Some news and open thread.

-

The Washington Post reports The Senate Judiciary Committee will vote on Mukasey confirmation on Tuesday. “Sen. Patrick J. Leahy (D-Vt.) announced today that the Senate Judiciary Committee will vote Tuesday on attorney general nominee Michael B. Mukasey, whose confirmation has been complicated by his repeated refusal to declare that an interrogation tactic that uses simulated drowning constitutes illegal torture. The announcement from Leahy comes a day after Mukasey wrote a letter to the committee saying that while he considers waterboarding ‘repugnant,’ he does not know whether the technique violates U.S. laws against torture.”

The Washington Post reports The Senate Judiciary Committee will vote on Mukasey confirmation on Tuesday. “Sen. Patrick J. Leahy (D-Vt.) announced today that the Senate Judiciary Committee will vote Tuesday on attorney general nominee Michael B. Mukasey, whose confirmation has been complicated by his repeated refusal to declare that an interrogation tactic that uses simulated drowning constitutes illegal torture. The announcement from Leahy comes a day after Mukasey wrote a letter to the committee saying that while he considers waterboarding ‘repugnant,’ he does not know whether the technique violates U.S. laws against torture.”Mukasey “said it is ‘an open question,’ for example, whether a U.S. citizen seized on U.S. soil can be detained indefinitely after the president declares that he is in an enemy combatant. He also reiterated his view that the president can ignore surveillance laws if they infringe on his powers as commander in chief, and said a Justice Department prosecutor cannot enforce a congressional subpoena if the White House has asserted a claim of executive privilege.”

Mukasey should be rejected by the senators. If any Democrat votes for Mukasey, he will become the Attorney General. Mukasey must be stopped in committee.

-

The New York Times reports the Fed lowers key interest rate by a quarter point. “Federal Reserve policymakers, worried that the meltdown in housing could continue to slow the entire economy, cut their benchmark interest rate today by a quarter point to 4.50 percent, from 4.75. Today’s rate cut follows an unusually large one-half percentage point in September”.

-

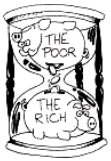

According to Spiegel, Rising prices widen gap between rich and poor. “Central banks flooded the world with cheap money for years, helping the rich get richer. Now inflation is on the horizon, threatening to make the poor even poorer… The excess dollars, euro and yen that were not being spent on capital goods went into more lucrative investments… And those were the rich of this world, the people who had enough surplus income to invest it profitably. The gap between rich and poor only became wider… Those who have money can also attempt to beat inflation with evasive strategies. Existing loans, such as mortgage loans, become cheaper relative to income. Besides, high earners can shift their assets to inflation-proof investments like gold or other precious metals.”

According to Spiegel, Rising prices widen gap between rich and poor. “Central banks flooded the world with cheap money for years, helping the rich get richer. Now inflation is on the horizon, threatening to make the poor even poorer… The excess dollars, euro and yen that were not being spent on capital goods went into more lucrative investments… And those were the rich of this world, the people who had enough surplus income to invest it profitably. The gap between rich and poor only became wider… Those who have money can also attempt to beat inflation with evasive strategies. Existing loans, such as mortgage loans, become cheaper relative to income. Besides, high earners can shift their assets to inflation-proof investments like gold or other precious metals.” -

A couple of developments from Burma. The Guardian reports Burmese monks begin fresh protests. “More than 100 Buddhist monks marched and chanted in Burma today in the first public demonstration since the military junta crushed last month’s anti-government protests, several monks said. The monks in Pakokku made no political statements and shouted no slogans, but their march, which lasted nearly an hour, was in clear defiance of the government.”

The Independent reports Burma forces children into combat as adults desert army. “The Burmese junta is making more and more use of child soldiers, some as young as 10, according to a Human Rights Watch report published today. Finding it increasingly hard to recruit adult soldiers, and trying to cope with high desertion rates and a constantly expanding demand for fighters, army recruiters pick on children at bus and train stations and force them to join up.”

So, what else is happening?

12 comments

Skip to comment form

Author

Does anyone still support Mukasey’s nomination?

I’m hijacking it.

In my most recent Essay, All Your Money Are Belong to Us I posted my Dollar trading chart (from Friday night). It was up to $169,000 profit from the month before, when it was up $118,000 (also posted at DD).

I commented:

Well, I am here to report that the dollar crashed nicely (right on schedule at around noon today) and that trading chart is at $215,000 profit as I type this. Even better, the European market won’t open until 11 PM (my time) and will smash the Dollar even more.

But the big Dollar killer doesn’t come until Friday:

And, quite frankly, I feel really bad.

Really bad.

sometimes means opening up the checkbook

link

He attacks the pentagon over mercenaries!

’bout f*ing time someone did…go watch the video…he gets spitting mad!

http://rawstory.com/…