(10 am. – promoted by ek hornbeck)

Goldman Sachs’ fraud epitomizes everything that is wrong with America: “the haves” repeatedly screwing “the have-nots,” not by being better or smarter, but through sheer, premeditated criminal fraud.

Goldman’s e-mails sound all too reminiscent of the criminal disregard for humanity at Enron before they collapsed (via Mish Shedlock, emphases mine):

Fabrice Tourre, a Goldman Sachs Group Inc. executive director facing a fraud lawsuit in the sale of a mortgage-linked investment, said an index that facilitated derivatives trading in the market was “like Frankenstein.”

The so-called ABX index is “the type of thing which you invent telling yourself: ‘Well, what if we created a ‘thing,’ which has no purpose, which is absolutely conceptual and highly theoretical and which nobody knows how to price?'” Tourre said in a Jan. 29, 2007, e-mail released yesterday by Goldman Sachs. Watching the index fall is “a little like Frankenstein turning against his own inventor.”

In a March 7, 2007, e-mail Tourre describes the U.S. subprime mortgage market as “not too brilliant” and says that “according to Sparks,” an apparent reference to Daniel Sparks who ran Goldman Sachs’s mortgage business at the time, “that business is totally dead, and the poor little subprime borrowers will not last too long!!!”

A few months later, a June 13, 2007, e-mail shows Tourre claiming, “I’ve managed to sell a few Abacus bonds to widows and orphans that I ran into at the airport, apparently these Belgians adore synthetic ABS CDO2,” using short-hand for asset- backed collateralized debt obligations squared, or CDOs made up of tranches of CDOs containing asset-backed securities.

Of course they knew their financial products were 100% crap. Such criminal fraud is at the very heart of Wall Street’s booms, busts, and bail-outs. What in hell is Obama thinking? Having the nation bail these criminal pricks out is beyond moral hazard. Maybe like Bush “The Haves” and “The Have-Mores” constitute Obama’s “base,” as well. His economic strategy sure looks that way.

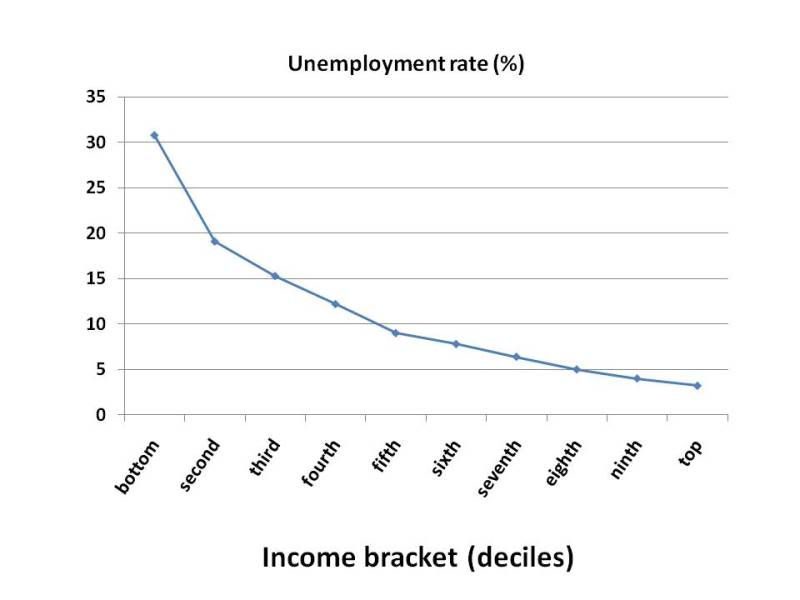

Meanwhile, George Washington points us to a labor study showing that the poor are getting hammered into Great Depression levels of unemployment by Wall Street’s Frankenstein monster, whereas the rich are essentially enjoying full employment:

In the face of one of the worst economic environments in memory, those in the highest income groups had nearly full employment levels, with just a 3.2 percent unemployment rate for households with over $150,000 in income and a 4 percent rate in the next-highest income group of $100,000-plus.

The two lowest-income groups — under $12,500 and under $20,000 annually — faced unemployment rates of 30.8 percent and 19.1 percent, respectively.

Of course, there are vastly more mid-to-low income people in the US than rich people, so unemployment is really affecting the vast majority of families, ya know, regular tax-paying Americans.

This is a policy decision coming directly from the White House: Save asset prices for the rich! Bail out Wall Street criminal fraud using your tax dollars! That policy is fundamentally “fucked-in-the-head.”

And it won’t work. But that doesn’t matter.

Over at Decline of the Empire, Dave Cohen shares the marvelous news that the rich are on the rebound!

“People are fed up, and they want to have a good time,” said Rina Anoussi, a Manhattan travel agent who handles high-end clients. They don’t want Italy 101. They want more exotic destinations like Kenya and Tanzania.”

The rich people are fed up with abstinence, and they are damn well going to let their engines roar once more now that everything is hunky dory for them. Dave reminds the rest of us to enjoy the “trickle down” from the surge in yacht building, jet brokerage, and jewelry stores you can read about in the ever more relevant New York Times:

Although most of you are not looking for the best deals on Turkish carpets, there is an infinitesimal chance that you will profit from the rich spending more money again. After all, they have almost all the money, and according to a theory called Trickle Down Economics that was very popular early in our Imperial Decline, some of this cash may flow through the economy and reach your front door. Ronald Reagan, a “B-movie” actor who played “the Gipper” in Knute Rockne All American, was a big believer in the salutary effects of trickle down. George W. Bush revived the theory early in last decade.

Surely, Dave jests at the expense – THE EXPENSE! – of young billionaire hedge fund managers who are all pent up with money:

Wall Street’s elite are once again splurging on multimillion-dollar estates in the Hamptons – Long Island’s summer playground for the ultrarich – where sales have more than doubled over the past year, The Associated Press reported.

In a report released Thursday, Prudential Douglas Elliman Real Estate found that home sales in the Hamptons in the first quarter of this year were up 173 percent over the same quarter in 2009. The agency also found that the median sales price on the 396 homes sold rose almost 35 percent to $908,500 from the same period a year ago. For homes priced in the top 10 percent of the market, the median sales price increased about 34 percent from the same period a year ago to $5.48 million.

“It’s as active in the Hamptons as I have ever seen,” Alan Schnurman, a high-end real estate developer, told The Associated Press. “It has to be because of Wall Street. You have these young billionaire hedge fund managers who all want to buy.”

Never mind that all the assets in all the bank vaults and at the toxic land-fills at the Fed and Freddie and Fannie are still marked to fantasy, and that everyone would be broke if they were marked to market.

But despite the usual claims of market omniscience, no one, including Barack Obama, wants to sully their beautiful minds by thinking about reality:

Banks generally loathe mark-to-market rules, which rely on what they feel are too-often irrational market prices.

Ha ha! So much for the theory of market efficiency! Truth is, there is no market for the crap they’d otherwise love to peddle off on someone else. Everyone is on to the fraud. Well, not everyone everyone.

Ah, hell. Let’s all just feel the fantasy.

Ah ha ha ha ha. Eubie doobie doo-o-o-o-o-b-i-e…

8 comments

Skip to comment form

Author

bubblicious.

The Embrace Mortgage broker company sent me a nifty mailing pre-approving my unemployed 55 year old self for the grand sum of $270,000. Cool I thought, just about the amount I would need to sustain while the empire collapses.

I can resonate with the statement about them “wanting to have a good time.” The rich I know have no sense of life being anything but enjoying food, wine, travelling, collecting art and antiques, interesting cars, and looking down on the poor as incompetent and ungrateful creatures. Quite honestly I don’t see how many of them live. I could never do it. I have no money but my sister is rich so I meet all kinds of people from time to time. Since I love people, I love them too. I’m not angry at them–it just doesn’t occur to them that there is more to life. If anything, I feel great pity and compassion for them.

At the same time, I also know that the “average” American shares the same shallow view of life. And I also know that the average American is the reason that the rich can live the way they do, not necessarily because they exploit the poor and middle-classes, but because the rich in this country are what the average person wants to be and tries to be in a limited way. Fortunately for the non-rich, life forces them to adopt more humanistic values because they must interact more equally with others in the world. The rich don’t need to operate on equal footing with anyone. They like being on an unequal footing with others.

… the concept that charging financial institutions to set up a fund to put them into receivership to avoid having to bail them out with taxpayer funds is “another bail-out”.

So on this one:

… forcing Wall Street to finance its own bail-out is not “having the nation bail out these criminal pricks”.

If the Senate finally ends up stripping out that part of Obama’s proposal, the question is “what is the Senate thinking?” And the answer would be “$$$$”.