(9 am. – promoted by ek hornbeck)

By now, Hurricane Gustav is ravaging the great city of New Orleans and the surrounding Gulf Coast. Our hopes and prayers goes out to the good folks of the area. Well you probably have guessed, that Johnny Venom would’ve found the economic angle on all this. Rest assured, fellow Kossacks, I won’t let you down! But once again, I do hope for the best for the folks aflicted by Gustave.

Gustave could raise the price at the pump, among other things

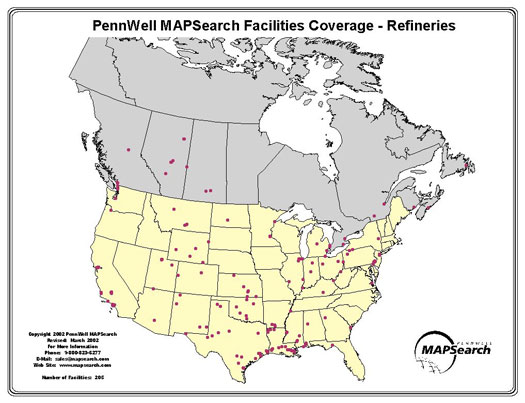

Hurricane Katrina had damaged a good chunk of the oil platforms off the Gulf Coast several years ago. Refineries located inland faced weather-related shutdowns as well. To make matters worse the force of the storm has managed to tear up the ground holding those massive pipes under the sea and going onto land; many of these pipelines had to be fixed or replaced. The effect of it all last time, was a major oil and gasoline shortage, that help shoot up prices across the board.

Expect history to repeat itself, sorta. Oil rigs in the path of Gustav have already been shut down. Refineries in the area also shut down or in the process of doing so. As the Wall Street Journal notes, no one is sure how powerful the damage will be and everyone is just waiting. Right now oil futures trading today on NYMEX’s Clear Port and the CME’s Globex platforms are down significantly. On Sunday late afternoon, the benchmark crude’s front-month contract had initially jumped about to about $120, but has since fallen about $5!

The energy industry faces the prospect of losing more than one million barrels a day of offshore oil production until later this week, and another one million barrels a day if the Louisiana Offshore Oil Port, or LOOP, sustains damage and can’t reopen to accept imports from tankers quickly. LOOP is an offshore delivery point which handles 10% of U.S. oil imports. Weather forecasters say Hurricane Gustav could make landfall Monday only a few miles west of LOOP. Such a disruption would force producers and refiners to scramble to find new ways to import oil from sources as diverse as Saudi Arabia and Venezuela.

“It remains likely that Gustav will prove to become a worst-case scenario for the [oil] producing region and places the heart of the oil production region under a high risk of sustaining significant or major damage,” says Jim Rouiller, senior energy meteorologist with Planalytics.

– excerpt from “Gulf Coast Energy Companies In Shutdown Not Seen Since 2005“, Wall Street Journal, 2008.

Gasoline futures are also falling as well. This morning, the government and oil companies have come out and said that they have enough supply in storage. For any possible shortages, the government has announced that they will loan any amount of crude needed from the Strategic Petrolium Reserve (to be paid back later). One reason energy prices saw a drop, according to some, was that Hurricane Gustave was demoted from a Catagory 3 to a Catagory 2. Now, given that prices have dropped, something else to keep in mind, NYMEX is not fully operational today, tomorrow when all the traders come back we could see a jump in gas and oil.

(the purple dots represent sites with refineries)

For manufacturers, they will soon face a possible delima that the average consumer will face, higher fuel prices and possible shortages. No one right now is sure which refineries will be put out of commission. Nor are they certain if the pipes that connect many platforms and such will be equally damaged as well. The process of shutting down takes a while, and thus a quick return to normal capacity will be equially time consuming.

The Gulf Coast region makes up approximately 25% of our domestic production, will now be offline. Manufacturers now must scramble to find other sources. To be sure, the US does have many other refineries still operating, though most are already at peak capacity.

As previously mentioned, oil has been dropping because supply concerns for the moment have been met. Energy companies for the past couple of months have come under intense scrutiny since oil had jumped to $145, and they remember Katrina. A loss of supply or price hikes would actually, in a political sense, not serve them well. Even so, despite assurances, expect shortages somewhere and other “revelations” on the energy situation.

Gustav has already forced preventative cutbacks in Gulf Coast energy output. Energy producers have shut in approximately 96.3% of oil production and 82.3% of natural gas output in the U.S. Gulf of Mexico, the U.S. Minerals Management Service said Sunday. The longer-term impacts from the storm won’t be immediately known, and traders and crude oil’s fall reflected wider concerns about softening oil demand. Trading volume was also light as the U.S. observed the Labor Day holiday and pit trading on the Nymex floor was shut, making the market liable to exaggerated price moves.

– excerpt from “Oil Prices Retreat After Earlier Gains“, WSJ.com, 2008.

Gustave won’t be sweet on sugar

While we may not see as bad a shortage, expect dissruption in the supply of sugar. Gustave will slam through the state’s sugar industry. Lousiana is one of the country’s domestic sources of sugar. And, according to an AP story, not at a great time for sugar cane growers.

The storm came on top of such problems as high fuel and fertilizer prices, sagging prices caused by imported sugar and a rainy summer that has delayed crops. Many growers have supplemented their sugar crops by growing soybeans, which also stand to get flooded, said the group’s general manager, Jim Simon.

Simon said the sugar business in Louisiana, in a good year, can carry a total economic impact of up to $2 billion.

“When we take a hit like this, it not only affects the growers, but it can trickle through the entire sugar economy,” Simon said.

– excerpt from “Gustave’s possible economic impacts“, AP, 2008.

( The red areas are sugar cane production, yellow for corn, and green for sugarbeets)

Sugar prices trading on the Intercontentental Exchange (ICE, and formally sugar traded on the New York Board of Trade) alrady had futures prices going up last week. Since last week, the price had been going down.

The market is closed on Labor Day, but it will be interesting to see if sugar breaks it’s yearly high of $14.5. The supply issue though may damper such a prospect.

Overall, the situation, if one looks at the map, isn’t entirely bad. The US has many other sources for pure sugar like Florida, Hawaii and Texas. Plus there are international sources that could supply producers who use the product.

Shipping taking a hit

Other ramifications include the halt of many shipping operations. Cargo fleets have been diverted to other ports, while products originally destined for the ports have also been transferred to new shipping facilities. The Port of New Orleans serves as a major import point for such things as steel, plywood, coffee, and rubber. It is has an extensive rail network conected to it.

Supply disruptions should be expected, and have an adverse effect on Industrial Production and Producer Price Index indicators. Mayor Nagin was on CNN today talking about how the Port of New Orleans and both state and local government have been pushing for further investment into PNO, to make it competetive against other major ports. It should prove interesting how things go if Gustave manages to significantly damage the area.

Cross posted on The Economic Populist – A Community Site for Economics Freaks and Geeks

2 comments

Author

I do hope that it isn’t as bad this time around.