You’re fucked by the shadow ruling elite.

Here’s one of many dogs that did not bark in Obama’s speech on financial reform:

You see, there has always been a tension between the desire to allow markets to function without interference and the absolute necessity of rules to prevent markets from falling out of kilter…blah, blah, blah….

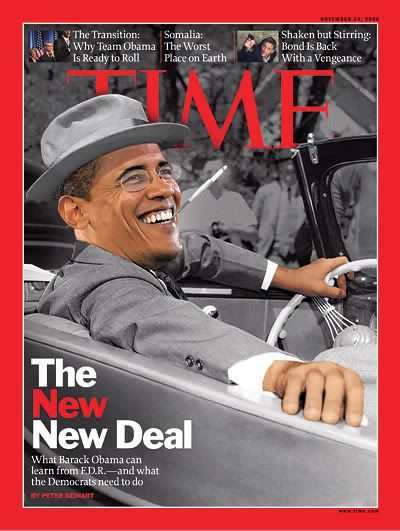

….And I read a report recently that I think fairly illustrates this point. It’s from Time Magazine. I’m going to quote:

“Through the great banking houses of Manhattan last week ran wild-eyed alarm. Big bankers stared at one another in anger and astonishment. A bill just passed… would rivet upon their institutions what they considered a monstrous system… such a system, they felt, would not only rob them of their pride of profession but would reduce all U.S. banking to its lowest level.”

That appeared in Time Magazine in June of 1933. (Laughter and applause.) The system that caused so much consternation, so much concern was the Federal Deposit Insurance Corporation, also known as the FDIC, an institution that has successfully secured the deposits of generations of Americans.

Amid the laughter and applause, did you hear the silent dog?

In referring to the Banking Act of 1933, aka Glass-Steagall, Obama mentions the FDIC, but not the provision keeping bank holding companies from owning other financial institutions, aka gambling houses.

Obama also forgot to mention the lawsuit against Goldman alleging that they were betting on the housing collapse that has brought the country to its knees. He forgot to mention Lehman’s liar’s loans. Nor did he mention rampant market rigging, aka high frequency trading.

Obama forgot to say that Goldman execs are insured against lawsuits (legal defense, damages, and fines) through AIG, in which taxpayers hold a 79% stake. And you thought you wanted to put Lloyd Blankfein in jail, but instead you are bailing him out. Again. And again. And again.

I mean seriously? Wall Street knowingly sells garbage loans and makes a killing. Then Wall Street bets against those very loans and wins again. You lose your jobs, houses, pensions, police and fire departments, sewage and water systems, teachers, property values, then bail-out Wall Street in 24 trillion different ways, and they get billion-dollar bonuses and record profits. Then, when they get sued for fraud, you pay for their defense, damages, and fines.

Ever see those little tubular Amazonian flesh-boring fish that can drill into and completely hollow out a carcass in seconds from the inside-out?

Obama also forgot to mention that Wall Street bought his presidency. He won’t be returning those tainted donations (stolen from you) any time soon.

Barack Obama welcomes your hatred.

9 comments

Skip to comment form

Author

….. linky here: http://www.reuters.com/article…

Stick it in diary ?, he’s given several when da google is used to search “obama speech financial reform”

Okay, going thru the speech all I see in concrete is he wants to do this Volcker rule http://en.wikipedia.org/wiki/V… ** and have more “transparency” and isn’t really saying how he’d shut down the bad actors nor get the too big to fail banks to spread the wealth out to many smaller ones. Did I miss anything ?

** restricts banks from certain speculative investments

WAPO, January, http://www.washingtonpost.com/…

Sounds sort of subversive, the customer being able to get their money if they need it.

As this term progresses, I can see why Timmeh and Petahhr are getting nervous.

….more like an old bad joke.

To tell the truth, I take very little of what Obama says seriously anymore.

He can give a speech, like the Cooper’s Union one, and basically there will be maybe two or three sentences in the 30 minute schtick that relate to any actual change, as minor or barely significant as that change may be.

I’m glad DD is here, if I posted this pic at the other place I’d likely be HR’d out the wazoo.

It’s the Illuminati Plan to Destroy America fest!

Git ur New World Order secret government agenda plans. Mix n mingle with survivalist gurus, spiritual guides and financial experts to discuss how best to take your cash off the electronic surveillance grid.

Seminars

Resisting the Technologies of Satan

Escape from Marxachusetts

Preparing for the Bernie Madoff Global Carbon Tax

Herbal remedies for the next bio plague

60 Soundbytes- The mind control analysis of the daily news