Author's posts

Mar 19 2012

On This Day In History March 19

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

March 19 is the 78th day of the year (79th in leap years) in the Gregorian calendar. There are 287 days remaining until the end of the year.

On this day in 1941, the 99th Pursuit Squadron also known as the Tuskegee Airmen, the first all-black unit of the Army Air Corp, is activated.

The Tuskegee Airmen is the popular name of a group of African American pilots who fought in World War II. Formally, they were the 332nd Fighter Group and the 477th Bombardment Group of the U.S. Army Air Corps.

The Tuskegee Airmen were the first African American military aviators in the United States armed forces. During World War II, African Americans in many U.S. states still were subject to racist Jim Crow laws. The American military was racially segregated, as was much of the federal government. The Tuskegee Airmen were subject to racial discrimination, both within and outside the army. Despite these adversities, they trained and flew with distinction. Although the 477th Bombardment Group “worked up” on North American B-25 Mitchell bombers, they never served in combat; the Tuskegee 332nd Fighter Group was the only operational unit, first sent overseas as part of Operation Torch, then in action in Sicily and Italy, before being deployed as bomber escorts in Europe where they were particularly successful in their missions.

The Tuskegee Airmen initially were equipped with Curtiss P-40 Warhawks fighter-bomber aircraft, briefly with Bell P-39 Airacobras (March 1944), later with Republic P-47 Thunderbolts (June-July 1944), and finally the fighter group acquired the aircraft with which they became most commonly associated, the North American P-51 Mustang (July 1944). When the pilots of the 332nd Fighter Group painted the tails of their P-47’s red, the nickname “Red Tails” was coined. Bomber crews applied a more effusive “Red-Tail Angels” sobriquet.

Before the Tuskegee Airmen, no African American had become a U.S. military pilot. In 1917, African-American men had tried to become aerial observers, but were rejected, however, African American Eugene Bullard served as one of the members of the Franco-American Lafayette Escadrille. Nonetheless, he was denied the opportunity to transfer to American military units as a pilot when the other American pilots in the unit were offered the chance. Instead, Bullard returned to infantry duty with the French.

The racially motivated rejections of World War I African-American recruits sparked over two decades of advocacy by African-Americans who wished to enlist and train as military aviators. The effort was led by such prominent civil rights leaders as Walter White of the National Association for the Advancement of Colored People, labor union leader A. Philip Randolph, and Judge William H. Hastie. Finally, on 3 April 1939, Appropriations Bill Public Law 18 was passed by Congress containing an amendment designating funds for training African-American pilots. The War Department managed to deflect the monies into funding civilian flight schools willing to train black Americans.

War Department tradition and policy mandated the segregation of African-Americans into separate military units staffed by white officers, as had been done previously with the 9th Cavalry, 10th Cavalry, 24th Infantry Regiment and 25th Infantry Regiment. When the appropriation of funds for aviation training created opportunities for pilot cadets, their numbers diminished the rosters of these older units. A further series of legislative moves by the United States Congress in 1941 forced the Army Air Corps to form an all-black combat unit, despite the War Department’s reluctance.

Due to the restrictive nature of selection policies, the situation did not seem promising for African-Americans since, in 1940, the U.S. Census Bureau reported only 124 African-American pilots in the nation. The exclusionary policies failed dramatically when the Air Corps received an abundance of applications from men who qualified, even under the restrictive requirements. Many of the applicants already had participated in the Civilian Pilot Training Program, in which the historically black Tuskegee Institute had participated since 1939.

Mar 18 2012

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History March 18 by TheMomCat

These featured articles-

- This Week In The Dream Antilles: Elephants by davidseth

our weekly features-

- Six In The Morning On Sunday by mishima

- Punting the Pundits: Sunday Preview Edition by TheMomCat

- Rant of the Week: Tim Carney by TheMomCat

This special features for March Madness and 2012 Formula 1–

- Formula One: Alberta Park by ek hornbeck

- 2012 NCAA Women’s Basketball Championship: Round of 64 Day 2 Afternoon by ek hornbeck

- 2012 NCAA Men’s Basketball Championship: Round of 32 Day 2 Afternoon by ek hornbeck

- 2012 NCAA Women’s Basketball Championship: Round of 64 Day 2 Evening by ek hornbeck

- 2012 NCAA Men’s Basketball Championship: Round of 32 Day 2 Evening

by ek hornbeck

This is an Open Thread

Mar 18 2012

On This Day In History March 18

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

March 18 is the 77th day of the year (78th in leap years) in the Gregorian calendar. There are 288 days remaining until the end of the year.

On this day in 1766, the British Parliament repeals the Stamp Act

After four months of widespread protest in America, the British Parliament repeals the Stamp Act, a taxation measure enacted to raise revenues for a standing British army in America. However, the same day, Parliament passed the Declaratory Acts, asserting that the British government had free and total legislative power over the colonies.

The Stamp Act of 1765 (short title Duties in American Colonies Act 1765; 5 George III, c. 12) was a direct tax imposed by the British Parliament specifically on the colonies of British America. The act required that many printed materials in the colonies be produced on stamped paper produced in London and carrying an embossed revenue stamp. These printed materials were legal documents, magazines, newspapers and many other types of paper used throughout the colonies. Like previous taxes, the stamp tax had to be paid in valid British currency, not in colonial paper money. The purpose of the tax was to help pay for troops stationed in North America after the British victory in the Seven Years’ War. The British government felt that the colonies were the primary beneficiaries of this military presence, and should pay at least a portion of the expense.

The Stamp Act met great resistance in the colonies. The colonies sent no representatives to Parliament, and therefore had no influence over what taxes were raised, how they were levied, or how they would be spent. Many colonists considered it a violation of their rights as Englishmen to be taxed without their consent, consent that only the colonial legislatures could grant. Colonial assemblies sent petitions and protests. The Stamp Act Congress held in New York City, reflecting the first significant joint colonial response to any British measure, also petitioned Parliament and the King. Local protest groups, led by colonial merchants and landowners, established connections through correspondence that created a loose coalition that extended from New England to Georgia. Protests and demonstrations initiated by the Sons of Liberty often turned violent and destructive as the masses became involved. Very soon all stamp tax distributors were intimidated into resigning their commissions, and the tax was never effectively collected.

Opposition to the Stamp Act was not limited to the colonies. British merchants and manufacturers, whose exports to the colonies were threatened by colonial economic problems exacerbated by the tax, also pressured Parliament. The Act was repealed on March 18, 1766 as a matter of expedience, but Parliament affirmed its power to legislate for the colonies “in all cases whatsoever” by also passing the Declaratory Act. This incident increased the colonists’ concerns about the intent of the British Parliament that helped the growing movement that became the American Revolution.

Mar 18 2012

Health and Fitness News

Welcome to the Health and Fitness weekly diary which is cross-posted from The Stars Hollow Gazette. It is open for discussion about health related issues including diet, exercise, health and health care issues, as well as, tips on what you can do when there is a medical emergency. Also an opportunity to share and exchange your favorite healthy recipes.

Welcome to the Health and Fitness weekly diary which is cross-posted from The Stars Hollow Gazette. It is open for discussion about health related issues including diet, exercise, health and health care issues, as well as, tips on what you can do when there is a medical emergency. Also an opportunity to share and exchange your favorite healthy recipes.

Questions are encouraged and I will answer to the best of my ability. If I can’t, I will try to steer you in the right direction. Naturally, I cannot give individual medical advice for personal health issues. I can give you information about medical conditions and the current treatments available.

You can now find past Health and Fitness News diaries here and on the right hand side of the Front Page.

Cut the tortillas in half or into quarters, or leave whole. Place as many as will fit in one layer on a plate and microwave on full power for 1 minute. Turn over the tortilla pieces (they’ll be wet on the bottom) and microwave again for a minute. The chips should be browned and crisp. If they are not, turn over once more and microwave for another 30 seconds to a minute. Repeat with the remaining tortillas until all of them are done. They’ll remain crispy for several hours.

Note: The process will take less time if you air-dry the tortillas on a rack for an hour or so before microwaving.

If you’re cooking for both meat-eaters and vegetarians, make a batch using mushrooms alone.

Give the stove the night off; other than toasting the tortillas, no cooking is required for these light and zesty tostadas.

Seasonal vegetables get a rich, spicy coating in this flavorful tostada topping.

This variation on huevos rancheros makes a satisfying breakfast, lunch or dinner.

Topped with avocado and cheese, these hearty tostadas will please both the vegetarians and the meat-eaters in your household.

Mar 17 2012

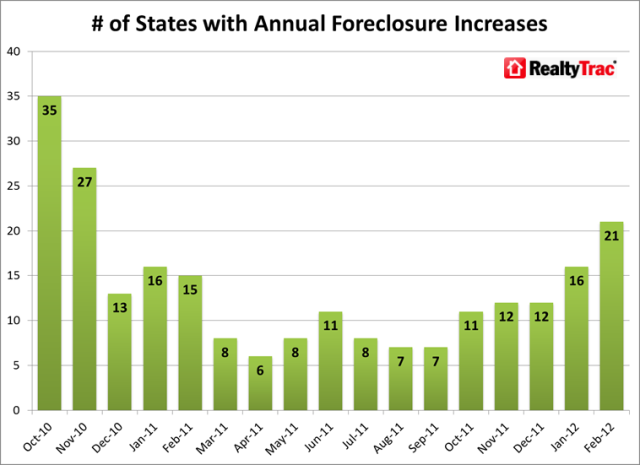

Foreclosure Fraud: More Foreclosures

Cross posted from The Stars Hollow Gazette

Who could have possibly thought that by giving the banks a pass on foreclosure fraud with the 49 state agreement that there would be an increase in foreclosures? That prediction came from Mark Vitner, an economist with Wells Fargo:

“The immediate results are not going to be all that pleasant,” said Mark Vitner, an economist with Wells Fargo. His bank is one of the biggest lenders in Florida as well as a participant in the settlement. “The amount of foreclosures will actually increase and there will be some additional downward pressure on home prices.”

And foreclosures are on the rise in half of the major metro areas:

February foreclosure activity in the 26 states with a judicial foreclosure process increased 2 percent from January and was up 24 percent from February 2011, while activity in the 24 states with a non-judicial foreclosure process decreased 5 percent from January and was down 23 percent from February 2011.

Half of largest metro areas post annual increases in foreclosure activity

Ten of the nation’s 20 largest metro areas by population documented year-over-year increases in foreclosure activity in February, led by the Florida cities of Tampa (64 percent increase) and Miami (53 percent increase).The 10 metro areas with increases were all on the East Coast or in the Midwest, while most of the metro areas with year-over-year decreases in foreclosure activity were in the West, led by Seattle (59 percent decrease) and Phoenix (43 percent decrease).

The metro areas with the highest foreclosure rates among the 20 largest were Riverside-San Bernardino in California (one in 166 housing units), Atlanta (one in 244), Phoenix (one in 259), Miami (one in 264) and Chicago (one in 302).

Meanwhile robosigning has still not stopped. Matt Stoller at naked capitalism found according to the HUD Inspector General Report Well Fargo is still using it:

At the time of our review, affidavits continued to be processed by these same signers, who may not have been qualified, and these signers may not have adequately verified certain figures because they accessed a computer screen of data showing a compilation of figures instead of verifying the data against the information through review of the books and records kept in the regular course of business by the institution.

Stollers reaction deserves repeating:

I’m sorry, but WHAT THE $&*@!?!? I’m so glad Eric Holder has cut a deal with Al Capone while Capone is still on a shooting spree. And note, this isn’t just robosigning, this is potentially overcharging homeowners with junk fees and just generally not verifying accurate data on who owes what to whom. There really is no lesson here except “crime pays”.

And they are still stealing homes.

Mar 17 2012

On This Day In History March 17

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

March 17 is the 76th day of the year (77th in leap years) in the Gregorian calendar. There are 289 days remaining until the end of the year.

On this day in 461, Saint Patrick, Christian missionary, bishop and apostle of Ireland, dies at Saul, Downpatrick, Ireland.

Much of what is known about Patrick’s legendary life comes from the Confessio, a book he wrote during his last years. Born in Great Britain, probably in Scotland, to a well-to-do Christian family of Roman citizenship, Patrick was captured and enslaved at age 16 by Irish marauders. For the next six years, he worked as a herder in Ireland, turning to a deepening religious faith for comfort. Following the counsel of a voice he heard in a dream one night, he escaped and found passage on a ship to Britain, where he was eventually reunited with his family.

According to the Confessio, in Britain Patrick had another dream, in which an individual named Victoricus gave him a letter, entitled “The Voice of the Irish.” As he read it, Patrick seemed to hear the voices of Irishmen pleading him to return to their country and walk among them once more. After studying for the priesthood, Patrick was ordained a bishop. He arrived in Ireland in 433 and began preaching the Gospel, converting many thousands of Irish and building churches around the country. After 40 years of living in poverty, teaching, traveling and working tirelessly, Patrick died on March 17, 461 in Saul, where he had built his first church.

First St. Patrick’s Day parade

In New York City, the first parade honoring the Catholic feast day of St. Patrick, the patron saint of Ireland, is held by Irish soldiers serving in the British army.

Early Irish settlers to the American colonies, many of whom were indentured servants, brought the Irish tradition of celebrating St. Patrick’s feast day to America. The first recorded St. Patrick’s Day parade was held not in Ireland but in New York City in 1762, and with the dramatic increase of Irish immigrants to the United States in the mid-19th century, the March 17th celebration became widespread. Today, across the United States, millions of Americans of Irish ancestry celebrate their cultural identity and history by enjoying St. Patrick’s Day parades and engaging in general revelry.

Mar 16 2012

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History March 16 by TheMomCat

- Punting the Pundits by TheMomCat

These featured articles-

- Foreclosure Fraud: More Foreclosures by: TheMomCat

This special features for March Madness–

- 2012 NCAA Men’s Basketball Championship: Round of 64 Day 2 Afternoon by ek hornbeck

- 2012 NCAA Men’s Basketball Championship: Round of 64 Day 2 Evening by ek hornbeck

This is an Open Thread

Mar 16 2012

Goldman Sachs “Old Days” Not So Rosy Either

Cross postedfrom The Stars Hollow Gazette

A Goldman Sachs executive resigned in a lengthly and scathing op-ed in the New York Times. Greg Smith worked at Goldman Sachs for 12 years, rising to executive director and head of the firm’s United States equity derivatives business in Europe, the Middle East and Africa. His latter shreds Goldman Sachs policies and employees:

To put the problem in the simplest terms, the interests of the client continue to be sidelined in the way the firm operates and thinks about making money. Goldman Sachs is one of the world’s largest and most important investment banks and it is too integral to global finance to continue to act this way. The firm has veered so far from the place I joined right out of college that I can no longer in good conscience say that I identify with what it stands for […]

How did we get here? The firm changed the way it thought about leadership. Leadership used to be about ideas, setting an example and doing the right thing. Today, if you make enough money for the firm (and are not currently an ax murderer) you will be promoted into a position of influence.

What are three quick ways to become a leader? a) Execute on the firm’s “axes,” which is Goldman-speak for persuading your clients to invest in the stocks or other products that we are trying to get rid of because they are not seen as having a lot of potential profit. b) “Hunt Elephants.” In English: get your clients – some of whom are sophisticated, and some of whom aren’t – to trade whatever will bring the biggest profit to Goldman. Call me old-fashioned, but I don’t like selling my clients a product that is wrong for them. c) Find yourself sitting in a seat where your job is to trade any illiquid, opaque product with a three-letter acronym.

Smith lays the blame for this climate of greed at the feet Goldman’s CRO, Lloyd Blankfein and the company’s president, Gary Cohn.:

When the history books are written about Goldman Sachs, they may reflect that the current chief executive officer, Lloyd C. Blankfein, and the president, Gary D. Cohn, lost hold of the firm’s culture on their watch. I truly believe that this decline in the firm’s moral fiber represents the single most serious threat to its long-run survival.

Matt Taibbi at Rolling Stone asks, like Forbes, should clients fire Goldman:

Banking, and finance, is a business that has to be first and foremost about trust. The reason you’re paying your broker/money manager such exorbitant sums is because that’s the value of integrity and honesty: You’re paying for the comfort of knowing he has your best interests at heart.

But what we’ve found out in the last years is that these Too-Big-To-Fail megabanks like Goldman no longer see the margin in being truly trustworthy. The game now is about getting paid as much as possible and as quickly as possible, and if your client doesn’t like the way you managed his money, well, fuck him – let him try to find someone else on the market to deal him straight.

These guys have lost the fear of going out of business, because they can’t go out of business. After all, our government won’t let them. Beyond the bailouts, they’re all subsisting daily on massive loads of free cash from the Fed. No one can touch them, and sadly, most of the biggest institutional clients see getting clipped for a few points by Goldman or Chase as the cost of doing business.

Speaking at the Atlantic Economy Summet in Washington, DC, former Federal Reserve Chairman, Paul Volker, said that Smith’s letter proves the need for the his rule

“[Trading] is a business that leads to a lot of conflicts of interest. You’re promised compensation when you’re doing well, and that’s very attractive to young people. All these firms can attract the best of American graduates, whether they’re philosophy majors or financial engineers, it didn’t make any difference,” Volcker said.

“A lot of that talent was siphoned off onto Wall Street. But now we have the question of how much of that activity is really constructive, in terms of improving productivity in the GDP,” Volcker said. “These were brilliant years for Wall Street by one perspective, but were they brilliant years for the economy? There’s no evidence of that. The rate of economic growth did not pick up, the rate of productivity did not pick up, the average household had no increase in their income over this period, or virtually no increase.”

Volcker noted that commercial banks hold the money of average Americans, and are insured by the federal government. “Should the government be subsidizing or protecting institutions that…are essentially engaged in speculative activities, often at the expense of customer relations?”

Yves Smith at naked capitalism, who also has been at the Atlantic conference weighed in that those good old days of the ’90’s weren’t as “rosy” as Smith remembers:

Earth to Greg: the old days were not quite as rosy as you suggest, but it is true that Goldman once cared about the value of its franchise, and that constrained its behavior. So it was “long term greedy,” eager to grab any profit opportunity but concerned about its reputation. I knew someone who was senior in what Goldman called human capital management, and even though, in classic old Goldman style, he was loath to say anything bad about anyone, he was clearly disgusted of Lloyd Blankfein and the crew that took over leadership after Hank Paulson, John Thain and John Thornton departed. Before the firm before had gone to some lengths to preserve its culture and was thoughtful about how to operate the firm. One head of a well respected investment bank told me in the mid 1990s: “It isn’t that Goldman has better people. All the top firms have good people. It’s that they make the effort to manage themselves better than anyone else.” That apparently went out the window when Blankfein came in. My contact said all his cohort cared about was how much money they could make in the current year.

Wall St. responded defensively calling Smith a “small timer” having a “midlife crisis“. That “crisis” so far has lost Goldman $2.5 billion in its market value:

The shares dropped 3.4 percent in New York trading yesterday, the third-biggest decline in the 81-company Standard & Poor’s 500 Financials Index, after London-based Greg Smith made the accusations in a New York Times op-ed piece.

Stephen Colbert “disapproves” of Greg Smith, after all Lloyd Blankfeid said Goldman was just doing “God’s work.”

Mar 16 2012

On This Day In History March 16

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

March 16 is the 75th day of the year (76th in leap years) in the Gregorian calendar. There are 290 days remaining until the end of the year.

On this day in 1802, The United States Military Academy, the first military school in the United States, is founded by Congress for the purpose of educating and training young men in the theory and practice of military science.

Colonial period, founding, and early years

The Continental Army first occupied West Point, New York, on 27 January 1778, making it the longest continually occupied post in the United States of America. Between 1778 and 1780, Polish engineer and military hero Tadeusz Kosciuszko oversaw the construction of the garrison defenses. The Great Hudson River Chain and high ground above the narrow “S” curve in the river enabled the Continental Army to prevent British Royal Navy ships from sailing upriver and dividing the Colonies. As commander of the fortifications at West Point, however, Benedict Arnold committed his infamous act of treason, attempting to sell the fort to the British. After Arnold betrayed the patriot cause, the Army changed the name of the fortifications at West Point, New York, to Fort Clinton. With the peace after the American Revolutionary War left various ordnance and military stores deposited at West Point.

“Cadets” underwent training in artillery and engineering studies at the garrison since 1794. Congress formally authorized the establishment and funding of the United States Military Academy on 16 March 1802,. The academy graduated Joseph Gardner Swift, its first official graduate, in October 1802; he later returned as Superintendent from 1812 to 1814. In its tumultuous early years, the academy featured few standards for admission or length of study. Cadets ranged in age from 10 years to 37 years and attended between 6 months to 6 years. The impending War of 1812 caused the United States Congress to authorize a more formal system of education at the academy and increased the size of the Corps of Cadets to 250.

In 1817, Colonel Sylvanus Thayer became the Superintendent and established the curriculum still in use to this day. Thayer instilled strict disciplinary standards, set a standard course of academic study, and emphasized honorable conduct. Known as the “Father of the Military Academy”, he is honored with a monument on campus for the profound impact he left upon the academy’s history. Founded to be a school of engineering, for the first half of the 19th century, USMA produced graduates who gained recognition for engineering the bulk of the nation’s initial railway lines, bridges, harbors and roads. The academy was the only engineering school in the country until the founding of Rensselaer Polytechnic Institute in 1824. It was so successful in its engineering curriculum that it significantly influenced every American engineering school founded prior to the Civil War.

The Mexican-American War brought the academy to prominence as graduates proved themselves in battle for the first time. Future Civil War commanders Ulysses S. Grant and Robert E. Lee first distinguished themselves in battle in Mexico. In all, 452 of 523 graduates who served in the war received battlefield promotions or awards for bravery. The school experienced a rapid modernization during the 1850s, often romanticized by the graduates who led both sides of the Civil War as the “end of the Old West Point era”. New barracks brought better heat and gas lighting, while new ordnance and tactics training incorporated new rifle and musket technology and accommodated transportation advances created by the steam engine. With the outbreak of the Civil War, West Point graduates filled the general officer ranks of the rapidly expanding Union and Confederate armies. Two hundred ninety-four graduates served as general officers for the Union, and one hundred fifty-one served as general officers for the Confederacy. Of all living graduates at the time of the war, 105 (10%) were killed, and another 151 (15%) were wounded. Nearly every general officer of note from either army during the Civil War was a graduate of West Point and a West Point graduate commanded the forces of one or both sides in every one of the 60 major battles of the war.

Mar 15 2012

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History March 15 by TheMomCat

- Punting the Pundits by TheMomCat

These featured articles-

- Goldman Sachs “Old Days” Not So Rosy Either by: TheMomCat

- President Obama’s happy numbers and the reality-based community by joe shikspack

This special features for March Madness–

- 2012 NCAA Men’s Basketball Championship: Round of 64 Day 1 Afternoon by ek hornbeck

- 2012 NCAA Men’s Basketball Championship: Round of 64 Day 1 Evening by ek hornbeck

This is an Open Thread

Mar 15 2012

On This Day In History March 15

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

March 15 is the 74th day of the year (75th in leap years) in the Gregorian calendar. There are 291 days remaining until the end of the year.

In the Roman calendar, March 15 was known as the Ides of March.

On this day in 1965, President Lyndon B. Johnson addressed a joint session of Congress to urge the passage of legislation guaranteeing voting rights for all.

Using the phrase “we shall overcome,” borrowed from African-American leaders struggling for equal rights, Johnson declared that “every American citizen must have an equal right to vote.” Johnson reminded the nation that the Fifteenth Amendment, which was passed after the Civil War, gave all citizens the right to vote regardless of race or color. But states had defied the Constitution and erected barriers. Discrimination had taken the form of literacy, knowledge or character tests administered solely to African-Americans to keep them from registering to vote.

“Their cause must be our cause too,” Johnson said. “Because it is not just Negroes, but really it is all of us, who must overcome the crippling legacy of bigotry and injustice. And we shall overcome.”

The speech was delivered eight days after racial violence erupted in Selma, Alabama. Civil rights leader Rev. Martin Luther King and over 500 supporters were attacked while planning a march to Montgomery to register African-Americans to vote. The police violence that erupted resulted in the death of a King supporter, a white Unitarian Minister from Boston named James J. Reeb. Television news coverage of the event galvanized voting rights supporters in Congress.

The Voting Rights Act of 1965 (42 U.S.C. §§ 1973 – 1973aa-6 is a landmark piece of national legislation in the United States that outlawed discriminatory voting practices that had been responsible for the widespread disenfranchisement of African Americans in the U.S.

Echoing the language of the 15th Amendment, the Act prohibits states from imposing any “voting qualification or prerequisite to voting, or standard, practice, or procedure … to deny or abridge the right of any citizen of the United States to vote on account of race or color.” Specifically, Congress intended the Act to outlaw the practice of requiring otherwise qualified voters to pass literacy tests in order to register to vote, a principal means by which Southern states had prevented African-Americans from exercising the franchise The Act was signed into law by President Lyndon B. Johnson, a Democrat, who had earlier signed the landmark Civil Rights Act of 1964 into law.

The Act established extensive federal oversight of elections administration, providing that states with a history of discriminatory voting practices (so-called “covered jurisdictions”) could not implement any change affecting voting without first obtaining the approval of the Department of Justice, a process known as preclearance. These enforcement provisions applied to states and political subdivisions (mostly in the South) that had used a “device” to limit voting and in which less than 50 percent of the population was registered to vote in 1964. The Act has been renewed and amended by Congress four times, the most recent being a 25-year extension signed into law by President George W. Bush in 2006.

The Act is widely considered a landmark in civil-rights legislation, though some of its provisions have sparked political controversy. During the debate over the 2006 extension, some Republican members of Congress objected to renewing the preclearance requirement (the Act’s primary enforcement provision), arguing that it represents an overreach of federal power and places unwarranted bureaucratic demands on Southern states that have long since abandoned the discriminatory practices the Act was meant to eradicate. Conservative legislators also opposed requiring states with large Spanish-speaking populations to provide bilingual ballots. Congress nonetheless voted to extend the Act for twenty-five years with its original enforcement provisions left intact.

Mar 15 2012

Foreclosure Fraud: The Criminals Conducted the Prosecution

Cross posted from The Stars Hollow Gazette

Along with the Foreclosure Settlement documents it was agreed that the Housing and Urban Development Inspector General report was also released. The New York Times review of the report noted that, contrary to the denial by the banks, top bank managers were responsible for the criminal conduct:

Managers at major banks ignored widespread errors in the foreclosure process, in some cases instructing employees to adopt make-believe titles and speed documents through the system despite internal objections, according to a wide-ranging review by federal investigators.

The banks have largely focused the blame for mistakes on low-level employees, attributing many of the problems to the surge in the volume of foreclosures after the housing market collapsed and the economy weakened in 2008.

But the report concludes that managers were aware of the problems and did nothing to correct them. The shortcuts were directed by managers in some cases, according to the report, which is by the inspector general of the Department of Housing and Urban Development […]

“I believe the reports we just released will leave the reader asking one question – how could so many people have participated in this misconduct?” David Montoya, the inspector general of the housing department, said in a statement. “The answer – simple greed.”

Ben Hallman at The Huffington Post observed that the report fell short because of stonewalling by the banks lawyers who blocked interviews with but a handful of employees:

Though the report describes a pattern of misconduct that appears widespread, it fails to quantify the damage to homeowners or, ultimately, how many home loans were affected. It also clearly reflects the frustration that investigators felt in conducting the review. Even as negotiators for the banks were fighting to win the best possible deal, their lawyers were stonewalling other government investigators trying to ascertain the scope of the “robo-signing” abuses.

Wells Fargo provided a list of 14 affidavit signers and notaries — but then stalled while the bank’s own attorneys interviewed them first. The bank then tried to restrict access to just five of those employees. The reason? “Wells Fargo told us we could not interview the others because they had reported questionable affidavit signing or notarizing practices when it interviewed them,” the report says. [..]

Bank of America only permitted its employees to be interviewed after the Department of Justice intervened and compelled the testimony through a civil investigation demand. Even so, the review was hindered, the report says. [..]

The investigation into Citigroup’s mortgage division was “significantly hindered” by the bank’s lack of records. Citigroup simply did not have a mechanism for tracking how many foreclosure documents were signed.

Both JPMorgan Chase and Ally Financial refused to provide access to some employees or documents or otherwise impeded the investigation, according to the report.

Hallman also noted some of what was uncovered by investigators:

Wells Fargo employees testified that they signed up to 600 documents a day without attempting to verify whether any of the information was correct. [..] The bank also relied on low-paid, unskilled workers to do the reviews: a former pizza restaurant worker, department store cashier, and a daycare worker, to name a few.

A vice president at Bank of America testified that she only checked foreclosure documents for formatting and spelling errors. Employees in India supposedly verified judgment figures in foreclosure documents, but none of the U.S. employees interviewed by the inspector general could explain how that process was supposed to work. One former employee described signing 12 to 18 inch stacks of documents without review.

Employees at Wells Fargo and Bank of America testified that they complained about the pace and lack of care given to reviews, but instead of relief, were told to sign even faster. One Bank of America notary said his target was set at 75 to 80 documents an hour, and he was evaluated on whether he met that target. One notary even notarized her own signature on a few documents.

Abuses at the other banks — JPMorgan Chase, Citigroup and Ally Financial — appear just as pervasive. Citi, for example, routinely hired law firms that “robo-signed” documents. An exhibit included with the report shows eight different versions of one attorney’s signature — all apparently signed by different people.

In signing off on this 49 state agreement the banks did not have to admit to any wrongdoing despite the damning evidence of fraud that was directed by top management. No other sanctions beyond a few billion dollars and certainly no criminal prosecutions. If I were Bernie Madoff, I’d be really pissed.