(10 am. – promoted by ek hornbeck)

What is a criminal enterprise? According to the FBI, a criminal enterprise is:

a group of individuals with an identified hierarchy, or comparable structure, engaged in significant criminal activity. These organizations often engage in multiple criminal activities and have extensive supporting networks…

The FBI defines organized crime as any group having some manner of a formalized structure and whose primary objective is to obtain money through illegal activities.

So have the big banks engaged in multiple criminal activities whose primary objective is to obtain money through illegal activities?

Consider just the past month:

First, Barclay’s manipulated the LIBOR, the main interest rate index in the world, for the benefit of its traders.

Of course Barclay’s couldn’t do that alone. It requires at least 8 other major banks to form a majority of the index.

Second, JP Morgan Chase is having a really great month. Recent reports describe how it is resisting Federal subpoenas related to price-fixing in U.S. electricity markets. It is also accused (by former employees among others) of deliberately inflating the performance of its investment funds to obtain business. And finally, JP Morgan’s failed “London whale” trade, which has now cost over $5 billion, is being investigated to determine whether the loss was initially concealed from regulators and the public.

JP Morgan Chase has a long history of criminal dealings. Chase had a cosy relationship with the Nazis half a year after America had declared war on them. JP Morgan assisted the Nazis with seizing the wealth of the Jews during the Holocaust, as well as conspiring in a coup against FDR.

But that’s all ancient history. We are talking about RICO today.

Let’s get back to #3.

Third, HSBC is paying a fine because it allowed hundreds of millions, perhaps billions, of dollars of money laundering by rogue states and sanctioned firms, including some related to terrorist activities and Iran’s nuclear efforts. But HSBC is only one of at least 12 banks now known to have tolerated, and in some cases aggressively courted, money laundering by rogue states, terrorist organizations, corrupt dictators, and major drug cartels over the last decade. Others include Barclay’s, Lloyds, Credit Suisse, and Wachovia (now part of Wells Fargo). Several of the banks created special handbooks on how to evade surveillance, created special business units to handle money laundering, and actively suppressed whistleblowers who warned of drug cartel activities.

Seriously? Special handbooks? How can these people still be walking the streets? If someone in the mafia was so arrogant they would have been killed by their own people for utter stupidity. But when you work for a big bank you get a promotion instead.

And terrorists? Are you kidding me? We are black-bagging people for just considering terrorist activities. Meanwhile Wall Street is competing for terrorist business while law enforcement looks the other way.

And yet we still haven’t listed everything.

Fourth, a new private lawsuit cites documents indicating that Morgan Stanley successfully pressured rating agencies into inflating the ratings of mortgage-backed securities it issued during the housing bubble.

Fifth, Visa and Mastercard have just agreed to pay $7 billion to settle a private antitrust case filed by thousands of merchants, who alleged that Visa and Mastercard colluded to fix fees and terms of service.

Just another month on Wall Street.

In fact, this past month was not all that unusual. One of my new favorite web sites, Washingtons Blog, gives an amazing list of criminal activity Wall Street has been engaging in this past decade. From laundering money for terrorists and drug cartels, to rigging markets at the expense of local governments and pensions, to systemic mortgage fraud (both in origination and foreclosure), to insider trading, to various ponzi schemes, to accounting fraud. The list is too exhaustive for me to repost here.

Almost all of the fraud was conducted by bank executives.

But big banks still do legit business, important stuff for the economy, right?

In fact, most of bank revenue comes from financial speculation these days. Less than 10% of Bank of America’s assets are from traditional banking.

Just like a front company for the mob will engage in a little legal business just to keep up appearances. For Wall Street, fraud is a business model.

Where are the regulators?

The news coverage of the JP Morgan Congressional hearings focused almost exclusively on what Jamie Dimon had to say. They largely ignored Dimon’s criminal behavior, not to mention the people who were specifically uninvited (like former regulator Bill Black).

But the most criminal part of the news coverage was that they mostly failed to report what the financial regulators had to say.

At a hearing before the Senate Banking Committee Tuesday morning, Securities and Exchange Commission Chairman Mary Schapiro and Commodity Futures Trading Commission Chairman Gary Gensler told lawmakers that the demands on their agencies to expand oversight are growing, but that their pocketbooks are not.

In fact, Sheila Blair, the chair of the FDIC, has come out and said that the big banks are too big to regulate and need to be broken up.

I find it curious that there is widespread criminal activity afoot, and yet the news media isn’t very interested in what the regulators have to say.

Reinstituting Glass-Steagall and rolling back the Riegle-Neal Act would effectively break up the largest banks, without the need for more regulators.

What the Dodd-Frank bill did was give regulators more oversight powers (as opposed to simple laws that don’t need much enforcing) without giving them the money and infrastructure to enforce those regulations. Thus it is effectively worthless.

To put this into perspective, the Financial Crisis Inquiry Commission, which Congress created to examine the full scope of the crisis and its causes, was given $9.8 million. Not the sort of cash you would expect to really get the bottom of things. The Senate panel did its investigation with only about a dozen staff members.

Of course, it was only two years ago that we learned the SEC investigators were surfing porn while the financial world melted down. Instead of doing their job, they were distracted by the pornography they could easily watch online. They were probably watching cam models on live cams from a site like www.thecamsites.com and now the rest of us have to suffer.

Where are the cops?

LAST week, Attorney General Eric H. Holder Jr. proclaimed in a speech that when it comes to fighting financial fraud, the Obama administration’s “record of success has been nothing less than historic.”

If pretending that financial fraud isn’t happening is the same as fighting it, then Holder is right.

For that exhaustive list of crimes listed above, what is the total number of criminal prosecutions of major firms and senior executives?

Zero.

As is nada. Nothing. After four years.

So how can Holder say that with a straight face? Well consider who Holder is and who the Obama Administration has put in charge of jailing these thieves.

The attorney general (Eric Holder) and the head of the Justice Department’s criminal division (Lanny Breuer) both come to us from Covington & Burling, a law firm that represents and lobbies for most of the major banks and their industry associations; indeed Breuer was co-head of its white collar criminal defense practice, and represented the Moody’s rating agency in the Enron case. Mary Schapiro, the head of the SEC, spent the housing bubble in charge of FINRA, the investment banking industry’s “self-regulator,” which gave her a $9 million severance for a job well done. And her head of enforcement, perhaps most stunningly of all, is Robert Khuzami, who was general counsel for Deutsche Bank’s North American business during the entire bubble. So zero prosecutions isn’t much of a surprise, really.

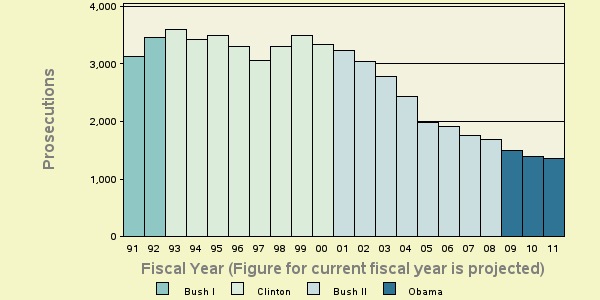

It turns out that criminal prosecutions for financial fraud have been dropping consistently since 1999.

Four years after the greatest financial meltdown the country has seen since 1929, with obvious evidence of widespread Wall Street fraud, criminal prosecutions under Obama are fewer in number than under Reagan or either Bush. In fact, the postal service prosecutes three times as many financial criminals than the IRS.

Paying for our own destruction

77% of JP Morgan Chase’s net income came from government subsidies over the past year.

Yes, you read that right. $14 Billion a year from the taxpayer.

And total taxpayer subsidies to the top 18 banks: $76 Billion a year.

Amazing isn’t it. The taxpayer is subsidizing criminal enterprises that are robbing us blind.

Nothing pays better than crime these days.

We have reached a critical point. A government and judicial system can only ignore law-breaking by a segment of society before it totally looses credibility. A government without credibility is an unstable (and often paranoid) government.

What’s more, a financial sector that is operating outside of the law destroys confidence in the markets, which damages economic activity in the short and long-term.

These points have arrived. We are on the shaky edge of the public losing confidence in the government and business losing confidence in the financial system.

We can’t afford to go another four years in this direction.

6 comments

Skip to comment form

Author

If the government won’t prosecute, I’m all for mob justice.

with prosecuting anyone involved in fraud, money laundering, rate fixing, etc: Barrack Obama, Eric Holder and Tim Geithner.

“The TRAC report, which compiles Justice Department data obtained through the Freedom of Information Act, notes that 2011’s relatively low number of financial fraud prosecutions is only the continuation of a trend spanning more than a decade.

Every year since 1999, the number of such prosecutions has gotten smaller and smaller, the report states. This means, for example, that there were more prosecutions in any given year during the presidency of George W. Bush than in any year during the presidency of Barack Obama.”

Number of prosecutions brought by financial regulators in the last decade? 0