Has Treasury Secretary, Timothy Geithner, done a good job so far? Kinda, I wouldn’t give him a gold star or anything. In fact, I’d say he’s done a mediocre job. Did he know about the whole bonus thing at AIG? And what about how the situation that went down with Lehman Brothers? Bottom line, is the GOP push to have Geithner removed legit? I say no.

Tag: AIG

Mar 21 2009

For lack of a better term, call it Capitalism

Burning the Midnight Oil for the Beauty Platform

Johnny Venom, in an extended comment on a Robert Oak post at The Economic Populist, says (note … much good stuff snipped, so click through):

My take on all this madness

What’s happening here is the collision of several realities:

1. You had institutions, who years if not decades, believing the hype they built themselves to sell to their clients. …

2. That you can’t simply create your own damn financial instrument to meet a client’s needs. …

3. Derivatives products work when they are designed well and implemented on a regulated environment. …

4. Many of these items will never be liquid. This brings us to today. The reality of the situation is that we now have to be discriminating between those derivatives that are somewhat liquid and those that aren’t. The former can have mark to market, but there needs to be a proper exchange for these things. Both the CME and ICE are going to have such a thing, and these banks should be made to trade them on it to get these things off their books. As for the iliquid ones, well unless our goal is to bankrupt these banks in some attempt to punish them, we will have to facilitate either a suspension of FASB 157 for these or some hybrid. …

5. Banks holding on to these illiquid derivative step children, that must be re-engineered, will have to realize they won’t get all their money back. …

6. Lastly, new accounting rules and financial regulations must be in place to keep in check the establishment of new positions. …

My response and thoughts after the fold.

Mar 21 2009

A Diary A Day – a Humongous Heaping Healthy Helping of FRAUD

Yesterday I diaried about my understanding of how the meltdown happened, here. But there is part of the diary worthy of a diary on it’s own. The very important part played by Wall Street’s three biggest arbiters of credit. We will look at their part combined with how these instruments were allowed to be traded that may be the largest fraud ever perpetrated against the American people. We will discuss the illegal actions that can and MUST be pursued below the fold.

Mar 20 2009

A Diary A Day- Get this math – It’s VEGAS BABY!!!!

In researching my Sunday diary I ran across some interesting facts and figures I thought I would share with you. Grab a pencil and paper, your pocket calculator and pop some pop corn because this is going to be entertaining in a sick and disgusting sort of way. Follow me below the fold for a trip to the house of cards where our dreams live, located at the intersection of greed and larceny with a little betrayal along for the ride.

Mar 19 2009

AIG’s Bonus Blow-Up: The Essential Q&A

If you’re anything like me and I suspect like most of us, you know about the scandal surrounding AIG’s bonus payouts to the same company employees in their London operation that were at the center of the Credit Default Swap scheming that triggered the current global financial meltdown, but also like me you’re probably no economist nor expert in financial matters and are having a difficult time wrapping your head around what, exactly is going on, how we got here, and why our economy seems to be collapsing.

Sharona Coutts is a law graduate and an honors graduate from Columbia Journalism School’s investigative seminar and now writes for ProPublica, an independent, non-profit newsroom in Manhattan that produces investigative journalism and describes themslves as “producing journalism that shines a light on exploitation of the weak by the strong and on the failures of those with power to vindicate the trust placed in them”.

Sharona has put together a very good Q&A piece that helps in understanding what exactly is going on with AIG. She has also produced a very good related piece: Timeline: AIG and Their Bonuses that she quotes in the Q&A article reproduced here.

AIG’s Bonus Blow-Up: The Essential Q&A

by Sharona Coutts, ProPublica – March 18, 2009 5:12 pm EDT

Monday marked six months to the day since AIG’s first bailout, but it wasn’t until news of executive bonuses over the weekend that public fury truly focused on the hemorrhaging insurer.

Monday marked six months to the day since AIG’s first bailout, but it wasn’t until news of executive bonuses over the weekend that public fury truly focused on the hemorrhaging insurer.

President Obama told Americans he was “choked up with anger” over bonus payments to executives at AIG’s Financial Products office whose bad bets pushed the company to the brink of collapse. The administration is worried about public anger turning against it, not just the company.

In some respects, the sudden anger is mystifying. After all, there’s nothing new about the bonuses except that a portion of them – $165 million – were actually paid on Friday. Contracts instigating the bonuses were made a year ago, and they’ve regularly been in the news in recent months.

And the amount involved is dwarfed by the tens of billions that flowed to banks and hedge funds.

AIG’s plan to pay bonuses have been public knowledge for more than a year. Why is this blowing up now?

Mar 18 2009

AIG Scandal: America Wakes Up To Extent of Capitalist Thievery

The news that AIG executives were to receive hundreds of millions of dollars in bonuses (maybe as high as $450 million!), even after a $170 billion dollar bailout, has fueled a populist revolt not seen since the initial shock of the economic crisis hit Americans last October. When Obama Treasury Secretary Timothy Geithner told American Insurance Group CEO, Edward M. Liddy, that government loans to AIG might be renegotiated as a result, Liddy responded with “grave concern” over the firm’s ability to retain “talented staff.”

Talented in rip-off, that is. But former New York governor and supposed scourge of Wall Street, Elliot Spitzer, is reporting over at Slate that the outrage in the media over the bonuses is a diversion. (H/T Inky99 at Daily Kos.) Not that they aren’t an outrage, the scandal misses the larger crime: the siphoning off of billions of taxpayer dollars to a handful of companies, who insured their highly risky investments with AIG. These companies have received hundreds of billions of dollars in bailout money. Now they are to receive 100% on the dollar reimbursement for their losses from AIG. Spitzer comments:

Mar 18 2009

Take Back the Economy

It’s still not too late to take our economy back, but we can’t depend on Obama to do it, we’re going to have to take it back ourselves. Starting on March 19th.

Credit derivatives are breaking and will continue to break the world’s financial system and cause an unending crisis of liquidity and gummed-up credit. Warren Buffett branded derivatives “financial weapons of mass destruction.” Felix Rohatyn, the investment banker who organized the bailout of New York a generation ago, called them “financial hydrogen bombs.”

Corporate elites have been waging class warfare against us for decades. They’ve riddled us with Bankruptcy Bill bullets, napalmed us with NAFTA, massacred our labor unions, turned our healthcare system into the Bataan Death March, and now they’re dropping financial hydrogen bombs on us.

According to The Village Voice, one of their deadliest and most lethal weapons has been the AIG Financial Products office in London, where a large proportion of those radioactive credit derivatives were written.

AIG had placed this unit outside American borders, which meant that it would not have to abide by American insurance reserve requirements. The president of AIGFP, a tyrannical super-salesman named Joseph Cassano, was an executive at Drexel Burnham Lambert, the now-defunct brokerage that became the pivot of the junk-bond scandal that led to the jailing of Michael Milken, David Levine, and Ivan Boesky.

During the peak years of derivatives trading, the 400 or so employees of the London unit reportedly averaged earnings in excess of a million dollars a year. They sold “protection”-this Runyonesque term was favored-worth more than three times the value of parent company AIG.

Those talented people are demanding the bonuses they’ve earned for that bang up job they’ve done hydrogen bombing everything in sight into radioactive rubble. As Emptywheel warns, if we don’t give them their bonuses, they’ve threatened to trigger a default event that will cost the US government hundreds of billions of dollars.

Mar 18 2009

A Diary A Day – Housing Starts Up-The Slumming of America Begins

Much to everyone’s surprise housing starts were up in February. Unfotunately the increase was for multi-family dwellings no doubt preparing to house all those on the street from foreclosures. The largest increases were in the Northeast, South and Midwest. Oddly California hard hit by foreclosures has a good backlog of housing available. And so it starts the slumming of America, more below the fold.

Mar 15 2009

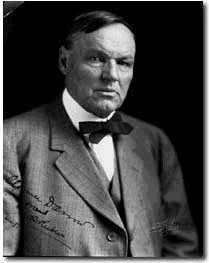

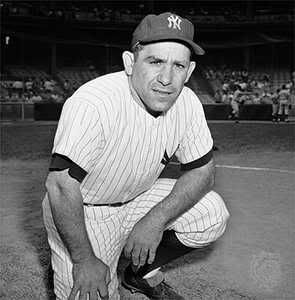

Clarence Darrow & Yogi Berra

The topic below was originally posted at the Intrepid Liberal Journal.

Arguably America’s greatest trial lawyer, Clarence Darrow, famously once said,

“First and last, it’s a question of money. Those men who own the earth make the laws to protect what they have. They fix up a sort of fence or pen around what they have, and they fix the law so the fellow on the outside cannot get in. The laws are really organized for the protection of the men who rule the world. They were never organized or enforced to do justice. We have no system for doing justice, not the slightest in the world.”

Reading this morning’s headlines about A.I.G. utilizing nearly $165 million of their $170 billion tax payer financed bailout for bonuses, reminded me of Darrow’s insight. The excuse being offered after all is that a “contract is a contract” and A.I.G. must fulfill their obligations.

Isn’t it curious how contracts are deemed sacrosanct for Wall Street beneficiaries but not blue-collar members of unions in the auto industry? Unions are expected to get “realistic” and ” renegotiate” their contracts but moneyed elites are allowed to carry on as before. Anyone who has the temerity to point out the contradiction is “unreasonable,” “angry,” “extreme,” or heaven forbid, one of those “crazy left wing bloggers.”

Mar 08 2009

Welcome to Monty Python’s Flying Bank Bailout Circus

In “The Big Dither” Paul Krugman warns:

There’s a growing sense of frustration, even panic, over Mr. Obama’s failure to match his words with deeds. The reality is that when it comes to dealing with the banks, the Obama administration is dithering. Policy is stuck in a holding pattern.

Here’s how the pattern works: first, administration officials, usually speaking off the record, float a plan for rescuing the banks in the press. This trial balloon is quickly shot down by informed commentators. Then, a few weeks later, the administration floats a new plan. This plan is, however, just a thinly disguised version of the previous plan, a fact quickly realized by all concerned. And the cycle starts again.

Welcome to Monty Python’s Flying Bank Bailout Circus. Everything is under control. Nudge, nudge. Wink, wink . . .

Say no more, say no more.

Jan 17 2009

Companies get bailout billions, hide billions in tax havens

The Goverment Accountability Office (GAO) released a report (pdf) on Friday detailing how the biggest U.S. companies are using offshore tax havens to avoid being responsible corporate citizens. The GAO summary explains:

Many U.S. corporations operate globally and have foreign subsidiaries… In some cases they may be used to reduce taxes…

Eighty-three of the 100 largest publicly traded U.S. corporations in terms of 2007 revenue reported having subsidiaries in jurisdictions listed as tax havens or financial privacy jurisdictions. Sixty-three of the 100 largest publicly traded U.S. federal contractors…

Not only that, but many of these corporations have received billions in federal bailout money and Senators Byron Dorgan (D-ND) and Carl Levin (D-MI) estimate this corporate tax exploit shifts $100 billion tax responsibility to other taxpayers in the form of loss tax revenue.