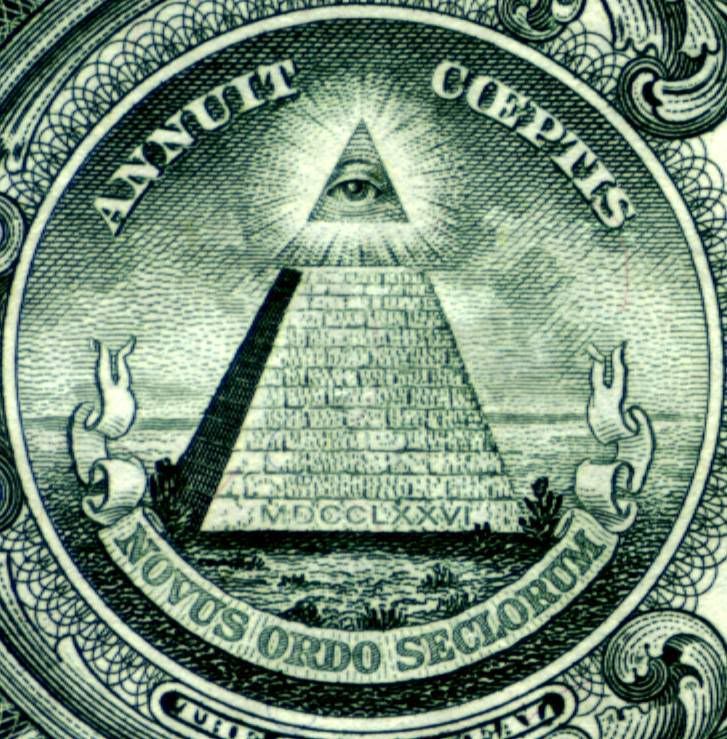

“Novus Ordo Seclorum” is Latin for “New Order of the Ages”

Richard Fuld, CEO, Lehman Brothers. John Thain, CEO, Merrill Lynch.

Stan O’Neal, former CEO, Merrill Lynch. James Cayne, CEO , Bear Stearns.

A video essay from ANP’s Nick Penniman and Eric Fritz, about the CEOs who got very rich while their firms crumbled, putting names and faces to the men operating these firms and making the disastrous executive decisions that are now affecting and destroying the lives of so many people.

The U.S. financial system faces a grave crisis as investment giants teeter on the edge of collapse. These institutions aren’t merely made of paper and percentages, though. They’re led by people – people who’ve made some rotten decisions in recent years. Whereas we’ll hear much in the coming weeks about the federal regulators who are scrambling to avert a disaster, we should also hear about the CEOs who got very rich while their firms crumbled.

8 comments

Skip to comment form

Author

we need to add the faces of everyone who agreed to bail them out, congress included. Its one thing to ruin a company, its another thing to reward that behavior by giving them our tax dollars and taking their ‘over-assessed’ equities (stocks) off their hands….(which will result in the ultimate ruin of our economy and country).

What’s so scary is that the national debt just keeps growing and growing — is there no cap on that? What are these bloodsuckers going to do now — while people are without homes, jobs, even adequate food? What are they going to do while people struggle to get back on their feet? It looks like the immigrants are being kicked out of this country, so the Americans, who have no jobs and jobs are not being created in this country, will take on the work that the immigrants once performed.

The obscene amounts of monies these CEOs have made, while people were being layed off their jobs is revolting!

What a joke this country has become — a very sick joke! Maybe, this is what the Bildeburgs decide when they meet — how to fuck the people!

…you an e-mail with some intersting stock charts for the big financials.

Along with the other news about a “consumer credit crunch” and projected possible increased unemployment, there was this report disturbing report yesterday: “Money Market Funds ‘Break the Buck'”:

Now just one day later, today, there’s this: Putnam Investments Close $12 B Money-Market Fund:

Though the Putnam Prime Money Market Fund was “open only to institutional investors”, this news so closely following yesterday’s report of the Reserve primary fund “breaking the buck” could well be an indication of more seriously painful consequences to a whole lot of people in this country:

lucid of articles I’ve read concerning this whole financial crisis.

Fixing Wall Street Won’t Fix Our Economy

Worth reading and I think captures the “guts” of whole disgusting scenario.