(10 am. – promoted by ek hornbeck)

Charles Blow of the New York Times has noticed that great sucking sound of our decadent empire in decline, and says, “It’s time for us to stop lying to ourselves about this country,” because among industrialized countries “we are among the worst of the worst.”

Zoinks, Scoob! It used to be that Americans didn’t want to know the truth, and the media had the courtesy not to tell us.

As for the cause of this decline to this “worst of the worst” status, Blow references “an increasingly cut-throat global economy” and shows an IMF chart indicating that the US has one of the highest Gini indices (i.e., measures of inequality) amongst industrial nations, just behind Hong Kong and Singapore.

I give Blow credit for his candor, as far as it goes, but let’s go ahead an nail that thesis to the door of the Church: Everything is going to shit because capitalism is an inherently psychopathic and monomaniacal drive for profits, all else be damned, and the plutocrats are taking increasingly large everything! for themselves.

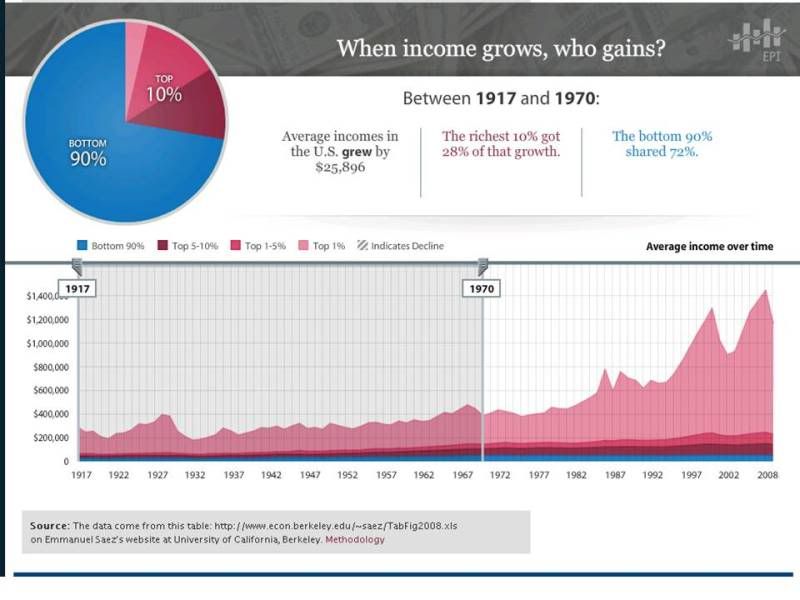

State of Working America has some interactive graphs showing average incomes of the top 10% (in red hues) and bottom 90% (in blue) of wage earners between 1917 and 2008. Moving the vertical bars in their graphs allows the user to select and summarize intervals of interest. Data were compiled by economist Emmanuel Saez at UC Berkeley.

From 1917 to 1970 the bottom 90% of wage earners took home 72% of income growth, whereas the top 10% earners took home 28%. The top 1% (light pink) took the smallest proportion of growth, whereas the next two largest income earners (rose and maroon)took the largest shares of the 28% cut.

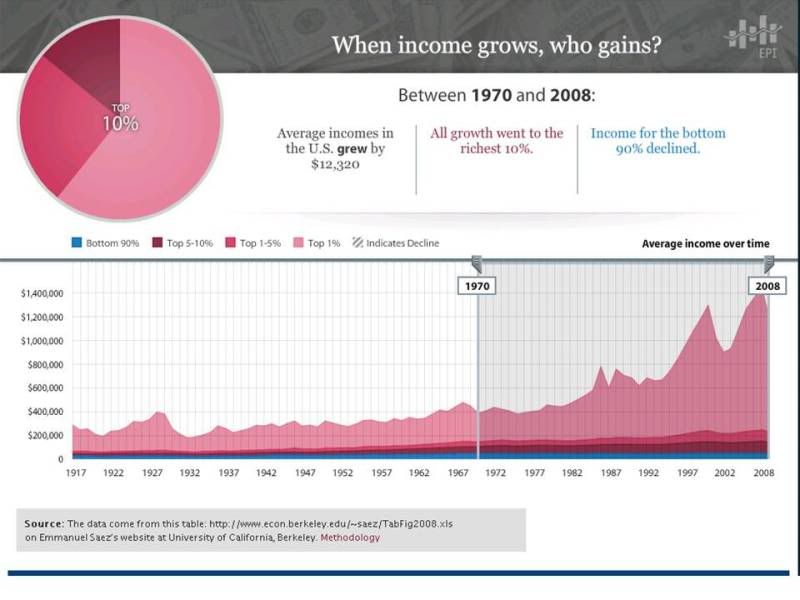

Over the past forty years or so, income inequality has ballooned. Specifically, from 1970 to 2008, the top 10% wage earners took home all the growth in incomes. The top 1% took the majority of that growth. The bottom 90% got nothing. For the past 40 years, the vast majority and poorest Americans have gotten nothing. Bupkis. Goose eggs. Zilch. All the money has gone to the very top, the worst of the worst, for forty fucking years.

This trend of the uber-wealthy getting uber-wealthier while the rest of us “suck on it” is only accelerating. From 2000 to 2007 the top 1% took 75% of all income growth.

During this same time, health care costs have ballooned, and remain the leading cause of bankruptcy.

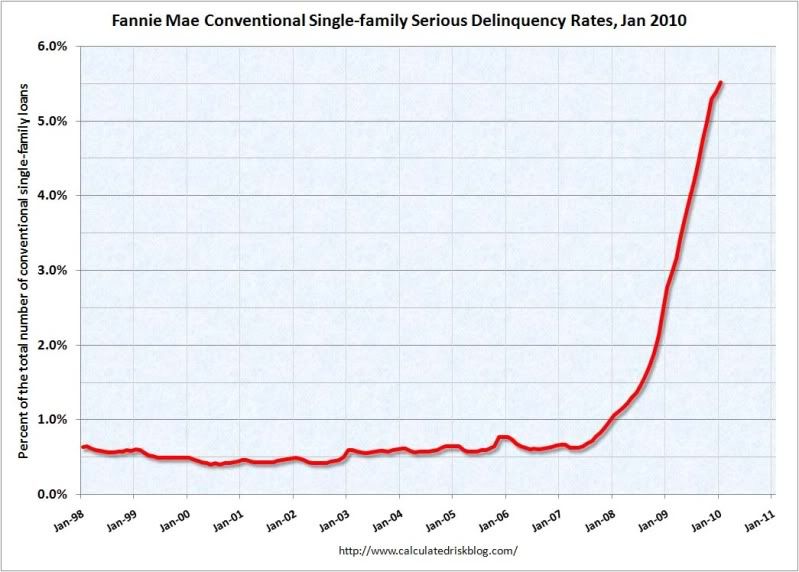

The only thing Americans seemed to have going for them was the ballooning prices on their houses, but that bursting bubble has turned into a 10 trillion dollar loss. So far. We haven’t come close to returning to the mean home value for the past 100 years, so we have further significant and painful drops to look forward to.

If you include the trillions of dollars of publicly owned toxic assets dumped by the banks at Freddie and Fannie, the losses get even bigger. The delinquency rates are exploding:

Throw in the trillions of dollars to cover the banks’ gambling losses, quantitative easings, zero percent interest rates, years of high un- and under-employment, at 10% and 20%, respectively, and now we’re really talking about a lot of money. Oh, and let’s not forget the losses on pensions. How is it even possible that we got put on the hook for their losses?

Our exploding national debt stands at around 14 trillion bucks:

The first part of the explosion occurred under Reagan’s ridiculous military spending and tax cuts for the rich. After Clinton slowed the rate of increase, it went exponential again under Bush’s multiple war crimes and more tax cuts for the rich. What the fuck is Obama thinking about in extending these war crimes and tax cuts?

On top of this all, no one has ever been held accountable for war crimes and financial fraud. The Feds just let Angelo Mozilo walk on criminal charges. And the mortgage fraud is so huge it really does involve everybody.

Columbia University law professor John Coffee said mortgage cases like Mozilo’s were muddied by the numerous parties involved, unlike Enron and other “cook the books” cases in which executives were convicted.

Countrywide’s model was to make or buy mortgages only to sell them off immediately to Fannie Mae or Wall Street as fodder for securities.

Given that model, Coffee said, blame could be assigned to an entire chain of players: mortgage brokers who falsified applications; investment bankers who concocted complex and “opaque” mortgage bonds; rating firms that provided high ratings on the bonds but said they were lied to; and institutional investors that relied on dubious ratings because the securities carried above-market interest while promising to be risk-free.

“All share responsibility, but none are culpable enough by themselves to compare with [Enron’s] Ken Lay, Jeff Skilling or the WorldCom CEO,” Coffee said.

See Ritholtz explain how “if everybody is guilty then nobody is.” The moral of the story, he concludes: Do not commit massive fraud by yourself (i.e., Skilling, Lay, Ebbers, Madoff). Commit exponentially larger fraud with the help of co-conspirators.

Meanwhile, the Feds are letting the statute of limitations expire on the whole ball of securities fraud wax.

And now these fucking plutocrats want austerity measures for the have-nots? They’ve stripped us of jobs, health, money, benefits, retirement, decent food to eat, put us on the hook for trillions and trillions in their financial losses, and now they’re looking for more? Without any thought of reforming their own criminal activity?

Bookmark Update: Dave Cohen today on Inequality, debt, and financial crises, based on an IMF paper (pdf warning), Inequality, leverage, and crises.

2 comments

Author

of the crimes of the elite? I know, it’s a big, ever-evolving undertaking.

Back….