(11AM EST – promoted by Nightprowlkitty)

By 1933 Americans were losing faith in the banking system. Banks had been failing by the thousands since 1930. When a bank failed it took everyone’s life savings with it.

On February 14, 1933, a coalition of major banks asked Governor Comstock of Michigan to declare a statewide bank holiday. He granted it.

The governors of Iowa, Tennessee and Kansas declared bank holidays in January, but it was Michigan that tipped the scales. It set off a nationwide panic that led to bank holidays in almost every state. On March 4, 1933, the Federal Reserve Bank of New York requested a statewide bank holiday be declared. On the same day that FDR was inaugurated as President of the United States, New York, Illinois, New Jersey, Massachusetts, and Pennsylvania all declared bank holidays.

The banking system had utterly and completely failed. In most counties there wasn’t a single working bank even before the bank holidays. Now the entire banking system simply vanished from the face of America despite years of federal government support.

No one was sure if any bank in America would ever open again.

When FDR instituted the Emergency Banking Act the following week there was no one to oppose it.

It was in this atmosphere of crisis that famous economist Irving Fisher proposed a radical new idea for money.

Germany in 1930 was very similar to the United States in 1933. Everywhere there was deflation and unemployment. People hoarded what little money they had.

Then in Schwanenkirchen, Bavaria, a town of only 500 people, where the only industry was a coal mine, something amazing happened.

For over two years this village had barely existed by means of the dole. Everybody was in debt; nor could anybody see the slightest hope of the mine being reopened; for (says Mr. Cohrssen, writing in the “New Republic”)(2) “deflation raged all through Germany, leaving bankruptcies, suicides and overcrowded jails in its wake. Herr Hebecker assembled his workers. He told them that he had succeeded in getting a loan of 40,000 Reichsmark, that he wished to resume operations but that he wanted to pay wages not in marks but in Wara. The miners agreed to the proposal when they learned that the village stores would accept Wara in exchange for goods.

The Wara was a product of the Freiwirtschaft movement (German for free economy). The movement, about a decade old at the time, was founded on the three F’s: free money, free land, and free trade.

The introduction of the Wara had an immediate and dramatic effect on the local economy.

When, after two years of complete stagnation, the workers for the first time brought home their pay envelopes, no one was interested in hoarding a cent of it, all the money went to the stores to pay off debts or for the purchase of necessities. The shopkeepers, too, were happy…

The news of the town’s prosperity in the midst of depression-ridden Germany spread quickly. From all over the country reporters came to see and write about the ‘Miracle of Schwanenkirchen.’

To complete the story about Wara it must be added that subsequently it was accepted in a few thousand stores throughout Germany, and that one or two more entire communities recuperated under the Wara treatment. A few small banks even opened Wara accounts, accepting the deposits and at once lending the Wara out to those who asked for credit.

That’s when the German Government stepped in. The German government claimed that the Wara was money, and therefore an illegal usurpation of the German Central Bank’s cartel monopoly. The question was taken to the courts and the Wara won.

So the Weimar government then passed an emergency law which forbade the Wara.

“As a result,” (writes Mr. Cohrssen), “Schwanenkirchen and other towns where Wära have provided the life blood of economic activity are on the dole again.”

This experiment was repeated in almost exactly the same form the Austrian town of Woergl, a town of 4,300, of which 1/3 were unemployed. On August 1, 1932, the Mayor convinced the local merchants to accept “the Woergl”. Within a year Mayor Unterguggenberger had this to say: “The Stamp Scrip of Woergl will have historic significance, because it has kept its promise to provide ‘work and bread.’ It has, in fact fully satisfied all our expectations.”

Unemployment was beginning to drop, back taxes were being paid, roads were being paved. The word of the Woergl’s success was spreading fast.

In June of 1933 170 Mayors met in Vienna to discuss the Worgl “Money”. Everyone that attended the meeting were of the opinion that they should introduce this currency in their towns. After that the Austrian National Bank found a scientist that proved the attempt to use this new money had to be forbidden. Worgl had broken article 122 of the bylaws of the Austrian National Bank and the area administration issued a Prohibition Order against the use of Worgl “Money”. It became a criminal offense to issue “emergency currency”.

With elimination of “Worgl Money” the town went back to 30% unemployment by the following year.

Do you see a pattern here?

The government and the banking cartel were much more interested in protecting their money printing monopoly than in fixing the economy.

What is stamp script?

So what was the Wara and the Woergl? It is “Stamp Script”. Irving Fisher explains it this way:

The two points about Stamp Script are:

First: It is like money, because it can be banked OR invested OR spent.

Second: It is unlike money, because IT CAN NOT BE HOARDED.

For the stamps, as we shall see, compel Stamp Scrip to “step lively.”

The stamp script had a fee on the use of the money of 1% per month (in the case of the Woergl). This fee had to be paid by the person who had the banknote in the form of a stamp worth 1% of the note. Otherwise, the note was invalid.

This caused everyone to spend the money as fast as they received it. Regardless of whether this money was spent trying to look for a suitable goldshell kd5 buy option that you will then be able to use to increase your money further, or if you decided to spend it on other investments or something completely different altogether, your main aim was to make sure that you didn’t waste any time in spending any money that you had to your name. The concept is called demurrage, and is similar to negative interest rates.

The Freiwirtschaft recognized that the financial markets did not function according to Adam Smith’s rules that falling prices increased demand. Their observations were based on a 19th Century economist called Silvio Gesell. Gesell recognized that people’s propensity to spend had more to do with interest rates than with the supply and demand of real goods.

Gesell explained the phenomenon that money, unlike all other goods and services, can be kept without costs. Gesell concluded that if we could create a monetary system which put money on an equal basis with all other goods and services, then we could have an economy free of the ups and downs of monetary speculation. He suggested that money should be made to “rust”.

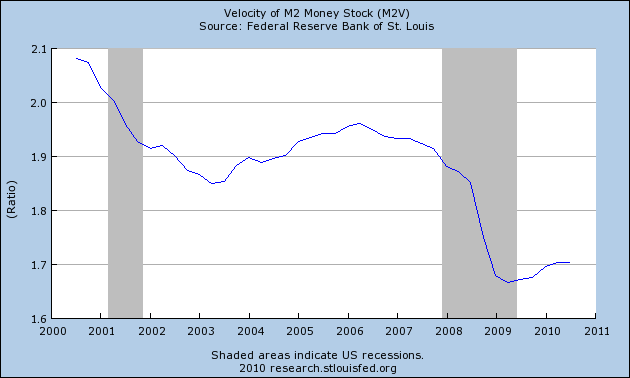

The turnover in currency exchanges is called “velocity”, and its generally a good thing. It’s been compared to the oil in a car’s engine.

It’s this velocity that is currently lacking in today’s economy.

The beauty of demurrage is that it imposes a tax on hoarding. It forces the wealthy to put money into productive uses rather than loaning it out at usury rates. It is actually a force against wealth inequality.

Many economists say that inflation accomplishes many of these same effects. However, demurrage goes beyond it. Banks couldn’t charge interest on stamp script that was loaned out, thus the wealth transfer effect from debtor class to lending class would be eliminated. Without interest, there would no longer be a need for inflation.

OTOH, a stamp script, if issued on a local level, sometimes tended to accumulate with the merchants, who didn’t have the opportunities to pass it along.

Of course to implement stamp script on a large scale would also require massive land tax reforms, because demurrage would encourage speculation in real estate.

Meanwhile, back in the United States

Three days after Michigan declared a bank holiday, the Bankhead-Pettingill bill was introduced in the Senate by Senator John Hollis Bankhead of Alabama. It was co-sponsored in the House by Representative Samual Barrett Pettingill of Indiana. The bill called for a billion dollars of interest-free stamp script to be created and injected into the economy.

Irving Fisher had been pushing this solution and it was gaining traction. At the time, 100 communities, including several large cities, had already planned on implementing stamp script money. It had already been tried in places such as Anaheim, California, and Hawarden, Iowa, among other places. It was a nationwide movement. The Congressional bill would just make it at a national level.

The issue went up to the Hoover Administration. The Secretary of the Treasury, Secretary of the Interior, and the Secretary of Labor all refused to oppose it, but none had the authority to grant permission.

Just as serious debate began on the issue, the matter was settled by FDR – he forbade any further issue of emergency currency.

The government/banker’s monopoly on creating currency had to be protected at all cost.

Fiscal Localism

Today there are dozens of alternative currencies or complementary currencies in the United States, and dozens, of not hundreds, more in the world. Most of them are considered local currencies.

The Local Exchange Trading System is probably the most successful of these alternative currencies. Most of them operate as interest-free credit and involves non-profit organizations.

Ithaca Hours, a local currency, has been in continuous use for nearly two decades.

Probably the most famous alternative currency was the Liberty Dollar. It was a private currency that minted gold and silver coins, as well as held warehouse certificates for precious metals.

The FBI and Secret Service raided and seized their holdings in 2007. The indictment basically centered around the claim that the coins were too similar to U.S. coins.

The WIR Bank has been operating in Switzerland since 1934. It has 62,000 members and operates with around $2 Billion in assets. Although it does deal with interest, it is not a profit bank.

This new Depression we find ourselves in has once again given rise to local currencies. Once again, it is Germany leading the way.

The Havelbluete, the Augusta and the Chiemgauer might sound like the names of locally brewed beers, but they are in fact micro-currencies which, like micro-breweries, are in abundance in Germany. There are more than two dozen local currencies in circulation, and 40 or so initiatives are about to start printing their own banknotes. These notes are not gimmicks. They’re recognized legal tender – at least within each local region.

There no surer way of promoting your community merchants over impersonal, multinational corporations than with local currencies. The alternative currencies vary in quality, depending on how they are implemented, but unlike banking cartel product we are familiar with, this is real capitalism in action.

There is no more effective way of undermining Wall Street’s dominance of all things monetary than by using the local currency in your area.

13 comments

Skip to comment form

Author

I was going to go into a full description of what is money and why the current system is sick, but this essay was already long enough.

It’ll have to wait for the next essay.

We’ve moved, in our culture, to an irrational economics based not on reasonable economic theories but by giving the arbitrary decrees of the oligarchs some kind of theoretical veneer. So the current economy is purely a political reality forced on us all by the oligarch class for their benefit.

Economics is subordinate to politics. Properly we should call it “political economy” (as it once was called) because it has no independent existence. It is like the idea of a “free market” which is only a way of creating some kind of theoretical game but has and has never had any basis in reality.

So when people talk about “the economy” they are really just talking about the politics of income distribution. A bottom-up economics, as you’ve described, is only possible when you have bottom-up politics. The only way to change this system is to force it to stop working. When you are hoping that the economy returns to prosperity you are really saying you want to oligarchy to be prosperous. The fact the rest of us have done well under the oligarchical economy has to do with the fact workers are needed to turn profits–when they aren’t needed they go int the trash, barring social programs.

I would favor alternative money but the state will just crack down the minute it gets popular and, at present, there is no way to stop the state.

On the whole, any rational talk of economics at this point in history is impossible–but great post, as usual I’ve learned something from you.

when considering “Global Street”.

http://www.zerohedge.com/artic…

…another piece to chew on, think about, and try to figure some new way out of our current conundrum.

Back in law school I had a constitutional law professor who was fond of saying that the US Constitution, was above all, an economic document.

But if so, why don’t we accept that fact and take seriously what it says when it comes to the issuance of money. Under Article I Section 8, the government is supposed to “coin” money and and not the private sector. Here’s what it says on the borrowing by the government and issuance of money:

To borrow money on the credit of the United States…

To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures…

To provide for the Punishment of counterfeiting the Securities and current Coin of the United States….

So what I want to know is why you haven’t taken up the banner of returning the issuance of currency to the federal government instead of borrowing it into existence through The Fed.

It seems like economists, just will not go there. You commented on a essay of mine that it would never happen. It has happened before, so why not again? What is so different about now?

All this about local currencies is interesting but it also violates the Constitution. Even states under Article I Section 10 cannot issue currency:

No State shall … coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts…

So going the local currency route is truly likely to fail.

But when the constitution mandates the coining of money by the Federal Government, why is it that all US money is not issued by the government?

It has all the advantage of the script you mention and the Constitution mandates it but bars the kind you mention.