(8 am. – promoted by ek hornbeck)

In “The Big Dither” Paul Krugman warns:

There’s a growing sense of frustration, even panic, over Mr. Obama’s failure to match his words with deeds. The reality is that when it comes to dealing with the banks, the Obama administration is dithering. Policy is stuck in a holding pattern.

Here’s how the pattern works: first, administration officials, usually speaking off the record, float a plan for rescuing the banks in the press. This trial balloon is quickly shot down by informed commentators. Then, a few weeks later, the administration floats a new plan. This plan is, however, just a thinly disguised version of the previous plan, a fact quickly realized by all concerned. And the cycle starts again.

Welcome to Monty Python’s Flying Bank Bailout Circus. Everything is under control. Nudge, nudge. Wink, wink . . .

Say no more, say no more.

Krugman:

Somehow, top officials in the Obama administration and at the Federal Reserve have convinced themselves that troubled assets, often referred to these days as “toxic waste,” are really worth much more than anyone is actually willing to pay for them – and that if these assets were properly priced, all our troubles would go away. Thus, in a recent interview Tim Geithner, the Treasury secretary, tried to make a distinction between the “basic inherent economic value” of troubled assets and the “artificially depressed value” that those assets command right now.

Thanks Tim. I understand now. It’s like that distinction between the artificially depressed value of the Titanic and its basic inherent economic value, which will be much higher someday. It’s like the Hindenburg explosion. That was just an artificial fireball. Say no more, say no more.

Krugman:

Earlier this week, Ben Bernanke, the Federal Reserve chairman, was asked about the problem of “zombies” – financial institutions that are effectively bankrupt but are being kept alive by government aid. “I don’t know of any large zombie institutions in the U.S. financial system,” he declared, and went on to specifically deny that A.I.G. – A.I.G.! – is a zombie.

It’s true. AIG is not a zombie.

It’s a dead parrot.

Bernanke and Geithner can keep telling us AIG is not a dead parrot, that Bank of America is not a dead parrot, that Citigroup is not a dead parrot, they can keep telling us that about every other dead parrot on Dead Parrot Street, but that isn’t going to change anything. They’re. Dead. Parrots.

Krugman:

The truth is that the Bernanke-Geithner plan – the plan the administration keeps floating, in slightly different versions – isn’t going to fly. Take the plan’s latest incarnation: a proposal to make low-interest loans to private investors willing to buy up troubled assets. This would certainly drive up the price of toxic waste because it would offer a heads-you-win, tails-we-lose proposition. As described, the plan would let investors profit if asset prices went up but just walk away if prices fell substantially.

We’ve been told Monty Python’s Flying Bank Bailout Circus is under new management. Yeah. It sure is.

Meet the new boss . . .

Same as the old boss . . .

Krugman:

Officials still aren’t willing to face the facts. They don’t want to face up to the dire state of major financial institutions because it’s very hard to rescue an essentially insolvent bank without, at least temporarily, taking it over. And temporary nationalization is still, apparently, considered unthinkable.

But not as unthinkable as telling us a dead parrot isn’t a dead parrot. I know a dead parrot when I see one, and AIG is a dead parrot. Bank of America is a dead parrot. Citigroup is a dead parrot. The New York Dead Parrot Exchange is filled to the rafters with dead parrots, and the deadest of all those dead parrots are the dead parrot banks.

Can Obama say they’re dead YET?

No he can’t.

But they’re dead. They’re bleeding demised, they’re no more, they’ve ceased to be, they’ve expired and gone to meet their maker, they are late parrots, stiffs, bereft of life. Geithner and Bernanke nailed them to their trillion dollar perches, but they’re pushing up the daisies anyway, they’re dead and gone, they’ve rung down the curtain and joined the choir invisible.

12 comments

Skip to comment form

Author

if I didn’t know who the guys in the picture were…I would have thought it was a still from a bad 70’s movie.

Ya know, I think their acting talent is about right for a bad 70’s flick, so maybe it makes sense after all.

…I’m rec’cing this solely on the basis of the title…

That’s enuff 4 me.

Read the Krugman piece & you’ve really done it justice. Thanks!

From left to right.

Felon number one- Scared shitless the true will come out placing himself between the secret government and the illusion one he is trying to prop up.

Felon number two-Already cut his immunity deal and thinks he is all set.

Felon number three is the most dangerous of all. This generationally dysfunctional individual has actually swollowed all of the propaganda and thinks he is doing the right thing.

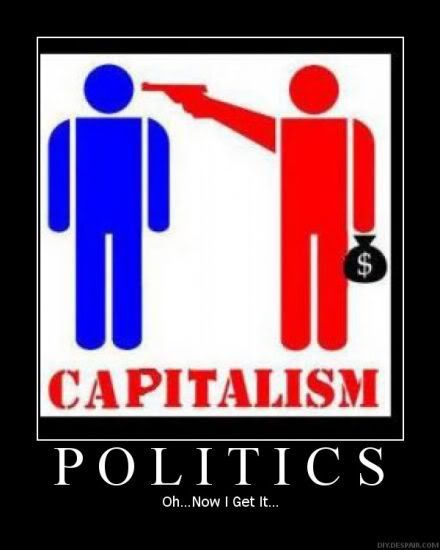

The blue red pictures are also an illusion for what is politics other than that institution by which man fights with his fellow man. Billionaires everywhere need not concern themselves with how they got away with such exploitation of so many people.

I’ve been really disappointed in the economic team that was appointed to deal with the economic crisis. Nouriel Roubini and Nassim Taleb speak the inconvenient truth.

Here’s what Taleb had to say about those in charge of solving the crisis, like the three stooges in the picture above:

IMHO, Roubini, Taleb, and, of course, the Pulitizer-prize winning Krugman should all be primary members of the economic team–instead of the clowns now on the team that helped cause the crisis in the first place.