(9 am. – promoted by ek hornbeck)

Jim Cramer Media Shill or Housing Whore?

On December 17th, 2008 Jim Cramer pronounced that the housing bottom will be in by June 30, 2009.

Well, I now have another contrarian point of view to proffer: The converted bears, as well as the panicked sellers desperate to bail out and nervous buyers afraid to jump in, will be dead wrong nine months from now, when housing prices bottom. In fact, I’ll call the precise date of the housing-market turnaround. It will begin on June 30, 2009.

In 2007 housings subprime market was just beginning to melt down all the while candidates were proclaiming that ours was a strong economy, and the Fed chairman was stating that subprime was contained, and there was no spill over into the broader economy.

These are the experts and yet they have been wrong at almost every turn. Listen to these asshats at your own peril. The government, media and banks are lying to you.

Take the jump to look at some numbers.

Recently LPS put out its national monthly default and foreclosure report.

(h/t to Mark Hanson). What the report shows is, that while housing inventory on the market is artificially low, delinquent mortgages are in the millions from this year alone.

Mortgages that are delinquent are continuing to rise to historical levels. For houses valued at $500k+ in LA county alone:

* 115 months potential supply based upon the number of props at the 90+ delinquency stage

* 71 months potential supply based upon the number of props at the foreclosure stage

* 62 months potential supply based upon the number of prop at the REO stage(supply estimates do not include houses already listed on the MLS and counted in the Realtor Association’s supply estimates other than a portion of the REO bucket – this is ADDITIONAL supply)

That is nearly 10 years of potential supply that the banks have not foreclosed on. How long can these financial institutions continue to run this kind of business model?

First you need to understand that housing is spoken of in the media in only the most broadest terms. So you have probably heard things like

What has happened is that prices have reached enough of a low to spark speculative buying. Because of the deep discounted price compared to just a couple of years ago, people are coming in and picking up what is now perceived as deals.

The problem with these blanket statements is they don’t address any specific issues and only serve as a headline. All real estate is regional, meaning what is going on in Detroit is completely different than Manhattan. Issues that affect California may not affect Kansas. Some of the bubble states experienced unheard-of levels of real estate appreciation where the flyover states did not. Some real estate agents will even be able to make use of things like expired listings software to keep up with the demand that they find themselves with. Apart from expired listings, there are also a lot more that can be done with FSBO leads that have become obsolete. With the help of more efficient and accurate fsbo leads (expired and current), real estate agents could cater to their wide range of clients’ needs and desires for a perfect home for themselves.

Next are different pricing levels for homes. When you hear that prices are at deep discounts from a few years ago they are saying that compared to a record peak prices are down. Entry level homes were never suppose to be priced at $750K. When they refer to a bottoming in housing, read foreclosed homes on the market at the steepest discounts are bringing in buyers (speculators). In between all of these, you may also have to keep in mind the closing costs (click here to read about the ways to lower the closing costs). In fact, banks much prefer to sell homes to cash buyers before a first-time buyer with an $8K tax credit and very little money to put down. This market is the investor class at $150K or less, and certainly not in the move-up buyer category. But many first time buyers are finding the right homes with first time home buyer Winnipeg services so we will have to see how the data changes with those kinds of services picking up steam in the market.

When it comes to RE I like to refer to historic norms. The average salary could purchase the average home. People bought homes to live in, not investments they intended to flip in a couple of years. You gained equity by paying off your mortgage, and if you had to take out a second you were considered high risk. The value of the home was based on the property it sits on, not the mortgage hanging over it, or the Mcmansion sitting on the postage stamp lot. If you couldn’t afford a home in town, prices were cheaper in the country.

So how did we get to this extreme. Briefly review how lending standards were allowed to become more and more relaxed.

Circa-2002, time-tested DTI standards went out the window. Allowable DTI ratios on Prime loans rose to 50% and much higher when considering that so many loans were made with limited or no income documentation. Alt-A and Subprime full-doc loans would routinely go to 55% DTI…and full-doc are supposed to be the safe loans. Given that full-doc only represented 50% of Subprime and 25% of Alt-A loans it is understandable why these two loan types are experiencing the worst trouble, even though across the Alt-A universe the average FICO was above 700 at the time of origination.

By ’04 house prices were already pushed beyond the average persons ability to pay under conventional mortgage standards. The new paradigm in lending now allowed up to 50% of gross income to go towards total debt servicing.

Deterioration ratios remain high – over 300 percent – indicating that three loans are deteriorating for every one loan that improves.

• Foreclosure to REO volume reached new highs in October; volumes into foreclosure remain elevated as well.

• Foreclosure timelines continue to extend, with almost 30 percent of loans that have missed 12 payments still not having foreclosure initiated (vs. 13 percent in October 2007).

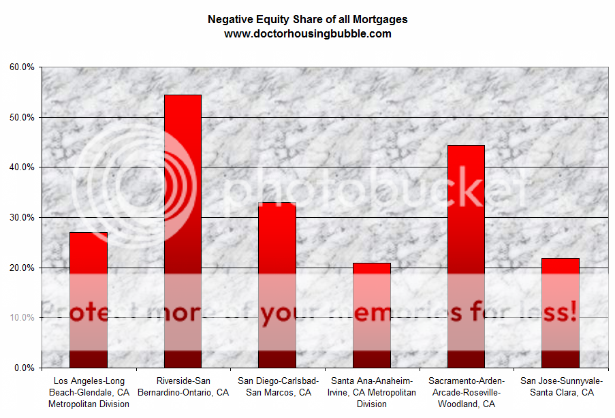

How underwater is California? Roughly 7 million mortgages with 2.4 million underwater. Throw in another 300,000 of “near negative equity” and you have yourself approximately 40% of all mortgages with negative equity.

The Inland Empire and the Central Valley have been devastated. With over 50 percent of mortgages underwater, there will be pain in these areas. This is part of California and this will add major burdens on central state governments.

But you’ll hear media shills like Jim Wasserman of SacBee calling for the housing bottom again, and again and again.

Its clowns like these that either do not understand that the housing sector is still at risk or they are complicit in the lie. Remember the catalyst to the meltdown of the entire system was subprime. Meaning the borrowers had low credit scores. All the toxic loans the banking sector created are also found with the prime loans as well.

People are pointing to the low interest rates as the reason we will not experience any further decline are missing the real problem. Prime loans will not only reset rates but more worrisome is the loans recasting.

[The Option ARM] sector shows “dismal” performance, with more than 40% of borrowers 60 or more days past due on payments. And many of these loans have yet to experience a recast event, when initial minimum monthly payments jump as much as 60%

Most in the media are using these terms interchangeably. Talking heads do not understand that they are anything but. “Reset” refers to a rate change. “Recast” refers to a payment change. It is the recast event that will shake the foundations once again. Recasting is really just another word for “reamortize”. Once the initial teaser rate is over the loan may reset based on the current APR. Next, the current balance, most of which have grown, are recalculated for the remaining term of the loan. It is this event that fully amortizes the loan now over a shorter period of time with a larger balance in most cases.

Now the borrower is trapped. Housing values have collapsed in bubble areas so they cannot refi. Once housing prices rose to the point that they were no longer serviceable Option ARM lending took over. Here is where even prime borrowers weren’t even making minimum interest payments. This is why these loans are going bad before the end of the teaser period.

It’s the NEW PRINCIPAL AMOUNT that is the worry here, because of all the borrowers out there choosing the negative amortizing monthly payment option that causes the original loan amount to rise over time! There are two main

reasons why your Adjustable Rate Mortgage will re-cast:

1) the loan reaches it’s balance cap

2) the first scheduled re-cast date, usually 5 years from origination

This is also the reason why the banks are not foreclosing on properties, even when occupants are 24 months in arrears. The loan value exceeds the property value by a large amount. Foreclosing sometimes costs more than the property itself and once closed the bank has to realize this loan loss.

Principle reductions is the only way to fix this problem but… the law of unintended consequences states that if the Gov’t goes this route you will see an unprecedented tidal wave of strategic defaults. Of course just this past week we had Wells Fargo cut the principle on loans as much as 30%.

This has now entered the weird.

5 comments

Skip to comment form

Author

I hope it gets the attention it deserves.

Author

If a few more people read it. :o)

I know there are a lot of other issues (unemployment, homeless, healthcare) on many peoples radar. Understandable.

This was the tipping point for the whole enchilada and I was trying to point out, it hasn’t gone away … In fact, it’s coming back like the other side of a hurricane, only this time the U$Gov has shot it’s wad.