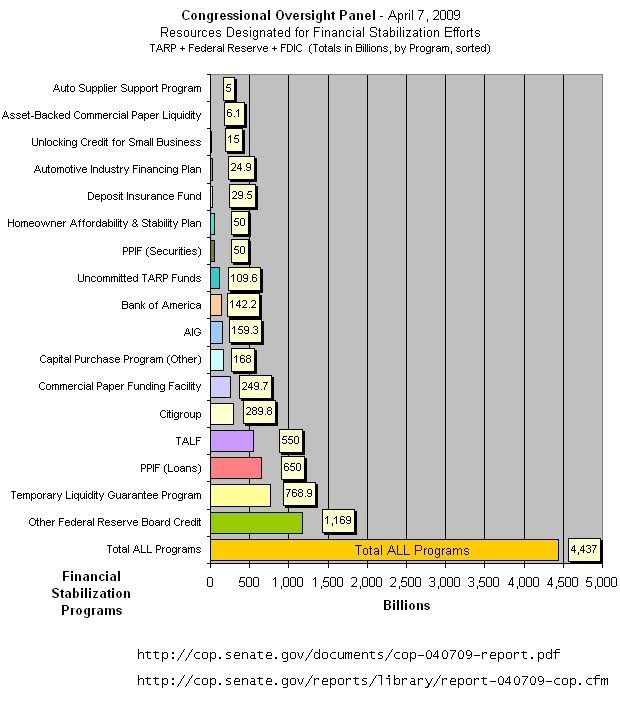

Speaking of Billions, the Congressional Oversight Panel has pieced together the BIG picture here too:

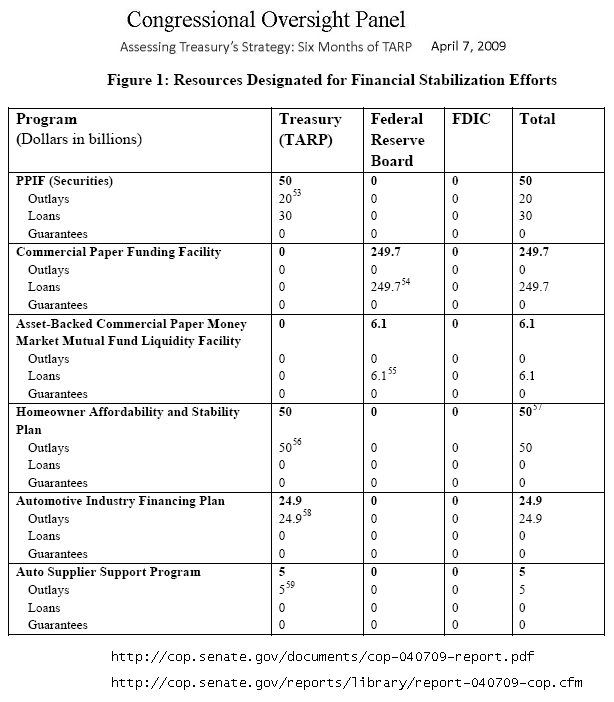

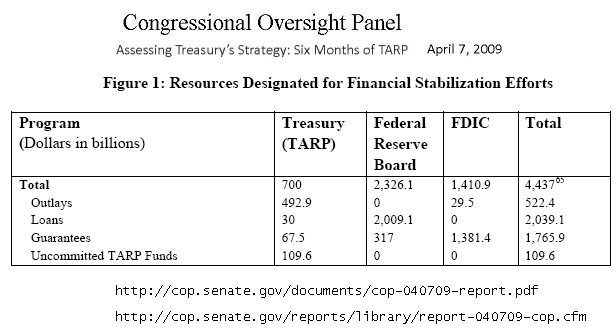

In addition to drawing on the $700 billion allocated to Treasury under the EESA, economic stabilization efforts have depended heavily on the use of the Federal Reserve Board’s balance sheet. This approach has permitted Treasury to leverage TARP funds well beyond the funds appropriated by Congress.Thus, while Treasury has spent or committed $590.4 billion of TARP funds, according to Panel estimates, the Federal Reserve Board has expanded its balance sheet by more than $1.5 trillion in loans and purchases of government-sponsored enterprise (GSE) securities. The total value of all direct spending, loans and guarantees provided to date in conjunction with the federal government’s financial stability efforts (including those of the Federal Deposit Insurance Corporation (FDIC) as well as Treasury and the Federal Reserve Board) now exceeds $4 trillion.

This report reviews in considerable detail specific criteria for evaluating the impact of these programs on financial markets. Six months into the existence of TARP, evidence of success or failure is mixed.

(emphasis added)

WOW! more than $4 Trillion already

(I wonder if they have that in a spreadsheet yet?)

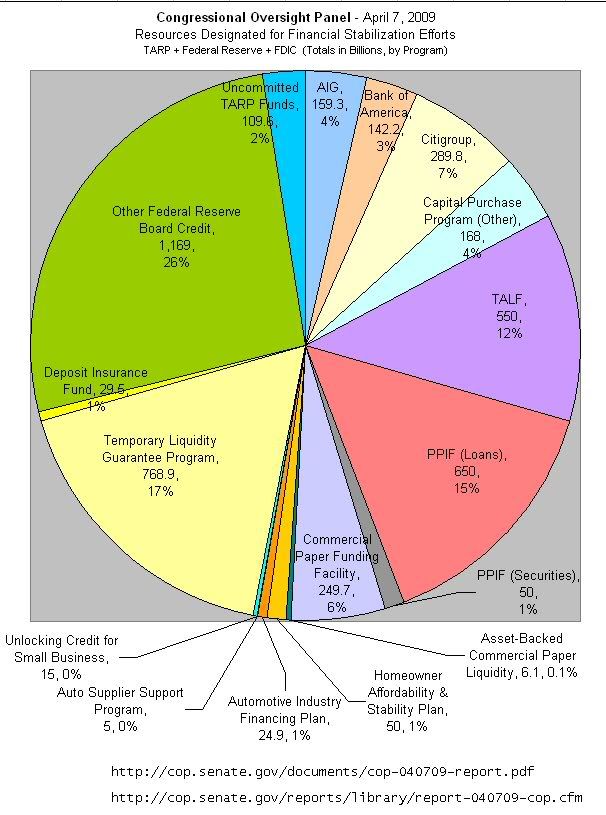

The more detailed COP Report, which supplements the Executive Summary, DOES break down those “trivial Trillions” into some “general Accounting Buckets” (although I had to transpose the totals into a spreadsheet, to build those handy Charts. So much for Transparency, and making it easy, for the average Taxpayer.)

Double WOW, WOW!

Nice to see that the Consumer-oriented “pieces of pie” are SO thin — Oh well I guess that helps with that Old “Frugality” Diet, now, doesn’t it?

As Elizabeth Warren puts it with her own brand of “citizen outrage”, in her recent interview:

Question: You’ve been quite critical of the Treasury. What troubles you most about what you’re getting and what you’re not getting?

Elizabeth Warren: There’s no discussion of the overall policy. Instead, there are specific programs that are announced, and from that, it’s necessary to reason backwards to figure out what the goal must have been. It’s like a “Jeopardy!” game. If this is the answer, what was the question?

It’s frustrating because without a clearly articulated goal and identified metrics to determine whether the goal is being accomplished, it’s almost impossible to tell if a program is successful.

(emphasis added)

http://www.boston.com/bostongl…

Listen to how Congressional Oversight “Checks and Balances” really works, in our Oh-SO complex, interconnected, too-big-to-fail world:

Elizabeth Warren

http://www.youtube.com/watch?v…

When will Small Businesses, and Homeowners, and Auto Workers, and workers in general, ever get our “Slice of the Pie?”

I guess it would help to first know — HOW big is that Pie anyways?

Afterall, we’re paying for it!

You’d think Bankers would be good at Balancing their Books —

afterall it’s their Business!

So start Counting, already!

9 comments

Skip to comment form

Author

Tips for Accountability

Thanks for this wonderfully in-depth examination of what’s known and unknown per the Great Heist of ’09. It’ll take me some time to get all through it with due attention, so this essay is bookmarked. Great!

Step #1:

COP set up to oversee TARP and other “relief” services.

Step #2:

COP unable, or barely able, to find TARP and/or other “relief” services.

That is, the Treasury has got the causality backwards … rather than the junk assets being the problem, with liquidity binds one consequence, they view it as liquidity binds undermining the price of “fundamentally strong” assets.

That is, rather than starting with the looking at the evidence and the actual operating rules of the systems they are looking at, they are proceeding on a “New Keynesian” approach of “there can be short run problems, and the short run problems can hurt, but the whole system tends toward the “right prices for full employment” in the long run. The idea that the system was broken and people were buying financial assets at fundamentally “wrong” prices for a number of years in a row simply flies in the face of the theory, even if it is also quite clearly true.

Author

with the “run-away” profits being reported by Goldman Sachs today —

and the still tight credit markets in the US,

I figured it was worth posting this Story again.

(originally posting in April 2009, on dkos)

What better place to start the “Accountability”

than with the Gamblers who wrecked the Economy,

who get paid back with “socialist-type” Bailouts, with few strings attached?

Just because Banking & Credit & Derivatives are complicated

is no reason, that Bankers should NOT Account for how they

used those Bailout Trillions!

We need more Sheriffs on Wall Street,

and less of the Old Boys club between

the Treasury and the Banks.

In short, we need Real Accountability!