(9 am. – promoted by ek hornbeck)

“The nation is on an unsustainable fiscal course.”

That is the prognosis of Peter Orszag, the director of the nonpartisan Congressional Budget Office, which he gave in a press briefing coinciding with the release of a CBO report today on The Budget and Economic Outlook: An Update.

The Congressional Budget Office (CBO) estimates that the deficit for 2008 will be substantially higher than it was in 2007, rising from $161 billion last year to $407 billion this year.

The CBO’s report was written before the government announcd the takeover of Fannie Mae and Freddie Mac, so the impact of the cost of their bailout — a cost of up to $100 billion each — was not factored into the report.

The budget deficit projection gets worse.

In the report, the CBO forecasts a record shattering deficit of $438 billion for the 2009 fiscal year that begins in October. “If current laws and policies remain in place, deficits for the next two years will remain above $400 billion”. A deficit of $431 billion is projected for FY 2010.

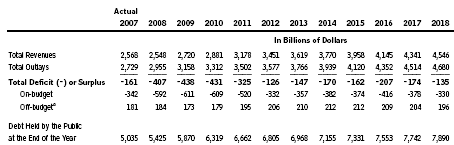

CBO’S Baseline Budget Outlook

Only until the Bush tax holiday for the wealthy expires at the end of 2010 does the CBO forecast the federal deficit dropping to $325 billion. A tax holiday that John McCain now seeks to make permanent.

Despite the belief of “many policymakers and other analysts” that “some of the expiring tax provisions will be extended past their scheduled expirations,” the CBO only projected what the budget deficit will look like if they expire. I think it is safe to assume the future budget predictions would look much bleaker.

As the forecast stand today without the mortgage lender bailout factored in, the projected 2009 federal budget deficit of $438 billion would shatter Bush’s record budget debt of $413 billion in 2004.

Where has our money gone? Much of it has gone to pay for war in extra budget “supplemental appropriations”. According to the CBO report, Bush and Congress has spent $858 billion on the military adventures in Iraq and Afghanistan.

Since September 2001, lawmakers have provided a total of $858 billion in budget authority for military and diplomatic operations in Iraq, Afghanistan, and other regions in support of the war on terrorism and for related veterans’ benefits and services… Appropriations specifically designated for those activities, which averaged about $93 billion a year from 2003 through 2005, rose to $120 billion in 2006, to $171 billion in 2007, and to $186 billion in 2008. The Congress has appropriated $68 billion for war-related activities for the first part of 2009.

Funding to date for military operations and other defense activities related to the war totals $771 billion, most of which has gone to the Department of Defense (DoD). Lawmakers have also provided more than $38 billion to train and equip indigenous security forces in Iraq and Afghanistan.1 A total of $810 billion has thus been appropriated since September 2001 for defense operations in Iraq and Afghanistan and for the war on terrorism.

In addition, $46 billion has been provided for diplomatic operations and foreign aid to Iraq, Afghanistan, and other countries that are assisting the United States in the war on terrorism. Of that amount, $16 billion was appropriated for the Iraq Relief and Reconstruction Fund.

President Bill Clinton left office with a budget surplus of $127 billion and had not the Bush tax holiday for the wealthy been passed by Congress, the Clinton administration had forecasted a $230 billion budget surplus.

The budget deficit has been rising steading under Bush’s watch since 2001. Not only has domestic spending increased, but Congress has been borrowing money to cover the costs for the wars in Afghanistan in Iraq. At the same time, Bush’s tax holiday for the wealthy was passed into law. The United States has been borrowing money for the past 7 years while the U.S. dollar has weakened incredibly.

The CBO budget forecast does not improve greatly even if the Bush tax holiday for the wealthy is allowed to expire. According to the CBO’s report summary:

Over the longer term, the fiscal outlook continues to depend mostly on the future course of health care costs as well as on the effects of a growing elderly population…

The housing market remains depressed; conditions in the financial markets have remained fragile; and prices for energy and agricultural commodities have risen precipitously since last year. According to CBO’s updated forecast, the economy is likely to experience at least several more months of very slow growth. Whether this period will ultimately be designated a recession or not is still uncertain, but the increase in the unemployment rate and the pace of economic growth are similar to conditions during previous periods of mild recession.

Reuters has the initial Democratic reaction to the CBO report.

Senate Budget Committee Chairman Kent Conrad, a North Dakota Democrat, said that CBO’s report confirmed “the federal debt will grow at an unsustainable rate, which means more borrowing from China, more borrowing from Japan, and more borrowing from oil exporters like Saudi Arabia.”

House Budget Committee Chairman John Spratt, a South Carolina Democrat, said the Bush administration “has presided over the largest budget deficits in American history with a 2008 deficit now estimated at the second-largest deficit ever reported.”

The long-term budge outlook is grim and sobering, according to the CBO report.

Over the long term, the budget remains on an unsustainable path. Unless changes are made to current policies, growing demand for resources caused by rising health care costs and the nation’s expanding elderly population will put increasing pressure on the budget…

Beyond 2018, those trends are poised to accelerate.

There is little leadership from Congress on ending the wars that drain our federal budget or in providing economic change needed to pay for government programs. In fact, the taxpayer bribe Congress sent out this year in the form of the Economic Stimulus Act has exacerbated the budget debt.

By the end of the fiscal year, almost $100 billion in rebates will have been disbursed, CBO expects, with roughly $60 billion of that amount representing revenue reductions.

The decade of bank deregulation has taken its toll as well.

With the number and size of failed financial institutions up sharply this year, CBO expects federal outlays for deposit insurance to rise by more than $15 billion. As of July 2008, the FDIC had spent about $18 billion to cover the insured deposits of insolvent institutions.

Lastly, discretionary spending by Congress has increased by 8.1 percent in FY 2008. The outlays for discretionary spending “constitute 38 percent of total federal spending in 2008.” Discretionary outlays are $1.1 trillion for 2008, up from $1.0 trillion in 2007. So, expect the blame for the near record budget deficit to be placed at the feet of the Democratic controlled Congress in the weeks before the general election.

However, do not let the Republicans get away with that line of attack. According to the CBO:

More than half of discretionary outlays are spent on national defense. CBO estimates that defense outlays will total $605 billion in 2008 – a gain of 10.5 percent from last year’s level…

Recent increases in defense spending have stemmed from higher funding for operations in Iraq and Afghanistan and for other activities related to the war on terrorism, as well as for defense activities not directly related to those conflicts. Funding for war-related operations continued to expand in 2008 (by about 9 percent).

Budget authority for non-war-related defense programs rose even more than funding for the war in 2008 – by roughly 11 percent.

In comparison, the discretionary spending on nondefense outlays increased only 5.5 percent from $493 billion in 2007 to $520 billion in 2008. This is an increase of $27 billion. If spending money on war and defense is an indication of priorities, the Democratic led Congress, is strong supporter of our nation’s military-industrial complex.

If after nearly eight years of borrow-and-spend economic policy, there is one clear take away from the CBO report for the American voter. The words of CBO director Peter Orszag:

“The nation is on an unsustainable fiscal course.”

Cross posted at Daily Kos.

35 comments

Skip to comment form

Author

We’re spending much of what we tax and what we spend on war, bombs, and ways to

kill peoplekeep Americans safe.. . . will be necessary? Next up could be Lehman Brothers, whose mortgage debt is scaring off investors and they can’t find capital. That seems to be the main reason for the Dow dropping 280 points on Tuesday.

No shit, Sherlock. You can’t keep running $437 billion dollar deficits, fighting every war you take a fancy to and make sure all the assholes who are sucking money out of economy anyway pay no taxes??

I want this guy’s job.

… over the next twenty decades if we continue Republican policies. A 3% deficit means no change in total public debt burden if the economy is growing at 3% … which is certainly would be if we were making the investment in the infrastructure of a New Energy Economy that we desperately need to make.

Of course, spending the money on military consumption rather than public investment in productive capacity means a drag on the economy rather than a boost to the economy, but a deficit of $400b is by no means unsustainable for a $14,312b economy.

people are all freaked out because they think Obama will increase their taxes. Talk about bamboozled. Americans apparently are unable to comprehend the reality of our economy and instead focus on the totally surreal version of the politics of denial pumped by the TV. I have taken to watching Bloomberg pretty weird as I’m a die hard socialist at heart. I’m no economist but .. “You don’t have to be a weather man to see which way the wind blows”.

A Washington Post-ABC News poll taken Sept. 5 to Sept. 7 found that 51 percent of voters think Obama would raise their taxes, even though his plan would actually cut taxes for the overwhelming majority of Americans. Obama has proposed eliminating income taxes on seniors making less than $50,000 a year, but 41 percent of those seniors say their income taxes would go up in an Obama administration.

This all seems so disconnected from the day to day reality people live with.

started making lots of noise about where things were headed, almost two years ago, when he was still Comptroller General.

I suppose that may have some bearing on why he is now former Comptroller General…

You Must Be Mad, Or You Wouldn’t Have Come Here

February 17, 2007