Gold, now at about $775 per ounce, could be worth more than $2000 by the end of 2009.

Gold, now at about $775 per ounce, could be worth more than $2000 by the end of 2009.

As the economic crisis continues to deepen, many are wondering if this recession will turn into a depression. Unemployment is up, the dollar is down, and US markets have lost nearly half their share values over the past year. The Real News spoke to economist Peter Schiff.

Peter Schiff, president of Euro Pacific Capital is an American Austrian School economist. Schiff frequently appears as a guest on CNBC, Fox News, and Bloomberg Television and is quoted in major financial publications. He was an economic adviser for the Ron Paul campaign in the 2008 Republican Party primaries. Schiff is the author of Crash Proof and The Little Book of Bull Moves in Bear Markets.

Real News: December 10, 2008

The Next Depression?

With markets in free fall, economist Peter Schiff opposes stimulus and printing money to fund it

I wonder what a loaf of bread will be worth?

17 comments

Skip to comment form

Author

for casseroles made of money or gold?

I wonder what a loaf of bread will be worth?

A lotta dough. ;-7

All that dye is terrible for the digestive track.

I’m going to rely on the millenial-old-tried-n-true method used in times of hardship.

Just like the Schnitznoodle*, I shall eat Air Sandwiches, aka in spiritual circles as Prana Burgers.

Very inexpensive, no messy preparation, cooking or clean up.

*the Snitznoodle was a famous character in “Raggedy

Ann and Andy in Cookie Land;” he ate only Air Sandwiches.

eventually we might sell it if and when it seems like a good idea.

Or we could live in a house that we really like (which is where we are now, all fixed up).

my ignorance about economics, but it looks to me like what we are facing is deflation rather than inflation. At least for right now, it seems that the public has lost faith in the economy more than they’ve lost faith in the currency. And they’re reducing their participation (ie, consumption) as much as possible. That, and the credit crunch are what seems to be driving the rise in unemployment.

I’m not sure where all of that goes in the future. But as far as I can see, this recession looks very different than others in my lifetime.

I know…I know….

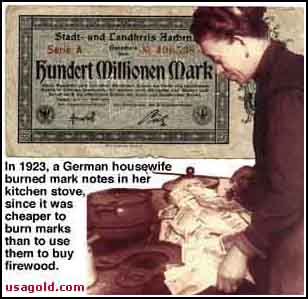

It seems to me we have two paths facing us: Either hyperinflation or deflation. Hyperinflation, such as Zimbabwe is going through now or the famous case of the Weimar republic is bad.

Deflation, such as the Great Depression, is bad, and may be worse since it seems to hang on longer.

Either way, it’s not a very bright economic future for us.

Unless…

All of the 7.5 trillion dollars + going out is aimed at stopping deflation (not likely and not likely to happen even if it is what’s being tried). To walk the tightrope and not fall off probably will take the work of near-gods.

My husband and I started shopping for our first house back in Summer 2007. We sold all our stocks to have cash on hand for the down payment — good thing we got out of the market early. But the housing prices still aren’t dropping that much in the area we want to buy and we figure the bottom is at least a few years off so the search is on hold indefinitely. We’re definitely concerned about the value of the dollar and even the possibility of bank runs so hubby started buying gold and silver coins and stashing them in a safe deposit box.

Now here’s the tip. If you use MSN Live Search to find the coins (or any product for that matter) you get cashback on each purchase. It takes a little hunting around but my husband was able to get 8-10% discounts from various vendors (on eBay). It seems like a good deal to me – if we see $2000/oz. gold it will be a really good deal!

and we’ll drag world economies down with us. Better fine tune your talents….Barter will become the preferred currency.