(noon. – promoted by ek hornbeck)

That’d be roughly seven hundred billion dollars.

Yeah. $700 billion.

$700,000,000,000. heh.

Two weeks ago, the value of nothing was around half a trillion dollars. For the war in Iraq and, I suppose, that includes the broader nothing of the war on terror.

But today, that nothing, those quote distressed assets unquote will cost the American tax payer almost three quarters of a trillion dollars. Like wOw. We are not asked, but, by proxy, forced to GIVE our money to those who made bad decisions to cover their bad debts, their distressed assets. These masters of the universe have acted out of greed. Drove the kinds of investments that have further battered our planet. Resulted in industrial practices in third world countries where child labor and human rights abuses abound.

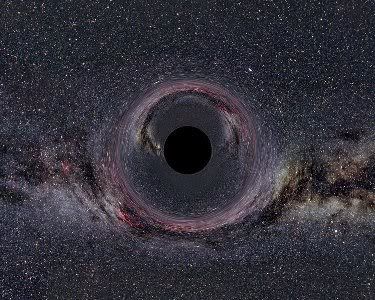

The value of nothing. This void that has been created around us. Our country’s great ideas, it’s innovations, it’s product pipelines… all dried up.

Our freedoms have become meaningless as the nothingness of FISA, the Patriot Act, and the Military Commissions Act take hold.

Money. Having stuff. Has transformed us into rats on cocaine… consumer driven, debt driven. Transformed into indentured servants, enthralled by wide-screen televisions, the newest version of ear phones, iPods, and sneakers.

The value of nothing is nothing. Unless you’re this guy, John P. Grayken of Lone Star Funds, who maneuvers in shark-infested waters, finding ways to kill the sharks while feeding on the rest of us.

A-fucking-mazing.

BTW, does anybody know about the impact of all this on retirement accounts? I haven’t read everything or looked everywhere, but I am amazed at the lack of reporting and analysis on the impact of retirement funds like 401Ks, et al.

I’d also like to know just where that $700 billion is coming from? Is the social security fund being looted? Is this a way to get at it do you suppose? Are they just printing up money? Where is this money coming from? China?

I’m still not clear on exactly who and/or what this bail will solve?

I’m still not clear on how we can trust those in our government… who didn’t react when Bear Stearns went down. . . who had access to the same information/data that has been analyzed on blogs, by guys like Paul Krugman for a few years now . . . all of whom predicted this meltdown? What qualifies somebody like Paulson to commit to this very radical action? The only thing the conventional politicians/policy makers/lobbists have done, their only claim to fame, is making money from nothing.

Knock on your neighbors’ doors. E-mail everyone in your address book. Call your family and friends. And ask if they know how and why these politicians and policy makers and lobbists can suddenly come up with $700 billion dollars to bail out Wall Street when promises to address issues like health care insurance have gone largely unkept for years.

Making lemonade out of lemons is one thing. But putting a value on nothing is fucking ridiculous.

Time to get it back. If you have the sense god gave a horse, then insert yourselves into your county’s political committees. Take back your school boards and town councils. Run for state government. It’s trickle up. It’s time to re assert states’ rights as one strategy to stopping the expansion of federal and corporatist power in the United States of America. Orchestrate a 50 state strategy of legislation that allows citizens to recall their elected representatives. Don’t wait for current Democrats. Every day we think conventional politics and politicians will solve our problems allows the black hole of nothing to expand over our country and our lives.

27 comments

Skip to comment form

Author

of substance, please!!!!!!!!!

cross-posted at daily kos

Treasury Securities such as T-Bills, notes, bonds, and TIPS will be issued to raise much if not all of of it- see: The Basics of Treasury Securities

In other word Treasury will borrow it by selling those instruments, with probably most sold to foreign investors, although pension funds might buy some of that debt. I don’t know if things like Social Security and Medicare are financed partly through buying such instruments.

Investors will have no problem buying those debt instruments as long as they have confidence that Treasury will not default on them down the road and that they will be redeemable.

How will US raise all that money?

Ultimately, like any other borrower, you or me for example, the government will become “owned” by its creditors, the people who buy those Treasury Securities.

And the only way ultimately the government can raise the money down the road to service that debt is through taxing people and through not providing services to them, perhaps Social Security included….

Ain’t it great? :-/

also a perfect description of neo-conservatism/neo-liberalism.

We all wanted to see the end of the neocons. This is what their end looks like. Unfortunately they have been driving the ship for too long, and we now teeter on the edge.

these are the ones who tore down the rules, claimed they could do it privately.

the same folks who were either aghast at the breakup of Ma Bell, or rubbing their hands in glee, seeing a way to get their filthy fingers into the pie.

NOW they want bail-out. they want you & i, who have suffered under their tearing down the no monopolies rules, watching mom & pops be put out of business by the ‘bigbox’ stores, watching agriculture being taken over by agri-business putting farmers off land thats been in the family for generations, watching jobs being exported and shoddy goods being imported…. and they want you & I to pay for this???

FUCK NO!!

it’s their bed, let ’em lie in it.

Larisa Alexandrovna, at-Largely, yesterday:

Newt f’ing Gingrich? Heh.

We end up paying it, but really where does it come from, and when do other countries quit lending to us? It would be kind of ironically funny if congress approved it, and nobody would lend it to us. What would happen then? Do we already owe more money than there really is in the world?

such as is there no cap on government spending? This bailout would put us into fourth or fifth generation spending, as we were already into third generation spending with Iraq!

I’ll be back later.

But here is an action page for right now — No Blank Check for Wall Street!

Even if it gets off the ground, there is nothing to keep it in the air.

Naomi Klein’s Shock Doctrine. If you haven’t already, get a copy and get the full story of how we got to this historic point. It wasn’t by accident and it’s not inevitable!

The exchange rate for the Amero. It was postulated that the bankers would get a 1/4 for their cut right off the top but when you add the other 1/4 for the global carbon tax and the other 1/4 to global government tax we are still left with nothing.

No badgers but there are lots of Canadian geese around to eat. Got my highway bridge abutment all picked out.