Author's posts

May 12 2010

Livestreaming the closed door debt commission pt. 2

Last week I livestreamed the first closed door meeting of the president’s fiscal commission. I did this out of frustration that we received no response to a letter that we sent from 81 organizations representing over 61 million Americans, asking that all the work of the commission be done in the open. Letters were also sent by Chairman John Conyers and Minority Leader Boehner asking for transparency.

Dan Froomkin sums up the problem with closed door meetings for the commission at the Huffington Post saying,

The move only heightens suspicion that rather than forging a national consensus on future spending priorities, the commission’s work will consist of backroom dealings in which members of the Washington aristocracy find high-minded excuses for cutting the social safety net.

You can watch the highlights of our previous livestream here

May 04 2010

The Other 98% Takes Wall Street [video]

I am one of The Other 98%, and I am really proud of this growing organization. Since the beginning of April, nearly 30,000 fans have joined us on facebook.

And this is certainly an awesome video that we made to showcase our involvement in the Show Down on Wall Street.

This Wall Street action was just the beginning, The Other 98% will be back in Washington on May 17th to take on K Street’s corporate lobbyists and their stooges in Congress.

It is going to be a good time; get involved here.

May 01 2010

Billionaires for Social Insecurity Ask for Donations

Also posted at the Alliance for Retired Americans Blog

This week, Peter Peterson [net worth $2.8 billion] and his foundation convened a closed-door meeting of Wall Street billionaires and millionaires at the Ronald Reagan International Trade Building in D.C.

Peterson is a former CEO of Lehman Brothers and former chair of the Federal Reserve Bank of New York. He underwrites the foundation with his own money, and his agenda is not a secret.

Peterson says the coming retirement of baby boomers is a threat to the economy and the federal budget. He wants to see significant cuts in Social Security and Medicare benefits, and would prefer a stream-lined process via a commission to implement these changes to “reduce the deficit.”

After taxpayers bailed out Wall Street for over $700 billion, Peterson is worried about the deficit. And, of course the real problem is… Social Security. (The problem certainly would not be recent tax cuts, unfunded wars, and billions of taxpayer dollars squandered as bonuses to the very financial managers who brought the economy to near-ruin.)

Apr 06 2010

Social Security Works for People of Color

This is the third installment in our Social Security Works series. So far, we have seen how Social Security works for America, how Social Security works for women, and today we will show how Social Security works for people of color.

Social Security is neutral with respect to race and ethnicity; the benefits it pays are a function of a worker’s earnings history and family situation.

People of color face numerous structural inequities throughout their lives that Social Security, because of its progressive benefit structure, helps to alleviate.

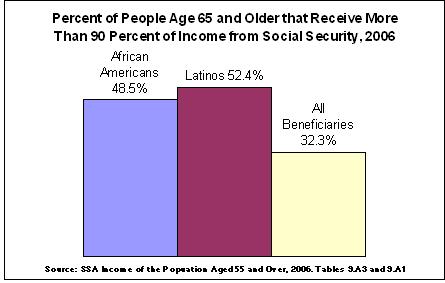

Communities of color receive higher average returns on what they have paid into the system than do other workers. Latinos and African Americans also rely on Social Security for a greater share of their income in retirement.

Mar 27 2010

Social Security Isn’t in “Crisis” – But, Older Women Are.

By Stacy Sanders, the Director of the Elder Economic Security Initiative, WOW

This week, with health care reform passed, the New York Times speculated that Social Security, “the other big entitlement program,” would be the next big program to “tackle,” specifically within the context of reducing the nation’s debt. Reports followed that suggest the program is in crisis, despite the fact that predictions show Social Security can pay benefits in full until 2037.

With thirty years to attend to the program’s ability to pay benefits, there’s little evidence to suggest that Social Security is in trouble. On the contrary, there is real data that shows its beneficiaries, particularly older women, are in crisis. Though never intended to be the only source of income in retirement, many find themselves solely reliant upon Social Security as they age. In fact, Social Security provides more than 90 percent of income to three out of ten retired elders. And, due to time spent out of the workforce for caregiving and lower lifetime wages, women are even more dependent on Social Security.

Last year, the average annual Social Security payment was only $11,316 for an older woman. According to the Elder Economic Security Standard™ Index (Elder Index), a new measure of what it costs to age in place, a single elder who rents needs $20,248 to make ends meet, almost twice the average annual Social Security payment for women. Developed by Wider Opportunities for Women (WOW) and the Gerontology Institute at the University of Massachusetts Boston, the Elder Index is a bare-bones measure of basic needs in retirement.

The data shows that, for older women, Social Security provides a life line. It offers a secure, reliable and necessary income base in retirement. But, those who rely only on Social Security must make difficult sacrifices – such as choosing between groceries and essential medications or going without heat.

As Congress and the Administration take up the nation’s deficit, they ought to consider the real, day-to-day crisis of our nation’s older women. Doing so means making responsible choices to safeguard and strengthen Social Security benefits while addressing its long-term stability.

Cross posted from the National Elder Economic Security Initiative

Mar 26 2010

Don’t Panic! Social Security will be there for you.

By Ashley Carson, the Executive Director of OWL- The Voice of Midlife and Older Women and www.SocialSecurityMatters.org

This week the New York Times decided to scare the bejeezus out of everyone by publishing several articles with slanted statements about Social Security. I’d like to revisit some key points in Williams Walsh’s piece from March 24 – statements from her article are in bold below.

“The bursting of the real estate bubble and the ensuing recession have hurt jobs, home prices and now Social Security.”

First of all, the real estate bubble was predicted and no one listened. In fact, it was predicted, ignored, and it is a large cause of the economic downturn and part of the larger deficit. We had to bail out banks and other financial institutions because everyone ignored the warnings about the real estate bubble. The bursting of the housing bubble doesn’t hurt Social Security the program, in fact, Social Security, the program, is designed to withstand just such miscalculations by our nation’s top economists.

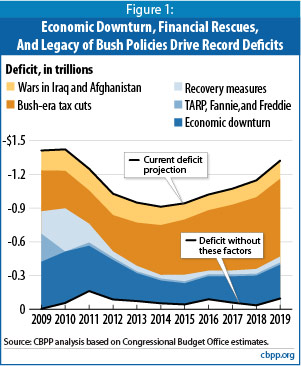

The causes of our deficit are approximately $1.5 trillion to the wars in Iraq and Afghanistan, $1.2 trillion due to the Bush-era tax cuts, $0.9 trillion for financial rescues and recovery measures including TARP, Fannie and Freddie. As indicated by the above figures, clearly Social Security is not causing the deficit.

“…payments have risen more than expected during this downturn, because jobs disappeared and people applied for benefits sooner than they had planned.”

Mar 10 2010

Social Security Works for Women

This is the second installment in our Social Security Works series. The first post focused on how Social Security works for America, and today we will show how Social Security works for women.

Since January 31, 1940, when Ida May Fuller was issued the first monthly retirement check in the amount of $22.54, Social Security has worked for women.

Social Security is neutral with respect to gender – individuals with identical earnings histories are treated the same in terms of benefits. But, with longer life expectancies than men, elderly women tend to live more years in retirement and have a greater chance of exhausting other sources of income.

• Women represent 57 percent of all Social Security beneficiaries age 62 and older and approximately 69 percent of beneficiaries age 85 and older

• Women reaching age 65 in 2007 are expected to live, on average, an additional 19.8 years compared with 17.5 years for men

In 2008, Social Security provided benefits to 31.3 million women. Women are:

• Over two-fifths of the beneficiaries of disabled worker benefits

• 99 percent of the spouses receiving Social Security benefits

• 99 percent of the nondisabled surviving beneficiaries

• 98 percent of the dually entitled, that is, persons entitled to benefits as retired workers and as spouses

Women are more likely than men to be out of the work force, or to have breaks in employment. Even with the narrowing gender gap in the rates of labor force participation, women often leave temporarily or permanently for pregnancy, child care, and other family care responsibilities.

As an insurance protection for older women, Social Security provides a modest benefit. Old-age insurance in 2006 supplied such a measure for women through an average monthly benefit of $904.

This bare-bones floor of protection provides elderly women, in Roosevelt’s words, “security against the inevitable hazards and vicissitudes of life.”

The poverty rate for women would be significantly higher without Social Security, increasing from 12.4 percent to over 50 percent.

• In 2007, Social Security kept 39.5 percent of women out of poverty

• In 2005, 42 percent of women over age 62 relied on Social Security for 90 percent or more of their income, compared to 28 percent of men

• In 2007, for unmarried women – including widows – age 65 and older, Social Security comprises 48 percent of their total income. In contrast, Social Security benefits comprise only 37 percent of unmarried elderly men’s income and only 30 percent of elderly couples’ income

Social Security works for women; Social Security works for America.

This blog series is a joint project of America’s Future and Social Security Works.

Also posted at OurFuture.org and The Seminal

Mar 07 2010

Social Security Works for America

In honor of the 75th anniversary of Social Security, we are kicking off a blog series called “Social Security Works.” Every post will examine one aspect of how Social Security works.

For our first installment we will examine how Social Security works for America as a whole.

Since President Franklin Roosevelt signed the Social Security Act at approximately 3:30pm on August 14, 1935, it has provided economic security for millions of Americans.

Currently, the Social Security Administration provides benefits to:

• More than 52.5 million total beneficiaries including:

• 9.7 million disabled persons under age 65 and dependent family members

• 6.4 million survivors of deceased workers

• 36.4 million retired workers and their families