Cross posted From The Stars Hollow Gazette

Don’t let the enthusiasm of the stock market or some financial reports that the job market and unemployment are improving or that the economy is growing faster. It’s not. None of today’s economics news is good. As a matter of facr, it’s rather depressing.

Better Than Expected Second Quarter Growth? Is the Post Kidding

by Dean Baker, Center for Economic Policy and Research

I somehow missed this Post article touting the 1.7 percent growth rate reported for the second quarter as better than expected. First it is incredible that the piece would leave readers with the impression that this strong growth, [..]

The economy’s rate of potential growth is generally estimated as being between 2.2-2.5 percent. This means that rather than making up some of the 6 percentage point gap between potential output and actual output, the gap increased in the second quarter. [..]

The GDP data released on Wednesday also included revisions to prior quarters’ data. The revision to the prior three quarters’ growth rate (Table 1A) were sharply downward lowering growth over this period by 1.3 percentage points or an average of 0.4 percent per quarter. With the revised data, growth over the last year has been just 1.4 percent. This is supposed to be a justification for withdrawing stimulus?

July Jobs Report Masks Real Problems In U.S. Labor Market

by Mark Gongloff, The Huffington Post

Fed Chairman Ben Bernanke has said the official U.S. unemployment rate could mask the real problems in the labor market. He got proof of that in July’s jobs report.

The unemployment rate dipped to 7.4 percent in July, the lowest rate since December 2008, the Bureau of Labor Statistics reported on Friday, down from 7.6 percent in June.

But payroll growth was anemic, wages dropped and more discouraged workers headed for the sidelines, continuing the slowest job-market recovery since World War II. [..]

Employers added just 162,000 jobs to non-farm payrolls in July, the Bureau of Labor Statistics reported on Friday, down from 188,000 in June, which was revised lower from an initial reading of 195,000. Together, revisions to May and June figures subtracted 26,000 jobs from payrolls, another sign of weakness. [..]

The unemployment rate, meanwhile, fell in part because 37,000 workers dropped out of the labor force, meaning they gave up looking for work. The labor-force participation rate, which measures the percentage of working-age Americans who are working or looking for work, fell to 63.4 percent in July, near a 35-year low.

The civilian employment-population ratio, which measures how many working-age Americans actually have jobs, was flat at 58.7 percent, near the lowest in 30 years and down from more than 63 percent before the recession. [..]

The majority of the jobs that have been created during the recovery have been low-paying jobs, worsening income inequality and keeping the economy sluggish.

The job market is a long way from recovery and with the slow rate of job creation there could be a deficit of 4.6 million jobs in May 2016. Not only that but the quality of the jobs that have been created are not conducive to economic stimulus:

More than half of the jobs added last month were either in retail trade or “food services and drinking places.” People employed in those sectors tend to have much shorter work weeks and much lower hourly wages than everyone else.

Even worse, a recent paper (pdf) by Canadian researchers suggests that many of the people taking these jobs are relatively over-educated. The authors argue that, since 2000, globalization and technological advancement have reduced the demand for “high-skilled” workers. Desperate for employment, these workers ended up pushing the “lower-skilled” out of the job market entirely. This may help explain why the share of people aged 25 to 54 counted as being in the labor force has plunged by 3.5 percentage points since 2000.

The quality of jobs being created is probably connected to the depressing performance of incomes and the decline in the work week. Hourly pay has grown by just 1.9 percent over the past 12 months — basically unchanged since the end of 2009. The data from the BEA tell a similar story. Real after-tax incomes fell in June. Americans still have less purchasing power than they did in November 2012. Our standard of living has barely improved over the past year.

None of this is good news. The other question is what will the Federal Reserve do? Chairmen Benjamin Bernanke has promised to keep its target interest rate near zero at least until unemployment is below 6.5 percent.

The Fed’s chairman, Ben S. Bernanke, said in June that the Fed wanted to end its current round of bond buying around the time the rate hits 7 percent, which he predicted would happen by the middle of next year. That prediction is looking conservative, suggesting the Fed could start tapering when its policy-making committee meets in September.

But Fed officials have cautioned that they want unemployment to fall because people are finding jobs, not because they’re leaving the labor force. And by broader measures, the job market remains weak. Growth is sluggish – just a 1.4 percent annualized pace in the first half of the year – and the share of American adults with jobs has actually fallen since the recession ended.

So the decision is unlikely to be clear-cut, particularly because Fed officials are divided about the benefits and the costs of the bond-buying campaign.

And the decision is not going to be made this week. Officials will see six more weeks of economic data, including one more jobs report.

I’m not all that well versed in economics but it seems fairly clear that there needs to be a huge influx of investment into the economy. Since it doesn’t appear to be coming from the private sector, which is more concerned about profits than quality job creation, then it need to start coming from the government. The likelihood of that happening any time soon is still rather grim.

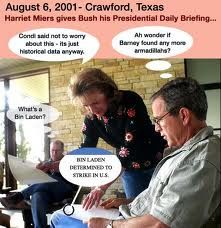

On this day there have been many significant events. Certainly, one of the most memorable is that this is the anniversary of dropping of the first atomic bomb on Hiroshima, Japan. It is also the anniversary of President Johnson signing the Voting Rights Act.

On this day there have been many significant events. Certainly, one of the most memorable is that this is the anniversary of dropping of the first atomic bomb on Hiroshima, Japan. It is also the anniversary of President Johnson signing the Voting Rights Act.

Television, rock and roll and teenagers. In the late 1950s, when television and rock and roll were new and when the biggest generation in American history was just about to enter its teens, it took a bit of originality to see the potential power in this now-obvious combination. The man who saw that potential more clearly than any other was a 26-year-old native of upstate New York named

Television, rock and roll and teenagers. In the late 1950s, when television and rock and roll were new and when the biggest generation in American history was just about to enter its teens, it took a bit of originality to see the potential power in this now-obvious combination. The man who saw that potential more clearly than any other was a 26-year-old native of upstate New York named