(Or who came first, the Human or the Egg.)

I haven`t been around for a while due to personal travails, but things are looking up.

On that note I`m posting these images as I used to in my Random Friday diaries.

Dec 09 2011

(Or who came first, the Human or the Egg.)

I haven`t been around for a while due to personal travails, but things are looking up.

On that note I`m posting these images as I used to in my Random Friday diaries.

Dec 09 2011

Crossposted from The Stars Hollow Gazette

The thoroughly discredited Chicago (Freshwater) School of Economics denies that these even exist.

It’s not just a river in Egypt, it’s also faith based not science in contradiction of actual factual evidence-

A deflationary spiral is a situation where decreases in price lead to lower production, which in turn leads to lower wages and demand, which leads to further decreases in price. Since reductions in general price level are called deflation, a deflationary spiral is when reductions in price lead to a vicious circle, where a problem exacerbates its own cause. The Great Depression was regarded by some as a deflationary spiral. A deflationary spiral is the modern macroeconomic version of the general glut controversy of the 19th century. Another related idea is Irving Fisher’s theory that excess debt can cause a continuing deflation. Whether deflationary spirals can actually occur is controversial, with its possibility being disputed by freshwater economists (including the Chicago school of economics) and Austrian School economists.

Systemic reasons for deflation in Japan can be said to include:

- Tight monetary conditions. The Bank of Japan kept monetary policy loose only when inflation was below zero, tightening whenever deflation ends.

…

- Fallen asset prices. In the case of Japan asset price deflation was a mean reversion or correction back to the price level that prevailed before the asset bubble. There was a rather large price bubble in equities and especially real estate in Japan in the 1980s (peaking in late 1989).

- Insolvent companies: Banks lent to companies and individuals that invested in real estate. When real estate values dropped, these loans could not be paid. The banks could try to collect on the collateral (land), but this wouldn’t pay off the loan. Banks delayed that decision, hoping asset prices would improve. These delays were allowed by national banking regulators. Some banks made even more loans to these companies that are used to service the debt they already had. This continuing process is known as maintaining an “unrealized loss”, and until the assets are completely revalued and/or sold off (and the loss realized), it will continue to be a deflationary force in the economy. Improving bankruptcy law, land transfer law, and tax law have been suggested (by The Economist) as methods to speed this process and thus end the deflation.

- Insolvent banks: Banks with a larger percentage of their loans which are “non-performing”, that is to say, they are not receiving payments on them, but have not yet written them off, cannot lend more money; they must increase their cash reserves to cover the bad loans.

- Fear of insolvent banks: Japanese people are afraid that banks will collapse so they prefer to buy (United States or Japanese) Treasury bonds instead of saving their money in a bank account. This likewise means the money is not available for lending and therefore economic growth. This means that the savings rate depresses consumption, but does not appear in the economy in an efficient form to spur new investment. People also save by owning real estate, further slowing growth, since it inflates land prices.

Sound familiar? It should.

Anxious Greeks Emptying Their Bank Accounts

Many Greeks are draining their savings accounts because they are out of work, face rising taxes or are afraid the country will be forced to leave the euro zone. By withdrawing money, they are forcing banks to scale back their lending — and are inadvertently making the recession even worse.

By Ferry Batzoglou in Athens, Der Spiegel

12/06/2011

(T)he outflow of funds from Greek bank accounts has been accelerating rapidly. At the start of 2010, savings and time deposits held by private households in Greece totalled €237.7 billion — by the end of 2011, they had fallen by €49 billion. Since then, the decline has been gaining momentum. Savings fell by a further €5.4 billion in September and by an estimated €8.5 billion in October — the biggest monthly outflow of funds since the start of the debt crisis in late 2009.

…

The hemorrhaging of bank savings has had a disastrous impact on the economy. Many companies have had to tap into their reserves during the recession because banks have become more reluctant to lend. More Greek families are now living off their savings because they have lost their jobs or have had their salaries or pensions cut.In August, unemployment reached 18.4 percent. Many Greeks now hoard their savings in their homes because they are worried the banking system may collapse.

Those who can are trying to shift their funds abroad. The Greek central bank estimates that around a fifth of the deposits withdrawn have been moved out of the country. “There is a lot of uncertainty,” says Panagiotis Nikoloudis, president of the National Agency for Combating Money Laundering.

…

Nikoloudis has detected a further trend. At first, it was just a few people trying to withdraw large sums of money. Now it’s large numbers of people moving small sums. Ypatia K., a 55-year-old bank worker from Athens, can confirm that. “The customers, especially small savers, have recently been withdrawing sums of €3,000, €4,000 or €5,000. That was panic,” she said.

…

The shrinking Greek bank deposits compare with bank loans totalling €253 million. Analysts say the share of bad loans could rise to 20 percent next year, or €50 billion, as a result of the recession. This in turn will worsen the already pressing liquidity problems faced by Greek banks.

Did I mention thoroughly discredited?

Germany next.

Dec 09 2011

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

December 9 is the 343rd day of the year (344th in leap years) in the Gregorian calendar. There are 22 days remaining until the end of the year.

On this day in 1861, The Joint Committee on the Conduct of the War is established by the U.S. Congress.

The Joint Committee on the Conduct of the War was a United States Congressional investigating committee created to handle issues surrounding the American Civil War. It was established on December 9, 1861, following the embarrassing Union defeat at the Battle of Ball’s Bluff, at the instigation of Senator Zachariah T. Chandler of Michigan, and continued until May 1865. Its purpose was to investigate such matters as illicit trade with the Confederate states, medical treatment of wounded soldiers, military contracts, and the causes of Union battle losses. The Committee was also involved in supporting the war effort through various means, including endorsing emancipation, the use of black soldiers, and the appointment of generals who were known to be aggressive fighters. It was chaired throughout by Senator Benjamin Wade of Ohio, and became identified with the Radical Republicans who wanted more aggressive war policies than those of Abraham Lincoln.

Union officers often found themselves in an uncomfortable position before the Committee. Since this was a civil war, pitting neighbor against neighbor (and sometimes brother against brother), the loyalty of a soldier to the Union was simple to question. And since Union forces had very poor luck against their Confederate counterparts early in the war, particularly in the Eastern Theater battles that held the attention of the newspapers and Washington politicians, it was easy to accuse an officer of being a traitor after he lost a battle or was slow to engage or pursue the enemy. This politically charged atmosphere was very difficult and distracting for career military officers. Officers who were not known Republicans felt the most pressure before the Committee.

During the committee’s existence, it held 272 meetings and received testimony in Washington and at other locations, often from military officers. Though the committee met and held hearings in secrecy, the testimony and related exhibits were published at irregular intervals in the numerous committee reports of its investigations. The records include the original manuscripts of certain postwar reports that the committee received from general officers. There are also transcripts of testimony and accounting records regarding the military administration of Alexandria, Virginia.

One of the most colorful series of committee hearings followed the Battle of Gettysburg in 1863, where Union Maj. Gen. Daniel Sickles, a former congressman, accused Maj. Gen. George G. Meade of mismanaging the battle, planning to retreat from Gettysburg prior to his victory there, and failing to pursue and defeat Robert E. Lee‘s army as it retreated. This was mostly a self-serving effort on Sickles’s part because he was trying to deflect criticism from his own disastrous role in the battle. Bill Hyde notes that the committee’s report on Gettysburg was edited by Wade in ways that were unfavorable to Meade, even when that required distorting the evidence. The report was “a powerful propaganda weapon” (p. 381), but the committee’s power had waned by the time the final testimony was taken of William T. Sherman on May 22, 1865.

The war it was investigating completed, the committee ceased to exist after this last testimony, and the final reports were published shortly thereafter. The later Joint Committee on Reconstruction represented a similar attempt to check executive power by the Radical Republicans.

Dec 09 2011

Dec 09 2011

Did you know Obama’s health care bill contained a $20 billion a year tax on the richest Americans? I didn’t until I stumbled onto a mention of this the other day, although writing about politics is my life and I knew enough to be angry at the gutting of a national public option. I asked a dozen other friends, half of whom work in health care or health care policy and most of whom are fellow political junkies. None of them knew either. If those who follow these issues intensely don’t know about something that all of us would cheer as a step toward getting the wealthiest to pay their fair share, most American voters sure aren’t going to know either.

Dec 09 2011

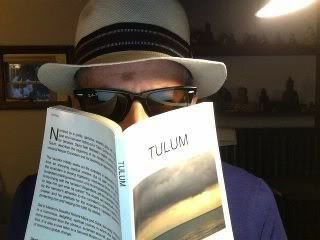

Your Bloguero And The Book

You probably didn’t know that your faithful Bloguero was interested in commerce. Actually, to tell the truth, he really isn’t. But he can’t lie. Even though he has neither real skill for commerce nor any interest in it, even though in general he could care less about it, he finds himself now personally involved in it. Namely, selling his book, Tulum. Your Bloguero can hear his faithful but somewhat intellectually snobbish readers (and his many wise-ass critics) saying, “Selling? Ewwww. How could you?” Your Bloguero agrees that selling is often crass, sometimes beyond distasteful, and frequently involves prevarication if not outright fraud. But this, your Bloguero assures himself and you, is a different matter. This is something else entirely.

After all, your Bloguero is not going door to soon-to-be-slammed door trying to sell encyclopedias or Bibles. He’s selling fiction. Magical realist fiction. He’s selling a book he wrote. What, you might ask, is so hard about selling fiction? Isn’t most political speech in the US just selling fiction? Isn’t most advertising just selling fiction? My goodness, your Bloguero hears you saying, in this season, the season of vast capitalistic excess and unnecessary expenditures, isn’t the main activity selling fiction of various sorts? All right. You’ve got a point there, but your Bloguero will not be diverted by it. Your Bloguero is selling only his new novel, Tulum. And he’s not at all that committed to doing that in the tradition, shameless, well worn way.

There are obvious problems with your Bloguero’s selling this book. Your Bloguero thinks of himself as a writer (he hopes that is not offensive to you for him to say it). And he thinks he is a terrible salesman. He doesn’t like selling. At all. He has little or no positive experience with it. And to make matters worse, your Bloguero’s psyche screams vociferous objections to tooting his own schnozz. In other words, your Bloguero doesn’t want to pimp his book. Or himself. Or his “abilities.” That seems unseemly. And as if that weren’t enough, there’s your Bloguero’s fabled and oft practiced sloth and indolence. These subvert selling and all other commercial activities. Put it this way to keep it simple: Your Bloguero thinks that if his book is any good at all, it should simply sell itself while your Bloguero returns to daydreaming and making up his third book. Your Bloguero shouldn’t have to occupy himself with the physical activity and mental exertions involved in selling his creation. Look. Your Bloguero writes magical realism. So if this book is going to sell, it’s logical, isn’t it, that it should only be sold magically.

Do you hear your Bloguero whining? Making excuses? Walking back the expectations? Your Bloguero is more worried that he sounds a lot like Ignatius Reilly. But no matter. Your Bloguero would like to sell many thousands of copies of his book through the magical reality of the Internet and through the magic of word of mouth. That is the sum and substance of your Bloguero’s sales business planning. Magic. When one writes magical realism, one doesn’t complete the book and then suddenly act like one just spent 5 years writing financial non-fiction. No. There has to be some consistency between what’s in the book and how it exists in the world, doesn’t there? So if the book is magical realism and fiction, it has to be sold magically. There. Your Bloguero said it. Your Bloguero doesn’t want to hear anyone criticize or analyze his motivations in making this assertion.

Anyway, that’s where you come in. This is really simple, and a solution beautifully fitting your Bloguero’s laziness and magical thinking. It is not a linear solution. It is not logical. But, alas, it’s your Bloguero’s magical solution. And his magical solution is his only one.

Here it is: your Bloguero wants you to buy a copy of the book (or more if you feel called to do so), read it, and write a short review at Barnes and Noble, or Amazon, or iUniverse, or on the Blogs or Facebook or wherever, and, whether you liked it or not, though the thought of the latter possibility disturbs your Bloguero’s feelings, tell your friends and family about it. And soon it will be, as Arlo once sang, a movement. And then, after a very short while,Tulum will magically be ubiquitous. Think of this: Your Bloguero will be lying on the floor with his faithful dog and staring at the ceiling and dreaming up something new, and as he does this, the book, this very book, will be selling effortlessly. Magically. Thousands and thousands of magical sales. An avalanche of books. And you dear reader will have made this possible.

One last thought. Your Bloguero would also like you to realize that no Christmas or Channukah or Solstice stocking is complete without a copy of this book in it. Yes, yes, your Bloguero knows that there are no Channukah stockings. Not yet. But he thinks there should be.

This Week In The Dream Antilles is usually a weekly digest. Usually, it appears on Friday. Sometimes, like now and for several of the past weeks, it isn’t actually a digest of essays posted at The Dream Antilles. And it’s not yet Friday. For the essays you have to visit The Dream Antilles.