(10 am. – promoted by ek hornbeck)

Headline (albeit a small one) in Sunday’s LA Times: “20% in Los Angeles County Receive Public Aid.”

Headline in Sunday’s Nashville Tennessean: Homeless Kids Flood Shelters and Schools.

Headline on the cover of this week’s The Economist: The Collapse of Manufacturing.

Paul Krugman noted on Saturday that the current situation bears resemblance to the Great Depression. Maybe this is no surprise to some of us. But I can’t help thinking it’s worse.

Said Krugman:

Your grandfather’s recession, on the other hand, was something like the Great Depression, which happened in spite of the Fed’s efforts, not because of them. When a stock market bubble and a credit boom collapsed, bringing down much of the banking system with them, the Fed tried to revive the economy with low interest rates — but even rates barely above zero weren’t low enough to end a prolonged era of high unemployment.

Now we’re in the midst of a crisis that bears an eerie, troubling resemblance to the onset of the Depression; interest rates are already near zero, and still the economy plunges.

The similarities are enough for anyone, save Phil Gramm, to recognize. But what of the differences?

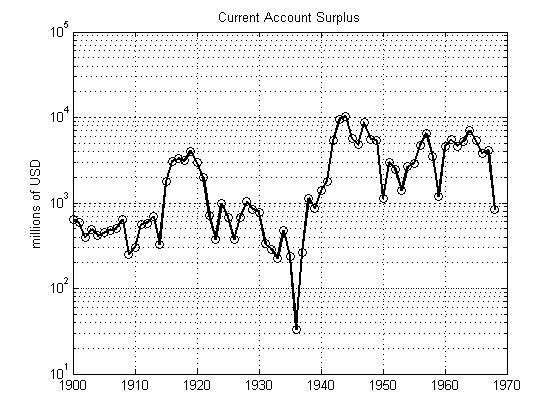

In 1930s, oil availability was not in question. Perhaps the most telling difference, at least to my eye, is the discrepancy in production. From 1900 through 1968, the US maintained net surplus of export over import. In other words, we sold more stuff than we bought in the world.

I generated this graph from National Bureau of Economic Research data sources. The modern data is not quite so optimistic. As of 2006, we imported some 800 billion dollars more stuff than we exported. That is not your grandfather’s American industry.

This was a country that manufactured things. Our industrial capability was the envy of the world. Even in our collapse of 1929, even with the Smoot-Hawley tariff act, that as any fan of Ferris Beuller knows, sank us deeper into depression, we were exporting more than we imported.

While we’re bemoaning the good old days, let’s think about food production. From 1954 to 1997, the number of farms in this country was cut from over 600,000 to less than 200,000. The industrialization of agriculture has changed so much about our food supply and our ability to cope with problems.

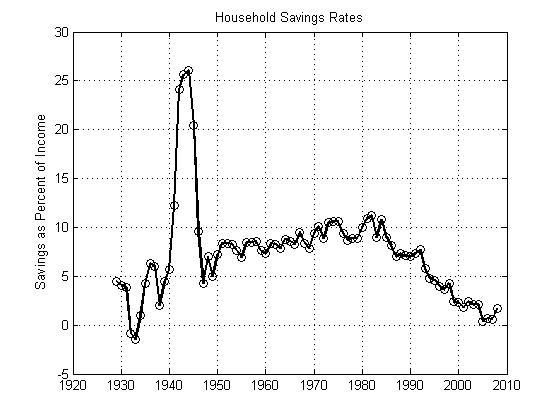

One more thing: personal savings rates. While these rates collapsed to negative territory in the in 1932-1933 years, the rates preceding the great depression were over 5%. Since 2000, however, our savings rates have been less than 2.5% (and in many months, negative).

In view of these things, I’d have to say to Professor Krugman “yes and no.” Certainly the financial symptoms of investment bubbles of all types are similar. Many things about the present situation are very different: resources and energy, industrial capacity and output, farming and food production, and energy are just a few things.

Krugman asks the question “who’ll stop the pain?” That is, what is actually going to bring us out of this depression? What scares me is that I see nothing on the horizon. The stimulus is something, and thank the lord McCain’s not in charge. But who’s going to have the appetite to choke down all of the debt the US is going to create? What happens when China stops buying? Times are sufficiently desperate that we’re seeing inflation as the answer! Cue Bill Murray: “dogs and cats, living together!”

Another movie comes to mind, however: I can’t help but think about this closing sequence from a classic film.

4 comments

Skip to comment form

Author

you’re gonna need every penny.

And the regionalism involved really pisses me off.

Why it feels worse (than some of the other Wall St. indicators might suggest)–because it IS worse for many Americans that are affected by the multiple downturns, in housing, jobs, personal income, etc.