(9AM EST – promoted by Nightprowlkitty)

Burning the Midnight Oil for Living Energy Independence

As Dean Baker reported on the (bookmark worthy) Real World Economics Review Blog, new home sales figures for July are out, and they are exactly as would have been expected when the Mortgage Brokers Association reported a slump in mortgage applications in May.

As Dean Baker reported on the (bookmark worthy) Real World Economics Review Blog, new home sales figures for July are out, and they are exactly as would have been expected when the Mortgage Brokers Association reported a slump in mortgage applications in May.

The stronger figures earlier in this year, in other words, included more than a normal rebound from a recession:

People who might have bought in the second half of 2010 or even 2011 instead bought their home before the tax credit expired. Now that the credit has expired, there is less demand than ever, leaving the market open for another plunge in prices. The support the tax credit gave to the housing market was only temporary

This does not mean that all policy response is futile: what it does mean is that the policy response must address the problem we are experiencing, not the problem we wish we were experiencing.

Treating Solvency Problems as Liquidity Problems Only Delays the Reckoning

Just as the months between the time the Housing Bubble collapsed and the Panic of 2008 exploded, we been focused on providing a liquidity fix to a solvency problem: but this solvency problem is the sustainability of 20th Century Sprawl Suburban Development.

Just as the months between the time the Housing Bubble collapsed and the Panic of 2008 exploded, we been focused on providing a liquidity fix to a solvency problem: but this solvency problem is the sustainability of 20th Century Sprawl Suburban Development.

Both Liquidity and Solvency are about assets and obligations, but Liquidity is about the ability to meet obligations presently due with cash on hand and other liquid assets.

Solvency is about whether the value of your assets is greater than the total amount of your obligations.

In the lead-up to the Panic of 2008, part of the multi-dimensional incompetence in economic management that greatly aggravated the severity of the Panic was the policy of the Federal Reserve Board, which addressed the collapse of the Housing Bubble as if it was a liquidity crisis.

Here, for example, is a defense of the Federal Reserve policy of the summer of 2008 by Thomas Palley (June 2008)

The bottom line is that current criticism of the Bernanke Fed is unjustified. Whereas the Fed was slow to respond to the crisis as it began unfolding in the summer of 2007, it has now caught up and the stance of policy seems right. Liquidity has been made available to the financial system. Low interest rates are countering the demand shock. And the Fed has signaled its awareness of inflationary dangers by speaking to the problem of exchange rates and indicating it may hold off from further rate cuts. The only failing is that the Fed has not been imaginative or daring enough in its engagement with financial regulatory reform.

This is precisely the stance you need to see off a liquidity crisis … or even a “soft” solvency crisis, where the solvency is restored at lower interest rates, shifting the balance between shorter term liabilities and longer term assets. However, a Brad DeLong noted in 2007, there is a more severe solvency crisis:

The third mode is like the second: A bursting bubble or bad news about future productivity or interest rates drives the fall in asset prices. But the fall is larger. Easing monetary policy won’t solve this kind of crisis, because even moderately lower interest rates cannot boost asset prices enough to restore the financial system to solvency.

When this happens, governments have two options. First, they can simply nationalize the broken financial system and have the Treasury sort things out — and reprivatize the functioning and solvent parts as rapidly as possible. Government is not the best form of organization of a financial system in the long term, and even in the short term it is not very good. It is merely the best organization available.

The second option is simply inflation. Yes, the financial system is insolvent, but it has nominal liabilities and either it or its borrowers have some real assets. Print enough money and boost the price level enough, and the insolvency problem goes away without the risks entailed by putting the government in the investment and commercial banking business.

There was, however, a third option: force banks to get their books into order so that they are in a position to weather the coming storm. And this is not just a hypothetical. Following the Asian Financial Crisis, which impacted on the Australian financial system, there was a restructure of financial system, with prudential regulation for most of the financial system, including banks, placed into the hands of the Australian Prudential Regulatory Authority (the Wikipedia machine). And unlike the Federal Reserve prudential oversight of US commercial banks, which was unmasked as incompetent by the Panic of 2008, the Australian system performed far better:

Ask an Australian what he or she thinks of the World’s Worst Financial Crisis Since the Great Depression and the response just might be, “What crisis?” Sure, the Aussie stock market lost 59 percent peak to trough and some people lost their jobs, but relatively speaking, Armageddon gave Australia a free pass. Down Under was the only developed country to avoid technical recession. The stock market has bounced back almost 30 percent since mid-July. And housing? Home prices are actually higher now than in the summer of 2007. Last week, the Reserve Bank of Australia (RBA) increased its benchmark interest rate by 0.25 percent, a clear indication that in the central bank’s opinion the danger has passed.

…

Australian banks proved to be more resilient during the crisis because they hadn’t exposed themselves to as much toxic debt as other nation’s financial institutions. The big four banks (Australia and New Zealand Banking Group Limited, Commonwealth Bank of Australia, National Bank of Australia and Westpac Banking Corporation) stayed profitable, maintained their top credit ratings and wrote down less than US$4 billion between them. In 2007, non-performing loans were 0.2 percent of all Aussie bank loans, far lower than the U.K. (0.9 percent), U.S. (1.1 percent), and Germany (3.4 percent).

And part of the reason that Australian banks did not lose their minds is that their chief prudential regulator kept engaging in prudential regulation, rather than giving them close to a free pass.

The Suburbs and the More Serious Solvency Crisis

Now, this was a financial solvency crisis, and it has had the devastating real economy impact that it has had because we decided to let it do so … in addition to not pursuing serious prudential regulation, once the financial solvency crisis hit, we pursued an the under-weight Stimulus II policy, addressing an output gap of $1,000b with a Federal spending stimulus targeted to peak at $250b and which, at present, is only allowing total government spending to tread water, because of a slightly larger drop in state and local government spending.

Now, this was a financial solvency crisis, and it has had the devastating real economy impact that it has had because we decided to let it do so … in addition to not pursuing serious prudential regulation, once the financial solvency crisis hit, we pursued an the under-weight Stimulus II policy, addressing an output gap of $1,000b with a Federal spending stimulus targeted to peak at $250b and which, at present, is only allowing total government spending to tread water, because of a slightly larger drop in state and local government spending.

Had the US, like Australia, been able to implement a serious and aggressive Stimulus, we would be experiencing a faster recovery now.

However, we continue to face the real solvency crises that underlay the financial solvency crisis.

What we have been doing over the past twenty years has been to allow gradually easing credit on new home lending to serve as an economic growth engine, in lieu of the income-driven growth that the US pursued in the 50’s and 60’s.

Not just houses, either: easing consumer credit was part of the system of encouraging households to lock down into nearly decade long car loans to allow the purchase of massive trucks masquerading as family cars. Since no other oil-importing nation in the world has such suicidally low gas tax rates, the US had the inside position for manufacture of massive piles of metal requiring massive amounts of gasoline to push around to work, soccer practice, the big box store, and etcetera.

But none of this was on the basis of growth income ~ since median income growth slowed in the 90’s (it took until 1997 to recover the 1989 level, so we only has two years of net growth in the 90’s), and stalled in the 2000’s, ending the decade lower than it started for the first time since the end of WWII.

But none of this was on the basis of growth income ~ since median income growth slowed in the 90’s (it took until 1997 to recover the 1989 level, so we only has two years of net growth in the 90’s), and stalled in the 2000’s, ending the decade lower than it started for the first time since the end of WWII.

And the easy consumer credit clearly overshot. Far from wondering if it can return, we need to hope that it does not, since the long term of the “cheap” consumer credit turns out to be far more than we can easily afford.

That is the one side of the Sustaining the Suburbs dilemma: the Rock of Stagnant Income Growth. In terms of solvency, the “Benefit” of the suburb has been driven by income growth, and the share of rising income that people are willing to allocate to their home … and that benefit was fading in the 90’s and vanished in the 2000’s.

The Long Term Cost of Sprawl Development

Many people confuse “sprawl development” with one of its primary symptoms, of low density housing. But Sprawl Development is a very clear and distinctive approach to property development that means far more than whether people are living in inner urban areas or outer suburbs.

Many people confuse “sprawl development” with one of its primary symptoms, of low density housing. But Sprawl Development is a very clear and distinctive approach to property development that means far more than whether people are living in inner urban areas or outer suburbs.

Sprawl Development is greenfield development in large tracts by type of activity. One tract is commercial, and is developed for one or more shopping malls, big box stores, strip malls, and free-standing drive-in establishments. One tract is industrial, and is developed for activities ranging from warehouses and manufacturing activity to office campuses and two-year Student Loan fueled business colleges. One tract is residential, and is developed into lot after lot of single-use, single-family residences.

Sprawl Development is mandated by the zoning systems in place in much of the United States, which required special zoning approvals for anything deviating from travel-maximizing development.

And travel maximization is a principle side-effect of Sprawl Development. While its primary purpose may be to continue to recirculate financial assets used by property developers into acquisition of new tracts to qualify for tax-sheltering of previous capital gains, forcing people to make distinct trips for distinct purposes is the primary side-effect.

And that is only financially prudent in an era of cheap energy. Forcing people to live at densities too low for public transport to serve effectively, and to organize their lives around trips that are too dispersed for public transport to serve effectively, requires an energy hungry private motor vehicle transport system.

But the most effective private motor vehicle fuel source is Petroleum, and we are either reaching or have reached Peak Oil. The US, producing a massive tenth of the world’s petroleum supply but consuming about a quarter of the world’s petroleum, cannot afford the transport system we have.

When, not if, gas returns to $4/gallon in real terms (corrected for inflation), that will be about one hour’s minimum wage work for two gallons of gas. When, not if, it reaches $8/gallon in real terms, that will be about one hour’s of minimum wage work for one gallon of gasoline.

People who cannot afford to get to work, shopping, school and other activities from a house cannot afford to live in that house, even if the house were to be given to them for free.

And that is the other side of the Sustaining the Suburbs dilemma: the Hard Place of escalating Resident+Transport costs.

We Can Either Make Suburban Transport Sustainable, or Watch Suburbs Become Slums

The “value” of Housing cannot be higher than what people can afford to pay. What people can afford to pay cannot be higher than their income minus their other necessities. And Peak Oil ensures that the real cost of other necessities will rise so long as we continue Business As Usual.

The “value” of Housing cannot be higher than what people can afford to pay. What people can afford to pay cannot be higher than their income minus their other necessities. And Peak Oil ensures that the real cost of other necessities will rise so long as we continue Business As Usual.

But a conclusion based on a premise of Business As Usual implies that there is an out, if we are willing to abandon Business As Usual. In this case, there are two, intimately related, outs:

- Housing that reduces the real cost of other necessities will rise in value

- If we can restore income growth, housing can rise in value

I have been mostly focusing in the past month on the second of these two: sustainable transport policies that can help generate a Brawny Recovery involving more real work for long-term sustainable economic benefit, leading to long-term sustainable income growth rather than the boom and crash approach of stagnant income and easy consumer credit.

But independently of the employment and income benefits of the four Steel Interstate, High Speed Rail, Electric Transport and Active Transport funds, to be financed by A Dime A Gallon on Imported Crude Oil … they also offer the opportunity to establish suburban transport systems that can anchor a Sustainable Suburban Retrofit.

I do not come, in other words, to Bury the Suburbs, but to Save Them. Sprawl Development ~ yes, that can be buried. But the material waste of abandoning the suburbs and building all new residences for half of the US population is something that we can most definitely avoid.

Suburban Retrofit and Sustainable Transport

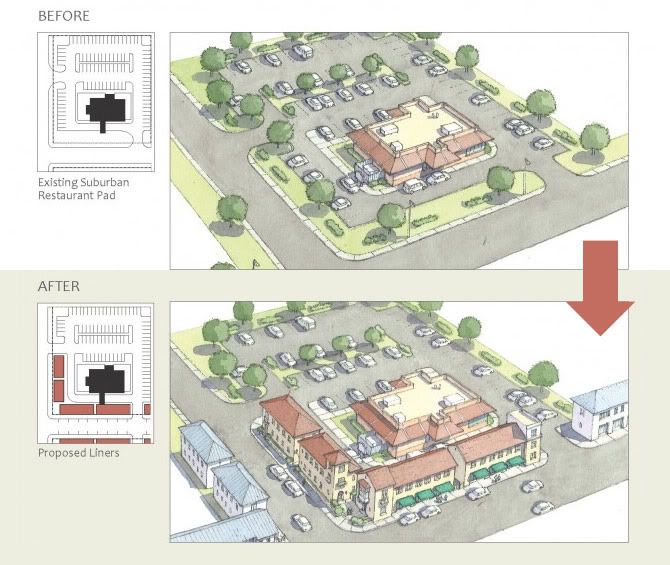

The key to Suburban Retrofit is the Suburban Village Center. Focused around a stop on a main sustainable regional transport corridor, a Suburban Village Center erases the government restrictions that forbid sustainable development: within a quarter mile radius around the designated primary stop, single-residence, single-use restrictions are removed and replaced by an allowance of at least four occupants per lot including at least one ground floor commercial or professional occupant. An easement of street set-back is allowed, in return for a urban width sidewalk. Minimum parking requirements are eased, allowing for the provision of as much auto-independent residences as the market will bear.

The key to Suburban Retrofit is the Suburban Village Center. Focused around a stop on a main sustainable regional transport corridor, a Suburban Village Center erases the government restrictions that forbid sustainable development: within a quarter mile radius around the designated primary stop, single-residence, single-use restrictions are removed and replaced by an allowance of at least four occupants per lot including at least one ground floor commercial or professional occupant. An easement of street set-back is allowed, in return for a urban width sidewalk. Minimum parking requirements are eased, allowing for the provision of as much auto-independent residences as the market will bear.

And, of course, a portion of incremental property tax revenue from all additional property value due to the easement is allocated to the funding of the transport system that is responsible for the easements.

The suburban village is like a pebble dropped in a pond: its impact ripples out from the suburban transport stop. The immediate impact is that any business that wishes to intercept people bound or returning for the transport stop is in the market for a location within the easement. Property developers can develop in the easement by buying out single-use, single residence properties and building multi-use buildings such as a street front shop with townhouses stacked on top.

As the suburban village develops, it becomes the transport center of the surrounding area. There is an immediate surrounding area of those in the surrounding suburban homes who can easily walk to the Suburban Village. There is a vicinity around that of people who can readily cycle to the Suburban Village. And there is a vicinity around that are those who can drive, whether present generation gasoline and neighborhood electric vehicles or a next generation of electric vehicle … combining local trips, and replacing longer trips with trips on the common carrier.

Three of the four funds in the Dime Per Gallon on Imported Crude Oil policy can contribute to establishment of this system. The Electric Transport fund can contribute to the establishment of a wide variety of common carrier transport corridors, from prioritized Quality Trolleybus Transit through to Rapid Streetcar to Regional Stopping Rail.

Of course, a regional transport corridor needs anchors, and there is a catch-22 on establishing the regional transport corridor if all of the potential anchors will be Suburban Villages that will not exist until the corridor has been established. The High Speed Rail corridors, and in particular the 110mph Emerging HSR corridors, provides opportunities to provide those anchors:

- Siding platforms for regional trains along the HSR corridor allow the corridor to be shared between regional trains and HSR

- Outer suburban HSR stations provide an outer-anchor for Urban/Suburban routes challenge by the problem of steadily dropping load factors the further they run from the urban center

- And outer suburban HSR stations provide a central target for a cross-cutting corridor ~ which may be a trolleybus if the patronage will not support development of a rail service

Note that the Suburban Village can be located in any single use tract. Thus one approach to a Suburban Village is to provided a regional Rapid Streetcar lines that operates primarily on a dedicated alignment, but leaves the alignment to pass through a commercial shopping center. The commercial shopping center then becomes the target for development of the Suburban Village. Common pool parking at the opposing ends of the Streetcar segment allows a reduction in parking available at each establishment, which frees up land for Suburban Village development, including housing.

Note that the Suburban Village can be located in any single use tract. Thus one approach to a Suburban Village is to provided a regional Rapid Streetcar lines that operates primarily on a dedicated alignment, but leaves the alignment to pass through a commercial shopping center. The commercial shopping center then becomes the target for development of the Suburban Village. Common pool parking at the opposing ends of the Streetcar segment allows a reduction in parking available at each establishment, which frees up land for Suburban Village development, including housing.

And finally, the Active Transport funds can provide the benches and drinking fountains and other pedestrian amenities, dedicated pedestrian walkways, cycle parking and cycleways to both maximize the car-independence of the Suburban Village itself and to more effectively leverage access to the Suburban Village from the surrounding suburban development.

Oh, and about that “Slum” remark

Many people confuse “slum” with “central city ghetto”. The “ghetto” is a reference to the “white flight” from central cities that accompanied sprawl development and the growth of the suburbs, where former middle class white central urban and former streetcar suburban neighborhoods “flipped” to primarily African American neighborhoods.

But just as we cannot confuse Suburb and Sprawl, we cannot confuse Slum and Ghetto. A Slum is an area where property value has dropped below replacement cost. In a slum, it literally costs “too much” to keep the existing buildings in a state of good repair.

But that does not mean that there is no way to generate income from those buildings: what it means is that the way to generate income from those buildings is to allow them to depreciate and find occupants who will pay to occupy them anyway.

In a certain sense, the poor residents are not what makes it a slum: rather, the fact that it is a slum means that the owners seek out the poor to offer them poor quality places to live at a price that they can afford.

So “suburban slum” is no hyperbole. Suburban slum is the natural end point of the path that we are presently treading.

However, there is a choice. If we provide a suburb with a sustainable transport system that allows residents of the suburb to continue to get around in the face of oil price shocks, then we maintain the value of that suburb as a place to live, and provide it with the opportunity to avoid the status of suburban slum that will come to many car-dependent outer suburbs in the coming twenty years.

Midnight Oil ~ Dream World

3 comments

Author

… we really want to go. Till then …

The question is if they can keep real estate levitated at least until early November.

Finally, People Are Calling For A REAL Housing-Market Fix: Letting Prices Fall Henry Blodget Business Insider

Modestly! For the national median home price, perhaps. But for markets such as Los Angeles it could be another 20% or more. But the government can’t levitate all prices forever — I don’t think.

Good discussion of the pros and cons of letting prices find their own level in the title link.