The The Patient Protection and Affordable Care Act as Passed is a transparent little document comprising a mere 2409 pages in pdf format, and Senate Democrats have made it conveniently available online.

One of the flagship provisions of this historic bill (“historic” meaning that this bill has already been discussed as much as the Magna Carta) will make it impossible for anyone to be denied health insurance on the basis of pre-existing conditions.

Health insurance for all of us, even if we’re actually sick! That’s the name of the game, but it isn’t exactly the name of the bill, and although coverage for individuals with pre-existing conditions has remained at the top of Democratic talking-points for 14 long months, I was surprised to see that the word “pre-existing” only appears 5 times in 2409 pages of legislative language, mostly in Sec. 1101 of Subtitle B, and…

Here it is! That awfully famous “section” in all it’s glory, along with a few typographical peculiarities which arise from pasting pdf into html.

Subtitle B-Immediate Actions to

2 Preserve and Expand Coverage

3 SEC. 1101. IMMEDIATE ACCESS TO INSURANCE FOR UNIN4

SURED INDIVIDUALS WITH A PREEXISTING

5 CONDITION.

6 (a) IN GENERAL.-Not later than 90 days after the

7 date of enactment of this Act, the Secretary shall establish

8 a temporary high risk health insurance pool program to

9 provide health insurance coverage for eligible individuals

10 during the period beginning on the date on which such pro11

gram is established and ending on January 1, 2014.

12 (b) ADMINISTRATION.-

13 (1) IN GENERAL.-The Secretary may carry out

14 the program under this section directly or through

15 contracts to eligible entities.

16 (2) ELIGIBLE ENTITIES.-To be eligible for a

17 contract under paragraph (1), an entity shall-

18 (A) be a State or nonprofit private entity;

19 (B) submit to the Secretary an application

20 at such time, in such manner, and containing

21 such information as the Secretary may require;

22 and

23 (C) agree to utilize contract funding to es24

tablish and administer a qualified high risk pool

25 for eligible individuals.

46

HR 3590 EAS/PP

1 (3) MAINTENANCE OF EFFORT.-To be eligible to

2 enter into a contract with the Secretary under this

3 subsection, a State shall agree not to reduce the an4

nual amount the State expended for the operation of

5 one or more State high risk pools during the year pre6

ceding the year in which such contract is entered into.

7 (c) QUALIFIED HIGH RISK POOL.-

8 (1) IN GENERAL.-Amounts made available

9 under this section shall be used to establish a quali10

fied high risk pool that meets the requirements of

11 paragraph (2).

12 (2) REQUIREMENTS.-A qualified high risk pool

13 meets the requirements of this paragraph if such

14 pool-

15 (A) provides to all eligible individuals

16 health insurance coverage that does not impose

17 any preexisting condition exclusion with respect

18 to such coverage;

19 (B) provides health insurance coverage-

20 (i) in which the issuer’s share of the

21 total allowed costs of benefits provided

22 under such coverage is not less than 65 per23

cent of such costs; and

24 (ii) that has an out of pocket limit not

25 greater than the applicable amount de47

HR 3590 EAS/PP

1 scribed in section 223(c)(2) of the Internal

2 Revenue Code of 1986 for the year involved,

3 except that the Secretary may modify such

4 limit if necessary to ensure the pool meets

5 the actuarial value limit under clause (i);

6 (C) ensures that with respect to the pre7

mium rate charged for health insurance coverage

8 offered to eligible individuals through the high

9 risk pool, such rate shall-

10 (i) except as provided in clause (ii),

11 vary only as provided for under section

12 2701 of the Public Health Service Act (as

13 amended by this Act and notwithstanding

14 the date on which such amendments take ef15

fect);

16 (ii) vary on the basis of age by a factor

17 of not greater than 4 to 1; and

18 (iii) be established at a standard rate

19 for a standard population; and

20 (D) meets any other requirements deter21

mined appropriate by the Secretary.

22 (d) ELIGIBLE INDIVIDUAL.-An individual shall be

23 deemed to be an eligible individual for purposes of this sec24

tion if such individual-

48

HR 3590 EAS/PP

1 (1) is a citizen or national of the United States

2 or is lawfully present in the United States (as deter3

mined in accordance with section 1411);

4 (2) has not been covered under creditable cov5

erage (as defined in section 2701(c)(1) of the Public

6 Health Service Act as in effect on the date of enact7

ment of this Act) during the 6-month period prior to

8 the date on which such individual is applying for

9 coverage through the high risk pool; and

10 (3) has a pre-existing condition, as determined

11 in a manner consistent with guidance issued by the

12 Secretary.

13 (e) PROTECTION AGAINST DUMPING RISK BY INSUR14

ERS.-

15 (1) IN GENERAL.-The Secretary shall establish

16 criteria for determining whether health insurance

17 issuers and employment-based health plans have dis18

couraged an individual from remaining enrolled in

19 prior coverage based on that individual’s health sta20

tus.

21 (2) SANCTIONS.-An issuer or employment-based

22 health plan shall be responsible for reimbursing the

23 program under this section for the medical expenses

24 incurred by the program for an individual who, based

25 on criteria established by the Secretary, the Secretary

49

HR 3590 EAS/PP

1 finds was encouraged by the issuer to disenroll from

2 health benefits coverage prior to enrolling in coverage

3 through the program. The criteria shall include at

4 least the following circumstances:

5 (A) In the case of prior coverage obtained

6 through an employer, the provision by the em7

ployer, group health plan, or the issuer of money

8 or other financial consideration for disenrolling

9 from the coverage.

10 (B) In the case of prior coverage obtained

11 directly from an issuer or under an employment12

based health plan-

13 (i) the provision by the issuer or plan

14 of money or other financial consideration

15 for disenrolling from the coverage; or

16 (ii) in the case of an individual whose

17 premium for the prior coverage exceeded the

18 premium required by the program (adjusted

19 based on the age factors applied to the prior

20 coverage)-

21 (I) the prior coverage is a policy

22 that is no longer being actively mar23

keted (as defined by the Secretary) by

24 the issuer; or

50

HR 3590 EAS/PP

1 (II) the prior coverage is a policy

2 for which duration of coverage form

3 issue or health status are factors that

4 can be considered in determining pre5

miums at renewal.

6 (3) CONSTRUCTION.-Nothing in this subsection

7 shall be construed as constituting exclusive remedies

8 for violations of criteria established under paragraph

9 (1) or as preventing States from applying or enforc10

ing such paragraph or other provisions under law

11 with respect to health insurance issuers.

12 (f) OVERSIGHT.-The Secretary shall establish-

13 (1) an appeals process to enable individuals to

14 appeal a determination under this section; and

15 (2) procedures to protect against waste, fraud,

16 and abuse.

17 (g) FUNDING; TERMINATION OF AUTHORITY.-

18 (1) IN GENERAL.-There is appropriated to the

19 Secretary, out of any moneys in the Treasury not oth20

erwise appropriated, $5,000,000,000 to pay claims

21 against (and the administrative costs of) the high risk

22 pool under this section that are in excess of the

23 amount of premiums collected from eligible individ24

uals enrolled in the high risk pool. Such funds shall

25 be available without fiscal year limitation.

51

HR 3590 EAS/PP

1 (2) INSUFFICIENT FUNDS.-If the Secretary esti2

mates for any fiscal year that the aggregate amounts

3 available for the payment of the expenses of the high

4 risk pool will be less than the actual amount of such

5 expenses, the Secretary shall make such adjustments

6 as are necessary to eliminate such deficit.

7 (3) TERMINATION OF AUTHORITY.-

8 (A) IN GENERAL.-Except as provided in

9 subparagraph (B), coverage of eligible individ10

uals under a high risk pool in a State shall ter11

minate on January 1, 2014.

12 (B) TRANSITION TO EXCHANGE.-The Sec13

retary shall develop procedures to provide for the

14 transition of eligible individuals enrolled in

15 health insurance coverage offered through a high

16 risk pool established under this section into

17 qualified health plans offered through an Ex18

change. Such procedures shall ensure that there

19 is no lapse in coverage with respect to the indi20

vidual and may extend coverage after the termi21

nation of the risk pool involved, if the Secretary

22 determines necessary to avoid such a lapse.

23 (4) LIMITATIONS.-The Secretary has the au24

thority to stop taking applications for participation

52

HR 3590 EAS/PP

1 in the program under this section to comply with the

2 funding limitation provided for in paragraph (1).

3 (5) RELATION TO STATE LAWS.-The standards

4 established under this section shall supersede any

5 State law or regulation (other than State licensing

6 laws or State laws relating to plan solvency) with re7

spect to qualified high risk pools which are established

8 in accordance with this section.

And then we’re off to Sec 1102, REINSURANCE FOR EARLY RETIREES!

But there’s a twist!

Although “pre-existing” only appears 5 times in the bill, “preexisting” appears another 7 times, and I have to confess that I like the sections with “pre-existing” better than the sections” with “preexisting,” for reasons that will probably be obvious after perusing one of the “preexisting” sections.

”SEC. 2704. PROHIBITION OF PREEXISTING CONDITION EX8

CLUSIONS OR OTHER DISCRIMINATION

9 BASED ON HEALTH STATUS.

10 ”(a) IN GENERAL.-A group health plan and a health

11 insurance issuer offering group or individual health insur12

ance coverage may not impose any preexisting condition

13 exclusion with respect to such plan or coverage.”; and

14 (B) by transferring such section (as amended by

15 subparagraph (A)) so as to appear after the section

16 2703 added by paragraph (4);

17 (3)(A) in section 2702 (42 U.S.C. 300gg-1)-

18 (i) by striking the section heading and all

19 that follows through subsection (a);

20 (ii) in subsection (b)-

21 (I) by striking ”health insurance issuer

22 offering health insurance coverage in con23

nection with a group health plan” each

24 place that such appears and inserting

82

HR 3590 EAS/PP

1 ”health insurance issuer offering group or

2 individual health insurance coverage”; and

3 (II) in paragraph (2)(A)-

4 (aa) by inserting ”or individual”

5 after ”employer”; and

6 (bb) by inserting ”or individual

7 health coverage, as the case may be”

8 before the semicolon; and

9 (iii) in subsection (e)-

10 (I) by striking ”(a)(1)(F)” and insert11

ing ”(a)(6)”;

12 (II) by striking ”2701” and inserting

13 ”2704”; and

14 (III) by striking ”2721(a)” and insert15

ing ”2735(a)”; and

16 (B) by transferring such section (as amend17

ed by subparagraph (A)) to appear after section

18 2705(a) as added by paragraph (4); and

19 (4) by inserting after the subpart heading (as

20 added by paragraph (1)) the following…

And so on, through many, many more strikes, transfers, and insertions.

And now, while all the good students strike, insert, and transfer language around 2409 pages of pdf, and eventually arrive at a full understanding of the PPACA, the rest of us will apply our limited intelligence to one simple element of this historic bill, and ask ourselves about the $5,000,000,000 (not quite yet) appropriated to cover patients with pre-existing (or preexisting) conditions, and other “high-risk” individuals, year by year beginning 90 days after the PPACA is enacted, until 2014, when all the other provisions of the PPACA are applicable.

That sounds like a lot of money, but remember that it’s supposed to cover (or fill up the gaps in coverage of) a lot of people who are sick already, or likely to get sick in a way that may cost a lot of money!

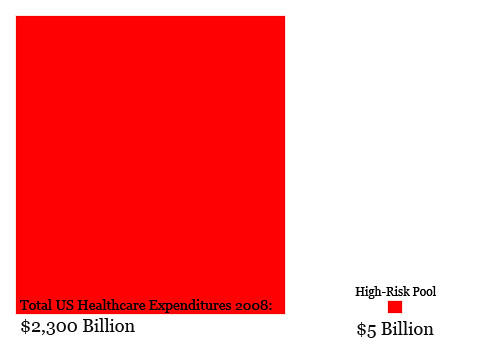

And to help us visualize the amounts of money involved, I have prepared a colorful illustration!

One red square is much bigger than the other!

But the little red square is supposed to cover a very big problem in the big red square!

How can $5 billion cover all currently uninsured “high-risk” individuals (including individuals with pre-existing conditions, which apparently includes anybody who is actually sick) as well as any “high-risk” individuals who lose their insurance between now and 2014?

Nobody seems to know.