(noon. – promoted by ek hornbeck)

If you missed Dylan Ratigan’s interview today with Senator Maria Cantwell (D-WA) — well you missed a lot!

They spell out in stark relief the very REAL need for serious Wall Street Regulation — NOW! (and still!)

Or we risk a repeat of the same Bubble-driven collapse of Trillion Dollar Derivative Bets, that occur in the dark, beyond the reach — or even the Watch — of any Govt Regulator, or even the Public scrutinity.

Nothing has changed, they can STILL Gamble Trillions in Derivatives, and let US the Taxpayers pick up the Tab, whenever their Bets GO Bad!

Link to MSNBC Clip to the Ratigan Cantwell Interview

Definitely a “Must See”, in my opinion.

So much so, I transcribed much of it, to help peak your interest …

Link to MSNBC Clip to the Ratigan Cantwell Interview

[apologies for any errors in the transcription; every reasonable effort was made to ensure its accuracy]

Dylan Ratigan paints the Wall Street Casino for what it is — “Legalized Gambling”. And while people can read more about legal gambling options and do so on their own volition, the risks need to be considered here.

[Beginning of Clip]

Video Excerpt from Front Line, The Warning

We had the most raw panic the Economy and the Financial Markets had seen since the 1930’s. It was ugly. It was broad-based. It was bringing huge Institutions to their knees, and a lot of that was tied into Derivatives.

Dylan Ratigan:

Well, that’s the latest edition of Front Line, titled “The Warning”. It examines the type of “Legalized Gambling” that took down Wall Street briefly, and CONTINUES to threaten the collapse of our ENTIRE American Economy. Although Wall Street has been resurrected, and the Casino has been put back in business — as you can see from Goldman and JP Morgan’s earnings — Thanks to the Taxpayer! It’s something we all talk about a lot on this show:The Derivatives are the Gambling Instrument — think of that as your “Black Jack Table” — between, Banks betting between each other: ‘Who can pay their Bills?’

NOT just each other, but everybody in America: ‘Who can pay their Credit Card Bills?’

These bets kept under the radar: ‘Who can pay their Mortgages?’, ‘Which Government can pay its Bills?’

They keep these Markets in secret.

The version of Financial Reform passed recently by a House Committee, originally aimed to put — again, “Black Jack Tables of Bets” on ‘Who can pay their Bills?’ — out in the open so that we could all see the Casino Parlor.

But so far even after what happened last year, even after 24 Trillions dollars were taken from the Taxpayer to support the system, even in the wake of record Unemployment movement, record Foreclosures period — Still OUR Regulators are trying to keep the Derivatives Market ‘out of whack’.

[…]

Dylan Ratigan explains why the Casino Betting has exploded [1:30]

Dylan Ratigan:

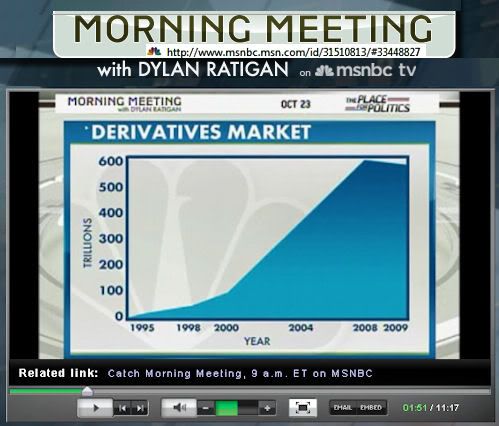

This Casino was opened in the year 2000, by president Clinton and these three men here, Authur Levitt, Larry Summers, Robert Rubin — they are featured in the Frontline piece — you can see after the Legalized the Gambling, you can see the Explosion in the size of the ‘Gambling Pit’

[…]

Dylan Ratigan:$80 Trillion was the size of the ‘Gambling Pit’ BEFORE the Legalization, under Clinton, again approved by Levitt, Rubin, and Summers —

And the Rule became, ‘He who can take the most Risk in the Casino, makes the most Money — and the Down-side goes to somebody else.’

Again that 80 Trillion Market goes to 600 [Trillion] in a heartbeat, because if you take more Risk you make more money. This is true, regardless of if you are looking at The Rise of Japanese Casinos or at the markets as a whole.

Senator Maria Cantwell sits on the Senate Finance Committee, pushing to put this Casino Capitalism to an end, and resurrect the Investment culture, that made America what it is today …

Cantwell on Wall Street Casino with NO Capital backing them up [3:00]

Maria Cantwell:

Well even in Las Vegas, when someone goes to the “Black Jack Table” — BOTH the House and the Player, have to have Capital behind their Bets!But we allow Wall Street to continue to operate without the “backing” of those Securities that really make the Financial system work and perform, as a Regulated entity.

Wall Street Compensation vs Main Street Wages

Cantwell on Closing the Bottomline Loophole [4:30]

Maria Cantwell:

But the bottomline is, if the Federal Government doesn’t regulate this, at least you should allow the States — who’s Insurance Commissioners want to know that this is an ‘Insurance Tool’, and THAT it really complies with “how to” financially “secure Risk” — they should allow the States to do their job.But THAT’s what the Loophole WAS, in 2000 — the Loophole prevented States from also, from having ANY Oversight and Regulation, in what is really Gambling.

And that’s what we need to change. We need Regulators to do their Job! We need to protect the American Economy. And we need Captial to flow to things, other than just Exotic Financial Tools.

Cantwell on the Capital Flow for real Investments [5:30]

Maria Cantwell:

This is what’s made the American Economy “sick” — these ‘Toxic Financial Tools’. And what will make America well again, in an Information Age Economy — where’s there’s lot’s of products and services to be created — is to have that Capital Flow to those New Technologies. Whether it’s Green Energy, or the next innovation in Software.

Cantwell on the Derivative “House of Cards” [6:14]

Dylan Ratigan:

The Commodities Future Modernization Act in 2000 Legalized Gambling with the following paragraph. … the Exemption is the Rule, when it comes to Legislation. …

In other words, if there is a State Law that outlaws Gambling, it does not apply to this “type of Gambling”. So they acknowledge that this a Gambling act, and then wrote an Exemption in saying this kind of Gambling is legal. Is that correct?

Maria Cantwell:

That’s correct. So, what happened is, in the Housing Market, while they were making Housing Loans, that probably were a little bit risky, they said, ‘Well were going to back them up, with these New Derivatives’.And yet those “Tools” DIDN’T have any Capital, really behind them — or the Transparency to set the Value of those Derivatives.

So consequently, it was a House of Cards, and as we know that House of Cards collapsed.

Cantwell on Penalties for such Enron Schemers [7:30]

Dylan Ratigan:

Finacial Reform Bill Loopholes

— No Government Regulation of who must clear and use Open Exchange.

— Large Exception for “Major Swap Participants”

— Foreign Currency Swaps are Excluded, encouraging U.S. Business to set up off shore.

[…]Maria Cantwell: [7:55]

Well I think we need to pass a law that says: ‘If you do off-book accounting schemes, and you manipulate the Market, like Enron did with Energy, you ought to Go to Jail.’And I think we need to have a very bright line, so that if it’s the ‘Next Financial Tool’ that someone cooks up, that they know that the penalty is going to be stiff.

I hate to think that someone is so cynical as to say, that were going to have a Recovery in the United States, by getting Wall Street healthy. And that, in and of itself, will be the key. You will NOT have a healthy Wall Street — you will have a re-occurrence of this event again, IF you’ve not closed these Loopholes.

Brooksley Born asks: Why the NEED for Secrecy?

Dylan Ratigan: [9:00]

[…] Brooksley Born was the fourth person in the room, who was the former head of the Commodities Trading Commission, saying ‘This is crazy — you’re legalizing gambling.’

[…] a sound bite from Brooksley Born: [9:20]

Video Excerpt from Front Line, “The Warning”

What was it, that was in this Market that had to be, hidden?

Why did it have to be, a completely ‘Dark Market’?

So it made me very suspicious, and troubled.

Dylan Ratigan:

Why are they so anxious to keep this Market off of an Exchange? Why is Wall Street so aggressively Lobbying to ‘Avoid the Transparency’, that we all deserve?Maria Cantwell:

Well the Titans of Wall Street’s Power SHOULD stop at the door of the White House. And the White House should be aggressive at saying, they are going to aid Closing these Loopholes, and making sure that Capital Flows to the Market of Products and Services, that really will strengthen our great U.S. Economy.But if we continue to have a lax attitude, then the Millions of dollars that are being spent on Capital Hill by the Financial Industry, to keep these Loopholes open, are going to be successful.

So we need the White House to weigh in, and to be strong, and to be forceful. And we have yet to see whether that is going to be the reality on Capital Hill.

Dylan Ratigan:

Listen, Senator Cantwell, thank you for efforts on the Finance CommitteeMaria Cantwell:

Thank you!Dylan Ratigan:

and if we can get back from ‘a Casino’ to ‘an Investment’ [Economy], we can probably “Go to Mars”, among other things — Cure Cancer, have a driver-less Car.

Well many great questions were raised. I hope Investigators like Ratigan, and Senators like Cantwell — KEEP asking them!

Because if experience teaches us anything, without the ‘light of day’ on these shady Markets, and serious Consequences for the participants that Bet recklessly, WE will be obliged to Bail them out, again someday.

link to Frontline: The Warning — Watch the entire Episode

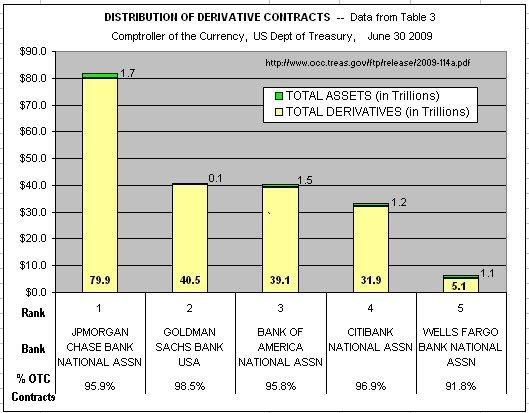

The potential Gains are TOO Great for the Bankers and Hedge Funds to ignore them:

The NEW Top 5 Banks — June 2009

(Data source: Comptroller of the Currency (pdf), of US Dept of Treasury, has issued an updated report as of June 2009).

AND The stakes are TOO High, for the American Taxpayers NOT to demand Transparency, Regulation, and Accountability — on those Bets!

Commodity Futures Trading Commission (CFTC) Chief: cover more of swaps market in US reform

Reuters — Oct 16, 2009

The bill sets a general requirement for “standardized” swaps to go through clearinghouses, as a step to reduce market risk, and it requires standardized swaps that involve financial speculation to trade on regulated exchanges or electronic platforms. Regulators would decide which swaps or class of swaps must be cleared.

http://www.reuters.com/article…

Yet the Wall Street Lobbyists will probably win this Battle too. The Need for Transparency on their toxic Wheelings and Dealings, just never seems to strike a chord, with the American public, no matter who is sounding the warnings …

Perhaps we should listen to the criers of decades past, like “Credit Crisis Cassandra” Brooksley Born’s who’s unheeded Warning, WAS actually worth Heeding, 10 years ago!

What was it, that was in this Market that had to be, hidden?

Why did it have to be, a completely ‘Dark Market’?

So it made me very suspicious, and troubled.

Good Questions … when you and I trade stocks, or invest in a 401k, the Govt Regulators get a public record of it — pronto! So why NOT the same standards for the Bankers and the Hedge Funds who “trade” in Derivatives and Credit Swaps, and other High Risk Investments?

“If they AREN’T doing anything Wrong — Then they GOT Nothing to Worry about”, DO They?

And IF They ARE, — Then — WE certainly Do!

8 comments

Skip to comment form

Author

Beware of the Billionaires —

Because if we Don’t — Who Will?

We’re living in a truly insane world if the idea of putting regulations on these thieves is considered “controversial”.

These people need to be in jail. And if not that, I’d say heads need to roll. Literally!

How much shit will Americans eat? It seems like they have an endless capacity.

Am I ever glad to see you back doing things around these parts. I didn’t follow the happenings–chose not to. But I think buhdy’s cathartic essay about closing

Alice’s Restaurantthe blog has been a turning pointWelcome back! And what a great choice for promotion!

…for this magnificent encapsulization and transcript. You did great work here, a service to us all. I’m Hot Listing for quick reference in future.

Wall Street must surely be hoping that the health care debate (which is critically important in its own right) continues as long as possible, diverting our attention, as they continue to take advantage of our state of distraction, lifting any and all loose currency and change from our soon to be empty pockets.

Yes, the name of the game today can be summed up as: Socialism for the Rich, Capitalism for Everyone Else!

As the teabaggers continue to cheer on their eventual executioners, some of the rest of us plead for a modicum of sanity. Speaking of teabagging, if any of your Neanderthal acquaintances proudly label themselves as a “teabagger”, you can ask them to stop telling you about their sexual preferences. Rather than provide the details, which may offend some, or perhaps many, those who dare can look up this term on any reputable on-line slang dictionary for further details. Caution: If you do this, you may have difficulty stifling derisive laughter the next time you hear someone proudly proclaim themselves to be a “teabagger.”

If you had a profligate nephew/niece who liked to gamble, and he/she asked you to designate your entire net worth as collateral to bankroll their gambling habit, how eager would you be to sign on the dotted line? Now keep in mind, he/she gets to keep any winnings. Your only job is to cover the losses. Still interested?

Without our knowledge or assent, the representatives of the Corporate World (who are, in theory only, our elected representatives) have surrendered the collective fortunes of all in this country and the world, for that matter, to satisfy their Wall Street “friends”, who then brush a few crumbs off the gambling table, to be licked off the floor by their Congressional enablers.

Did anyone else note the figure that Ratigan threw out of $24,000,000,000,000? In case your eyes are glazing over from all the zeros, that figure is 24 trillion dollars. How does one conceptualize such a figure? Since the population of the United States is currently just north of 300,000,000, that figure comes out to only $8,000,000 for every man, woman and child in this country. And if the entire world were to jump upon this ill-fated bandwagon, the figure would come out to only $353,356.89 per person, given today’s population estimate (see http://en.wikipedia.org/wiki/W… for further details).

So, in either case, count the number of persons in your household and multiply by $8,000,000 or, if it makes you feel better, by the $353,356.89 figure (assuming that we can convince the rest of the world to go over the edge of the cliff with us), and when calculating your net worth, enter either of those figures as liabilities.

Can we all say together, “I’m mad as hell…and I’m not going to take it anymore!”?