(10 am. – promoted by ek hornbeck)

Many people view the Federal Reserve’s role in monetary policy as an unqualified good. If there isn’t enough money in the economy, or if there is too much debt or deflation, then the Fed should print money until both situations are fixed.

Simple.

But it isn’t that simple.

Monetary policy is a zero-sum game. It’s much like Isaac Newton’s 3rd law of motion: for every action there is an equal and opposite reaction.

Not only do many people fail to understand that, they are also under false impressions of what the reactions are and who they effect.

Let’s start with the definition of Financial Repression:

A term that describes measures by which governments channel funds to themselves as a form of debt reduction.

Financial repression can include such measures as directed lending to the government, caps on interest rates, regulation of capital movement between countries and a tighter association between government and banks.

That doesn’t sound so bad. But consider places it has been used, such as India, Mexico, Pakistan, Sri Lanka, and Zimbabwe. Not exactly a list of economic success stories.

The key is understanding Financial Repression is to understand how it works.

Negative Real Interest Rates

The primary mode of Financial Repression, and one that’s been used in the United States for over a decade, is negative real interest rates (i.e. interest rates below the level of inflation).

The Federal Reserve controls short-term interest rates with discounted money from its electronic printing presses, and then holds down long-term interest rates with huge purchases in the bond markets (also known as Quantitative Easing). Both actions have the effect of enabling the federal government to reduce existing debts, and make funding large deficits easier.

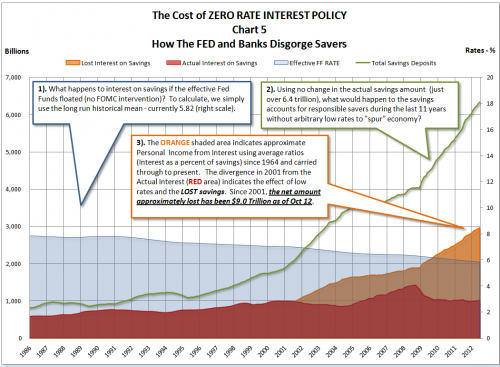

However, there is a cost, in the form of a hidden tax, on savers who are not getting returns on investment that the market would normally pay them.

Unlike income, consumption or sales taxes, the “repression” tax rate is determined by factors such as financial regulations and inflation performance, which are opaque — if not invisible — to the highly politicized realm of fiscal policy.

At this point most people stop paying attention because their savings is rather modest, or their debt level is rather large. Thus negative real interest rates are a good thing in their eyes.

But to stop paying attention here is like only watching the first half of a movie and then walking out, thinking that you know the plot. Or to put it another way, only reading the “For every action” part of Newton’s law and skipping the “reaction” part.

…an equal and opposite reaction

Buyers of bonds aren’t going to take financial repression lying down. They are going to shift their money elsewhere.

One potential consequence of sustained financial repression is asset bubbles, as investors seek something better than negative returns on their money. “Without full-bore financial repression, would you have the equity markets at the levels they’re at in the U.S.? I doubt it,” says Mr. Mellyn…Because interest rates are kept artificially low, equities get reflated by investors seeking higher returns.

So financial repression makes stock markets go higher. That sounds good, right? But good for who?

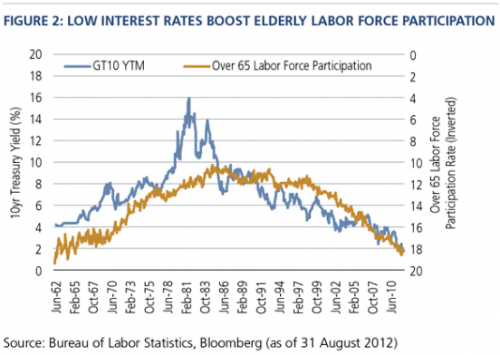

Pension funds and retirees don’t, or at least shouldn’t be, investing in risky and volatile stocks. Their traditional sources of income, bonds and savings, are getting returns of less than the inflation rate. Thus, Baby Boomers can’t retire. They have to stay in the workforce well into their golden years.

“Well, I’m not a Baby Boomer. So I don’t care because it doesn’t effect me.” But it does effect you. Baby Boomers not leaving the workforce means fewer jobs available for young people, in particular, good-paying jobs.

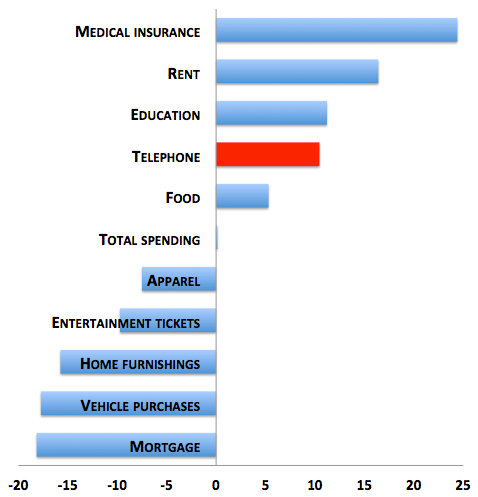

What’s more, the price deflation is most obvious in areas that benefit the wealthy, and price inflation is most obvious in areas that hurt the poor.

Wealth Inequality

Normally when people understand that financial repression punishes savers and rewards debtors, they think this is good for the poor and bad for the wealthy. Which just shows that people don’t understand how it works.

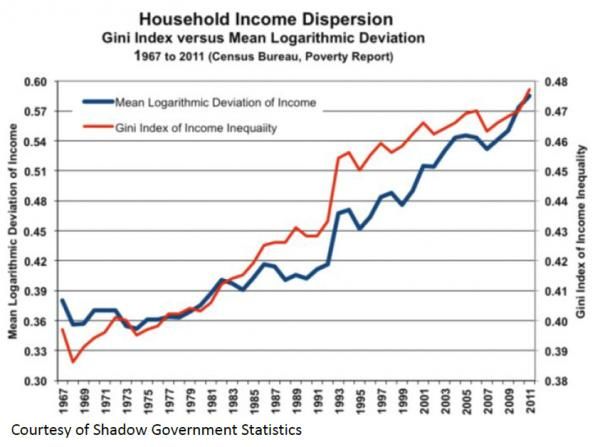

In 2010, the top 1 percent of U.S. families captured as much as 93 percent of the nation’s income growth, according to a March paper by Emmanuel Saez, a University of California at Berkeley economist who studied Internal Revenue Service data.

The earnings gap between rich and poor Americans was the widest in more than four decades in 2011, Census data show, surpassing income inequality previously reported in Uganda and Kazakhstan.

If financial repression was punishing the wealthy then this shouldn’t be happening.

One reason it is happening is because the wealthy own the overwhelming percentage of stocks and bonds, while the working class have their wealth tied up in housing.

For stockholders like Hemsley, the value of all outstanding shares has soared $6 trillion to $17 trillion since June 2009, the recession’s end. Even after a recent rebound, the value of owner-occupied housing, the chief asset of most middle- income families, has dropped $41 billion in the same period, part of a $5.8 trillion loss in home values since 2006.

About 11.7 percent of middle-income families owned stock in 2010, down from 14 percent in 2007, according to the Federal Reserve. Almost half of the wealthiest 10 percent of American families owned stock in 2007 and 2010, the Fed says.

Put simply, financial repression is a wealth transfer from the working class to the wealthy elite. In other words, it is the opposite of what many people think it is who walked out of the movie halfway through. It is a repression on hard-working, working-class savers. It is a taxation on people like you and me, and public subsidy for the wealthy.

What the left hand giveth, the right hand taketh away

So how big of an effect is financial repression having on the economy?

Consider what UBS’ George Magnus had to say on the issue:

“In the US household interest income from assets has dropped to below $1 trillion, compared to $1.4 trillion in 2008. That $400 billion drop is equivalent to a fall from 11.5% to below 7.5% as share of personal income, and, in passing, to the size of President Obama’s stimulus programme in 2009.”

What Obama givith, the Federal Reserve taketh away.

Let’s be clear on something: lowering interest rates on money creation cheapens money. It is inflationary. Quantitative easing is printing money, and is also inflationary.

Many might respond that “deflation is bad and must be avoided at all cost”. But consider what deflation is – lower prices. When you go shop and you find a lower price on something, is your reaction “this is bad”? Of course not.

If the price of food, tuition, and medical care was falling you would rejoice, not panic. Instead, food prices are on track to hit a new world record.

Therefore, the Federal Reserves policies are inflationary. However, the Fed can’t control where the newly created money goes, and that is the crucial issue here. Who is getting all this money?

Or to put it another way, what asset price has gone up since 2007, and what asset prices have fallen? Then ask yourself who owns those assets?

Consider the $1.1 Trillion of dollars of mortgage-backed securities the Fed has purchased through its quantitative easing policies. Some people are under the foolish idea that this is somehow supposed to benefit the “homeowners”. But like every other Fed action, its designed to benefit the bankers.

Let’s say you own a portfolio of mortgage-backed securities and your pals at the Fed are willing to buy the garbage at full price, no questions asked: are you going to sell your few AAA-rated MBS, the good stuff, or are you going to sell them the absolute dregs, the MBS so stuffed with defaulted mortgages that you’ve never dared to even do a mark-to-market estimate of their real worth?

You dump the worst of your portfolio, naturally, and so in effect the $1.1 trillion in MBS the Fed bought with newly created cash was probably worth (charitably) $600 billion at best.

There are $9.7 Trillion worth of mortgages in the country. If the Fed wanted to, it could have completely wiped out the housing bust at the benefit of homeowners (ignoring the obvious problem of not helping renters).

There is another added bankers benefit from this subsidy – to hide fraud.

The Fed is now where mortgages go to die. Thousands of mortgages on homes that do not exist or on homes that have more than one “first” mortgage are now going to the Fed to disappear. Thousands of multifamily and commercial mortgages will be bought up as well. As this happens, trillions of dollars that have been amassed offshore will be free to come back into the US to buy up and reposition land, farmland, residential and commercial real estate and other tangibles.

With documents shredded, criminal liabilities extinguished and financial institutions made whole, funds can return without fear of seizure.

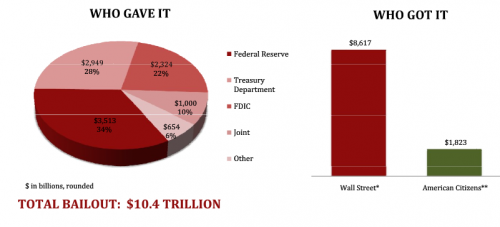

Imagine what else we could have done with $29 Trillion the Federal Reserve either loaned or backstopped for the banking elite.

for example Cost of Iraq War: $3 Trillion; Cost of Solar Plants to Power all 105 million U.S Households: $500 Billion (April 10, 2008)

Just 3% of the Fed money used to save the wealthy elite on Wall Street could have switched us over to a mostly solar-powered energy grid.

This isn’t to say that the our monetary policy is by its nature evil. What it means that trying to use monetary policy to paper over problems rather than undergoing real reforms that would upset the status quo is evil.

2 comments

Face it “they”, them, them own the media, corpo-fascisticallywise so in addition to financial policy being the path to post modern feudalism.

Smartphone apps own your data, your location, your pictures/contacts/conversations, and nobody cares.

I think deflation or inflation or stagflation it is not so important as the political situation. To be precise, economic variables whether controlled by the Federal Reserve or the Federal Government reflect political decisions whose goal is to keep the current power-elite in power indefinitely. The system works and it is robust. They are trying to balance things so that we do not face drastic changes.

The goal is to establish neo-feudalism and an hereditary aristocracy. If you ask rich people they often say the are “doing” what they are doing in order to provide for their children, i.e., insure that their children maintain their privileged status. The issue is not that they are “wrong” in wanting this but, rather, is reflects a culture that is radically split by religion, culture, income, race, ethnicity, sexual orientation that nothing will bring together because we lack common values other than making money. Everybody understand and respects making money so value is based on that. Because money is central to rich, poor and middle class there can be nothing called public morality. Only morality would indicate that it would be a good idea to redistribute income or, in this case, encourage savers and discourage speculators. In fact, pragmatically it is best to have a managed social democracy if you care about not only your own well-being but that of others. But, in this country, because there is such a high quota of hate towards the “other” people would rather harm themselves a little to insure that they harm those they hate (or just dislike) more.

I see no alternative to the present situation. We are moving towards neo-feudalism and there is absolutely no chance that that trend will change–the only other possibility is a rigidly enforced fascist police state–but I just don’t see that even the rich will want to finance such a venture and we are too disunited to be able to get all factions to agree to that or anything else despite bold attempts by the Feds to do just that.

To put it another way, economics as such is bunk, there is only political-economies.