Author's posts

Jul 19 2012

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History July 18 by TheMomCat

- Punting the Pundits by TheMomCat

These featured articles-

- HSBC: Money Laundering for Drug Dealers & Terrorists by TheMomCat

- Consequences of the War on Terror by TheMomCat

These special features-

- 2012 Le Tour – Rest Day 2 – Points Part 1 by ek hornbeck

- 2012 Le Tour – Rest Day 2 – Points Part 2 by ek hornbeck

- 2012 Le Tour – Rest Day 2 – Points Part 3 by ek hornbeck

- 2012 Le Tour – Stage 16 by ek hornbeck

Follow us on Twitter @StarsHollowGzt

This is an Open Thread

Due to weather conditions here in the northeast, I’m a bit late tonight. Yeah, climate change!

Jul 18 2012

On This Day In History July 18

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

Click on images to enlarge

July 18 is the 199th day of the year (200th in leap years) in the Gregorian calendar. There are 166 days remaining until the end of the year.

On this day in 1940, Franklin Delano Roosevelt, who first took office in 1933 as America’s 32nd president, is nominated for an unprecedented third term. Roosevelt, a Democrat, would eventually be elected to a record four terms in office, the only U.S. president to serve more than two terms.

Roosevelt was born January 30, 1882, in Hyde Park, New York, and went on to serve as a New York state senator from 1911 to 1913, assistant secretary of the Navy from 1913 to 1920 and governor of New York from 1929 to 1932. In 1932, he defeated incumbent Herbert Hoover to be elected president for the first time. During his first term, Roosevelt enacted his New Deal social programs, which were aimed at lifting America out of the Great Depression. In 1936, he won his second term in office by defeating Kansas governor Alf Landon in a landslide.

The two-term tradition had been an unwritten rule (until the 22nd Amendment after his presidency) since George Washington declined to run for a third term in 1796, and both Ulysses S. Grant and Theodore Roosevelt were attacked for trying to obtain a third non-consecutive term. FDR systematically undercut prominent Democrats who were angling for the nomination, including two cabinet members, Secretary of State Cordell Hull and James Farley, Roosevelt’s campaign manager in 1932 and 1936, Postmaster General and Democratic Party chairman. Roosevelt moved the convention to Chicago where he had strong support from the city machine (which controlled the auditorium sound system). At the convention the opposition was poorly organized but Farley had packed the galleries. Roosevelt sent a message saying that he would not run, unless he was drafted, and that the delegates were free to vote for anyone. The delegates were stunned; then the loudspeaker screamed “We want Roosevelt… The world wants Roosevelt!” The delegates went wild and he was nominated by 946 to 147 on the first ballot. The tactic employed by Roosevelt was not entirely successful, as his goal had been to be drafted by acclamation. The new vice presidential nominee was Henry A. Wallace, a liberal intellectual who was Secretary of Agriculture.

In his campaign against Republican Wendell Willkie, Roosevelt stressed both his proven leadership experience and his intention to do everything possible to keep the United States out of war. In one of his speeches he declared to potential recruits that “you boys are not going to be sent into any foreign war.” He won the 1940 election with 55% of the popular vote and 38 of the 48 states. A shift to the left within the Administration was shown by the naming of Henry A. Wallace as Vice President in place of the conservative Texan John Nance Garner, who had become a bitter enemy of Roosevelt after 1937.

Jul 18 2012

Meet Your Billionaire Owners

Cross posted from The Stars Hollow Gazette

The Supreme Court ruling in the case of Citizens United v Federal Election Commission opened the flood gates for millions of dollars of donations to political campaigns with virtually no oversight and no control. The Court sent the message that it was up to Congress to require disclosure of donations to political campaigns. So far, that has not worked out so well. But some members if the traditional and nontraditional media have taken the matter into their own hands and made public the names of the largest donors to mostly the coffers of the GOP and their radical agenda.

Most of those donors are billionaires who have only their own wealth and self-interest at heart over the needs and rights of the 99.9%. Yeah, damned some of those puny millionaires, too.

ProPublica, an independent, non-profit investigative internet news site along with PBS’ Frontline did an expose of one of those billionaires, formerly one of the most secretive, Sheldon Adelson. The article takes a look at Mr. Adelson’s casino holdings in Macau and possible violations of the Foreign Corrupt Practices Act:

Where competitors saw obstacles, including Macau’s hostility to outsiders and historic links to Chinese organized crime, Adelson envisaged a chance to make billions.

Adelson pushed his chips to the center of the table, keeping his nerve even as his company teetered on the brink of bankruptcy in late 2008.

The Macau bet paid off, propelling Adelson into the ranks of the mega-rich and underwriting his role as the largest Republican donor in the 2012 campaign, providing tens of millions of dollars to Newt Gingrich, Mitt Romney and other GOP causes.

Now, some of the methods Adelson used in Macau to save his company and help build a personal fortune estimated at $25 billion have come under expanding scrutiny by federal and Nevada investigators, according to people familiar with both inquiries.

Internal email and company documents, disclosed here for the first time, show that Adelson instructed a top executive to pay about $700,000 in legal fees to Leonel Alves, a Macau legislator whose firm was serving as an outside counsel to Las Vegas Sands.

The company’s general counsel and an outside law firm warned that the arrangement could violate the Foreign Corrupt Practices Act. It is unknown whether Adelson was aware of these warnings. The Foreign Corrupt Practices Act bars American companies from paying foreign officials to “affect or influence any act or decision” for business gain.

Federal investigators are looking at whether the payments violate the statute because of Alves’ government and political roles in Macau, people familiar with the inquiry said. Investigators were also said to be separately examining whether the company made any other payments to officials. An email by Alves to a senior company official, disclosed by the Wall Street Journal, quotes him as saying “someone high ranking in Beijing” had offered to resolve two vexing issues – a lawsuit by a Taiwanese businessman and Las Vegas Sands’ request for permission to sell luxury apartments in Macau. Another email from Alves said the problems could be solved for a payment of $300 million. There is no evidence the offer was accepted. Both issues remain unresolved.

Steve Engelberg, managing editor at ProPublica, talks with Rachel Maddow about the reporting in a new ProPublica/Frontline PBS collaboration looking into the questionable dealings behind the Macau-based casino fortune of big-money Republican donor Sheldon Adelson

Jul 18 2012

The Fraud of the Financial Fraud Task Force

Cross posted from The Stars Hollow Gazette

Financial Fraud Enforcement Task Force is the umbrella group for the RMBS (Residential Mortgage-Backed Security) Task Force. Remember that task force that was so gleefully announced by President Obama in his State of the Union address in January, appointing New York State Attorney General Eric Schneiderman to participate? Yeah, that one. It’s been under the radar for the most part and as yet has inadequate staff no office space or even a phone number.

The gang at FireDogLake has been relentless in tracking down what he FFETF and the RMBS have and haven’t done. My FDL contributor massacio has been a wizard at uncovering new releases that claim the groups are making progress when in reality the Obama DOJ is refusing to go after the big fish:

Like every one else who is following the refusal of the Obama Administration and its cowardly prosecutors to investigate Wall Street for crimes in the run-up to the Great Crash, I figured this was just a name given to a collection of prosecutors around the country who were already working on fraud cases.

The official website of the FFETF confirms this. [..]

I’ve gone back through February looking at the press releases, and this is a fair sample of the work of the FFETF. There is not a single case related to fraud in the creation, sale or operation of real estate mortgage-backed securities, the frauds that led to the Great Crash. The FFETF is a random collection of people working on cases that can be tied to financial fraud.

The FFETF and its 20 subpoenas and its 50 or more personnel and whatever else we hear from them are a sham. Wall Street has nothing to fear from the FFETF and its co-chair, Eric Schneiderman.

Richard (RJ) Eskow points out that Wall St. has nothing to fear from these task forces or for that matter from Attorney General Eric Holder:

Confidential sources say that the President’s much-touted Mortgage Fraud Task Force is being starved for vital resources by the Holder Justice Department. Political insiders are fearful that this obstruction will threaten Democrats’ chances at the polls. Investigators and prosecutors from other agencies are expressing their frustration as the ever-rowing list of documented crimes by individual Wall Street bankers continues to be ignored. [..]

A growing number of people are privately expressing concern at the Justice Department’s long-standing pattern of inactivity, obfuscation, and obstruction. Mr. Holder’s past as a highly-paid lawyer for a top Wall Street firm, Covington and Burling, is being discussed more openly among insiders. Covington & Burling was the law firm which devised the MERS shell corporation which has since been implicated in many cases of mortgage and foreclosure fraud. [..]

But there’s no evidence that Mr. Holder’s Justice Department has mounted a serious effort to investigate bank crime. Its first, much-touted “coordinated effort” to crack down on mortgage fraud turned out to be a PR trick, not a law enforcement effort, which the Columbia Journalism Review described with the headline, “The Obama Administration’s Financial-Fraud Stunt Backfires.” That’s not the kind of press a President wants to see repeated in an election year.

“Democrats have been having good luck painting Romney as the candidate of the one percent,” said one observer. “But that could change quickly with a few bad headlines.”

While nobody we spoke with was willing to raise the subject of a Holder resignation, they did insist that time was running out for the Attorney General to show concrete results.

Without criminal investigations and indictments, bankers will continue to commit crimes. The LIBOR scandal, which implicates a number of leading banks, proves that. The Justice Department’s inaction is putting the world economy at risk by allowing bankers to continue their reckless and illegal behavior.

The clock is ticking on many of these case since there is a five year statute of limitations under federal law for civil charges. There is now mounting evidence that Obama administration is letting that statute of limitations expire on the criminal charges, too. David Dayen at FDL News reports that he spoke with Rep. Brad Miller (D-NC), a member of the House Financial Services Committee, concerning the Justice Department stonewalling prosecutions of securitization abuses. He asked Miller about the coalition of housing advocates charging the Justice Department with stonewalling the investigation and denying it critical resources:

Miller, who at one point was a potential choice to be the executive director of the working group, said that he had not personally spoken with anyone involved in the task force since he missed out on the position in late February/early March. But as an interested observer, he made a few points. “It does appear that the task force is really not doing anything that the various agencies weren’t doing already,” Miller said. “They’re just saying they are doing it as part of this task force.”

And Miller added something else, that members of the various agencies associated with the working group have acknowledged this in conversations with members of Congress. Miller cautioned that he hadn’t heard this from agency officials personally, but that other members have. [..]

Miller also noted that the statutes of limitations, at least on criminal fraud claims, have almost certainly run out. “I said a few weeks ago that the clock on the statute of limitations was ticking like Marisa Tomei’s biological clock in My Cousin Vinny,” Miller said. “If there have not been extensions worked out in private negotiations, and if the law is that the statute runs from occurrence rather than discovery, it’s probably the case that most statutes have expired.”

And unless we forget our erstwhile Treasury Secretary Timothy Geithner, maybe up to his ears in the multi-trillion dollar LIBOR fraud:

The flames of the Libor scandal have been creeping up under the feet of Treasury Secretary Timothy Geithner. Evidence showed that the New York Fed found out about the rate-rigging from Barclays and other banks in 2007, when Geithner was still the bank President. This appeared to display regulatory impotence in the face of massive fraud. Geithner had to respond. And he did with a classic version of CYA. [..]

Geithner passed the documents around to anyone who wanted them last night. If there can be something less than the bare minimum, a two-page document to the Bank of England – not the banks implicated in the rate-rigging over which the NY Fed has control, but some other regulator – would be it. He didn’t speak out publicly, he didn’t use his regulatory power over the banks he had authority and in defense of the stateside financial products calculated using the Libor benchmark rate, he just wrote a memo.

The memo says that the Bank of England should “eliminate the incentive to misreport” Libor on the part of the banks. So there’s no doubt in the minds of the regulators that there was misreporting going on.

Timmy’s excuse for doing nothing now is that he did nothing then

The Federal Reserve Bank of New York will release on Friday documents showing it took “prompt action” four years ago to highlight problems with the benchmark interest rate known as Libor and to press for reform, an official at the regional U.S. central bank said on Wednesday.

As early as 2007, the New York Fed may have discussed problems with the setting of the London Interbank Offered Rate with Barclays Plc, the British bank currently at the center of the Libor scandal and investigation

Well, Timmy did send a memo.

Jul 18 2012

Le Tour de France 2012: Stage 15

The Tour de France 2012, the world’s premier cycling event kicked off last Saturday with the Prologue in Liège, Belgium and will conclude on July 22 with the traditional ride into Paris and laps up and down the Champs-Élysées. Over the next 22 days the race will take its course briefly along the Northwestern coast of France through Boulogne-sur-Mer, Abbeville and into Rouen then into the mountains of the Jura, Swiss Alps and the Pyrenees.

We will be Live Blogging Le Tour 2012 every morning at The Stars Hollow Gazette starting at 7:30 AM EDT. Come join us for a morning chat, cheer the riders and watch some of the most beautiful and historic countryside in Europe.

Samatan

Samatan is a commune in the Gers department in southwestern France. This is the first time Samatan has been a stage town for Le Tour.

From its many hills, Samatan, at the gates of Gascony and Toulouse, offers a great view on the Pyrenees with the pikes of Arbizon and Midi de Bigorre in the background. Its harmonious landscape, green and relaxed, is scattered with small woods and isolated farms in the huge check-board of the fields. This is why Samatan logically turned to green tourism with an emphasis on gastronomy and trekking.

From its many hills, Samatan, at the gates of Gascony and Toulouse, offers a great view on the Pyrenees with the pikes of Arbizon and Midi de Bigorre in the background. Its harmonious landscape, green and relaxed, is scattered with small woods and isolated farms in the huge check-board of the fields. This is why Samatan logically turned to green tourism with an emphasis on gastronomy and trekking.

The town has been equipped since the 1980S by a holiday village on the banks of a now renowned lake. It comprises a hotel nd adining rooms with a panoramic view over the lake. 2012 is an important year for the holiday centre as the lodgings will be entirely refurbished while the outside greens have been renovated in the respect of environment. Among the novelties, a spa has been added to the many activities on offer while access for the disabled has been improved.

Pau

Pua is a commune on the northern edge of the Pyrenees, capital of the Pyrénées-Atlantiques département in France. The site was fortified in the 11th century to control the ford across the Gave de Pau. It was built on the north bank, equidistant from Lescar, seat of the bishops, and from Morlaàs, and became the seat of the viscounts of Béarn. Pau was made capital of Béarn in 1464. During the early 16th century, the Château de Pau was made more habitable by Gaston III, count of Foix and became the residence of the kings of Navarre, who were also viscounts of Béarn.

Pua is a commune on the northern edge of the Pyrenees, capital of the Pyrénées-Atlantiques département in France. The site was fortified in the 11th century to control the ford across the Gave de Pau. It was built on the north bank, equidistant from Lescar, seat of the bishops, and from Morlaàs, and became the seat of the viscounts of Béarn. Pau was made capital of Béarn in 1464. During the early 16th century, the Château de Pau was made more habitable by Gaston III, count of Foix and became the residence of the kings of Navarre, who were also viscounts of Béarn.

In 1188, Gaston VI assembled his cour majour there, predecessor of the conseil souverain and roughly equivalent to the House of Lords (but predating it). Gaston VII added a third tower in the 13th century. Gaston Fébus (Gaston III of Foix and Gaston X of Béarn) added a brick donjon (keep).

Pau was birthplace of Henry IV of France. His mother, Jeanne d’Albret, crossed into France to ensure her son would be born there. The baby’s lips were moistened with the local Jurançon wine and rubbed with garlic shortly after birth. When Henry IV left Pau to become King of France, he remarked to local notables that he was not giving Béarn to France, but giving France to Béarn.

Napoleon III refurbished the château and Pau adding streets of Belle Époque architecture, before the fashion transferred to Biarritz. Pau is still a centre for winter sports and equestrian events, with a steeplechase. King Charles XIV of Sweden, the first royal Bernadotte, was also born in Pau.

Following the assassination of Abraham Lincoln, Mary Todd Lincoln stayed in Pau in the late 1870s, toward the end of her life.

Pau Porte des Pyrénées is a territory of 250,000 men and women with a strong sense of common identity based on peace, sharing and passion. It is a natural outdoors sports destination with the Eaux-Vives Stadium, a golf course, trails for walking and rambling… Nature is everywhere in the town, in its numerous parks and gardens or its plots of land maintained by the sheep. It is also a cultural destination with the Chateau de Pau, its light show and outdoor nightime spectacles in its gardens. Royal land, the city was the birthplace of Henri IV and Jean-Baptiste Bernadotte who became King of Sweden. It is also the land of good cheer with many homegrown produce: the Jurancon wines, la poule au pot, foie gras, sheeps’ milk cheese. Finally Pau makes the most of an innovative global economy: geosciences, food processing, aeronautics, horse breeding and Pau Broadband Country, the first high speed network in France. Pau has everything on offer to tempt you to stay either for a day, a weekend or your whole life so you can adopt brand Pau Porte des Pyrénées!

The bikers took the today off in the city of Pau. Stage 16 tomorrow will start in Pau

Jul 18 2012

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History July 17 by TheMomCat

- Punting the Pundits by TheMomCat

These featured articles-

- LIBOR: Past Time to Investigate the NY Fed by TheMomCat

- About that Hoax by LaEscapee

- Meet Your Billionaire Owners by TheMomCat

Follow us on Twitter @StarsHollowGzt

This is an Open Thread

This special feature-

Today is a rest day for Le Tour de France. We resume our coverage of Le Tour 2012 with ek hornbeck tomorrow morning at 8 AM

Jul 17 2012

On This Day In History July 17

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

Click on images to enlarge

July 17 is the 198th day of the year (199th in leap years) in the Gregorian calendar. There are 167 days remaining until the end of the year.

On this day in 1998, a diplomatic conference adopts the Rome Statute of the International Criminal Court, establishing a permanent international court to prosecute individuals for genocide, crime against humanity, war crimes, and the crime of aggression.

The Rome Statute of the International Criminal Court (often referred to as the International Criminal Court Statute or the Rome Statute) is the treaty that established the International Criminal Court (ICC). It was adopted at a diplomatic conference in Rome on 17 July 1998 and it entered into force on 1 July 2002. As of March 2011, 114 states are party to the statute. Grenada will become the 115th state party on 1 August 2011. A further 34 states have signed but not ratified the treaty. Among other things, the statute establishes the court’s functions, jurisdiction and structure.

Under the Rome Statue, the ICC can only investigate and prosecute in situations where states are unable or unwilling to do so themselves. Thus, the majority of international crimes continue to go unpunished unless and until domestic systems can properly deal with them. Therefore, permanent solutions to impunity must be found at the domestic level.

Following years of negotiations aimed at establishing a permanent international tribunal to prosecute individuals accused of genocide and other serious international crimes, such as crimes against humanity, war crimes and the recently defined crimes of aggression, the United Nations General Assembly convened a five-week diplomatic conference in Rome in June 1998 “to finalize and adopt a convention on the establishment of an international criminal court”. On 17 July 1998, the Rome Statute was adopted by a vote of 120 to 7, with 21 countries abstaining.[5] The seven countries that voted against the treaty were Iraq, Israel, Libya, the People’s Republic of China, Qatar, the United States, and Yemen.

On 11 April 2002, ten countries ratified the statute at the same time at a special ceremony held at the United Nations headquarters in New York City, bringing the total number of signatories to sixty, which was the minimum number required to bring the statue into force, as defined in Article 126. The treaty entered into force on 1 July 2002; the ICC can only prosecute crimes committed on or after that date. The statute was modified in 2010 after the Review Conference in Kampala, Uganda, but the amendments to the statute that were adopted at that time are not effective yet.

The Rome Statute is the result of multiple attempts for the creation of a supranational and international tribunal. At the end of 19th century, the international community took the first steps towards the institution of permanent courts with supranational jurisdiction. With the Hague International Peace Conferences, representatives of the most powerful nations made an attempt to harmonize laws of war and to limit the use of technologically advanced weapons. After World War I and even more after the heinous crimes committed during World War II, it became a priority to prosecute individuals responsible for crimes so serious that needed to be called “against humanity”. In order to re-affirm basic principles of democratic civilisation, the alleged criminals were not executed in public squares or sent to torture camps, but instead treated as criminals: with a regular trial, the right to defense and the presumption of innocence. The Nuremberg trials marked a crucial moment in legal history, and after that, some treaties that led to the drafting of the Rome Statute were signed.

UN General Assembly Resolution n. 260 9 December 1948, the Convention on the Prevention and Punishment of the Crime of Genocide, was the first step towards the establishment of an international permanent criminal tribunal with jurisdiction on crimes yet to be defined in international treaties. In the resolution there was a hope for an effort from the Legal UN commission in that direction. The General Assembly, after the considerations expressed from the commission, established a committee to draft a statute and study the related legal issues. In 1951 a first draft was presented; a second followed in 195] but there were a number of delays, officially due to the difficulties in the definition of the crime of aggression, that were only solved with diplomatic assemblies in the years following the statute’s coming into force. The geopolitical tensions of the Cold War also contributed to the delays.

Trinidad and Tobago asked the General Assembly in December 1989 to re-open the talks for the establishment of an international criminal court and in 1994 presented a draft Statute. The General Assembly created an ad hoc committee for the International Criminal Court and, after hearing the conclusions, a Preparatory Committee that worked for two years (1996-1998) on the draft. Meanwhile, the United Nations created the ad hoc tribunals for the former Yugoslavia (ICTY) and for Rwanda (ICTR) using statutes-and amendments due to issues raised during pre-trial or trial stages of the proceedings-that are quite similar to the Rome Statute.

During its 52nd session the UN General Assembly decided to convene a diplomatic conference for the establishment of the International Criminal Court, held in Rome 15 June-17 July 1998 to define the treaty, entered into force on 1 July 2002.

Jul 17 2012

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History July 16 by TheMomCat

- Punting the Pundits by TheMomCat

These featured articles-

- Pique the Geek 20120715: Carbon, the Stuff of Life Part I by Translator

- The World’s Biggest Starbucks by ek hornbeck

- Let’s Talk ‘Decolonization’ by Unaspencer by Anti-Capitalist Meetup

- Sunday Train: NEC High Speed Rail for Under $20b by BruceMcF

This special feature-

- 2012 Le Tour – Stage 15 by ekhornbeck

Follow us on Twitter @StarsHollowGzt

This is an Open Thread

Jul 16 2012

Le Tour de France 2012: Stage 14

The Tour de France 2012, the world’s premier cycling event kicked off last Saturday with the Prologue in Liège, Belgium and will conclude on July 22 with the traditional ride into Paris and laps up and down the Champs-Élysées. Over the next 22 days the race will take its course briefly along the Northwestern coast of France through Boulogne-sur-Mer, Abbeville and into Rouen then into the mountains of the Jura, Swiss Alps and the Pyrenees.

We will be Live Blogging Le Tour 2012 every morning at The Stars Hollow Gazette starting at 7:30 AM EDT. Come join us for a morning chat, cheer the riders and watch some of the most beautiful and historic countryside in Europe.

Limoux is a commune and subprefecture in the Aude department, a part of the ancient Languedoc province and the present-day Languedoc-Roussillon region in southern France.

Limoux is a commune and subprefecture in the Aude department, a part of the ancient Languedoc province and the present-day Languedoc-Roussillon region in southern France.

After being developed around its church, the city rapidly developed thanks to its linen and leather industry. Today, Limoux is renowned for its blanquette (sparkling wine), its Toques et Clochers Festival, its carnival, its museums and its gastronomy.

– la blanquette – it is the oldest sparkling wine in the world. Discovered in 1531 its method of wine production was subsequently applied to champagne by Dom Perignon. It makes up the main economy of the town and of the region. You can also include the Anne de Joyeuse cave that produces quality AOC wines.

– Toques et Clochers – this wine auction held in Spring takes place with the aim of raising money for the restauration of the ancient belltowers (clochers). It is followed by a meal prepared by a top chef (Toque).

– the carnival – every winter it lasts nearly three months. It is the longest carnival in the world. Festivities begin 12 weeks before the religious festival of Palm Sunday.

– the museums – the Petiet Museum is dedicated to paintings, there are also museums celebrating the piano, automata, printing and plants at La Bouichère.

Foix is a commune, the capital of the Ariège department in southwestern France. It is the least populous administrative center of a department in all of France. The town of Foix probably owes its origin to an oratory founded by Charlemagne, which afterwards became the Abbey of Saint Volusianus in 849.

Right in the heart of the Ariège, at the foot of the Pyrenees, Foix, symbolised by its three towers of its Château Comtal, combines the quality of life of an average town with the advantages of its immediate proximity to a great metropolis, Toulouse, but also with the Pyrenees, Spain and Andorra. Undoubtedly the emblematic monument of the city, the Castle (10th – 15th centuries) stands majestically on its rock and was home to the Counts of Foix, including the brilliant Gaston Febus (1343-1391). A Tour stage town and popular with tourists, Foix combines the authenticity of its ancient medieval centre with the diversity of its businesses and the quality of its beautiful natural environment. This unspoiled environment is perfect for so many sporting activities and outdoor leisure pursuits: cycling and mountainbiking, walking or horseriding, rafting in calm or choppy waters or even paragliding down the valley. Foix is in a privileged spot for discovering the treasures of the Ariege department: middle age castles, Cathar citadels, roman abbeys, prehistoric caves.. or quite simply sublime natural locations.

Jul 16 2012

On This Day In History July 16

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

Click on images to enlarge

July 16 is the 197th day of the year (198th in leap years) in the Gregorian calendar. There are 168 days remaining until the end of the year.

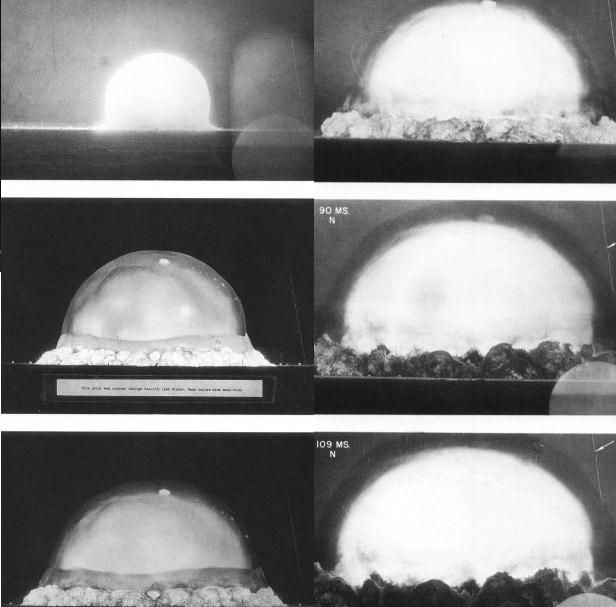

On this day in 1945, at 5:29:45 a.m., the Manhattan Project comes to an explosive end as the first atom bomb is successfully tested in Alamogordo, New Mexico.

If the radiance of a thousand suns were to burst at once into the sky, that would be like the splendor of the mighty one…

“Now I am become Death, the destroyer of worlds.”

Plans for the creation of a uranium bomb by the Allies were established as early as 1939, when Italian emigre physicist Enrico Fermi met with U.S. Navy department officials at Columbia University to discuss the use of fissionable materials for military purposes. That same year, Albert Einstein wrote to President Franklin Roosevelt supporting the theory that an uncontrolled nuclear chain reaction had great potential as a basis for a weapon of mass destruction. In February 1940, the federal government granted a total of $6,000 for research. But in early 1942, with the United States now at war with the Axis powers, and fear mounting that Germany was working on its own uranium bomb, the War Department took a more active interest, and limits on resources for the project were removed.

Brigadier-General Leslie R. Groves, himself an engineer, was now in complete charge of a project to assemble the greatest minds in science and discover how to harness the power of the atom as a means of bringing the war to a decisive end. The Manhattan Project (so-called because of where the research began) would wind its way through many locations during the early period of theoretical exploration, most importantly, the University of Chicago, where Enrico Fermi successfully set off the first fission chain reaction. But the Project took final form in the desert of New Mexico, where, in 1943, Robert J. Oppenheimer began directing Project Y at a laboratory at Los Alamos, along with such minds as Hans Bethe, Edward Teller, and Fermi. Here theory and practice came together, as the problems of achieving critical mass-a nuclear explosion-and the construction of a deliverable bomb were worked out.

Jul 15 2012

Happy Friday the Thirteenth or Not

Cross posted from Friday the 13th news dump at The Stars Hollow Gazette

If it weren’t Friday the Thirteenth, you’d think it was April’s Fool. It’s all the usual excuses by the CEO’s and the TBTF banks, “we are just finding it was this bad”

JPMorgan Fears Traders Obscured Losses in First Quarter

JPMorgan Chase, which reported its second-quarter results on Friday, disclosed that the losses on a soured credit bet could mount to more than $7 billion, as the nation’s largest bank indicated that traders may have intentionally tried to conceal the extent of the red ink on the disastrous position. [..]

If the trades, made out of the powerful chief investment office unit in London, had been properly valued, the bank said it would have lost $1.4 billion on the position in the first quarter.

Jamie Dimon, the bank’s chief executive who has consistently reassured investors that the losses would be contained, announced that the bank lost $4.4 billion on the botched trade in the second quarter. So far this year, the bank says it has lost $5.8 billion on the trades in credit derivatives. [..]Since announcing the multibillion-dollar mistake, JPMorgan has lost $25 billion in market value.

Jamie Dimon finally admitting what we already knew but still not admitting that the real losses for the bank is closer to $30 billion. He is either the most incompetent CEO or he thinks that we’re all stupid to realize he knew about tis all along.

or “but Timmy wrote a memo”

Barclays Informed New York Fed of Problems With Libor in 2007

A Barclays employee notified the Federal Reserve Bank of New York in April of 2008 that the firm was underestimating its borrowing costs, following potential warning signs as early as 2007 that other banks were undermining the integrity of a key interest rate.

In 2008, the employee said that the move was prompted by a desire to “fit in with the rest of the crowd” and added, “we know that we’re not posting um, an honest Libor,” according to documents that the agency released on Friday. The Barclays employee said that he believed such practices were widespread among major banks.

In response, the New York Fed began examining the matter and passed their findings to other financial authorities, according to the documents.But the agency’s actions came too late and failed to thwart the illegal activities. By the time of the April 2008 conversation, the British firm had been trying to manipulate the interest rate for three years. And the practice persisted at Barclays for about a year after the briefing with the New York Fed.

Friday’s revelations shed new light on regulators’ role in the rate manipulation scandal. The documents also raise concerns about why authorities did not act sooner to thwart the rate-rigging.

The perp’s figured they were too big to indict and the Justice Department agreed.

In Barclays Inquiry, the Calculation in Making a Deal

The question needs to be faced in the wake of the bank’s admitted efforts to manipulate the London interbank offered rate, known as Libor, the benchmark for countless interest rate determinations and approximately $450 trillion in derivative contracts.

If the Justice Department was looking for a textbook case of white-collar financial crime – including a conspiracy that was flourishing at the height of the financial crisis – this would seem tailor-made. As the facts released by the government make clear, there were two separate but overlapping schemes to manipulate Libor within Barclays. Yet the bank secured a nonprosecution agreement and agreed to pay a penalty of more than $450 million, a comparatively paltry sum for a bank that had more than £32 billion ($50 billion) in revenue in 2011. “The perception so far has been that the regulators have been toothless,” John C. Coffee Jr., professor of law and specialist in white-collar crime at Columbia Law School, told me this week. [..]

(The criminal division said its agreement with Barclays was reached in conjunction with the antitrust division.)

And this is why Richard Diamond and Jamie Dimon have nothing to worry about and the world is still being screwed.

Jul 15 2012

LIBOR Effects on US Loans

Cross posted from The Stars Hollow Gazette

LIBOR just keeps getting bigger by the day, like a wildfire.

Effect of Libor on US loans examined

by Shahien Nasiripour at The Financial Times

US lawmakers have raised concerns that the alleged manipulation of the London Interbank Offered Rate, or Libor, may have harmed households, raising the stakes on a scandal that thus far has been confined to Wall Street and the City of London.

There are at least 900,000 outstanding US home loans indexed to Libor that were originated from 2005 to 2009, the period the key lending gauge may have been rigged, investigators have said. Those mortgages carry an unpaid principal balance of $275bn, according to the Office of the Comptroller of the Currency, a bank regulator.

During periods when banks were allegedly attempting to push Libor higher, households with loans tied to the gauge may have paid higher rates than necessary. However, if the rate was manipulated lower, households may have benefited from paying below-market interest rates.

“I think the US government should be just as aggressive in getting to the bottom of this scandal as the United Kingdom has been,” said Senator Sherrod Brown, chair of the bank regulatory subcommittee on the Senate banking committee.

“This was not isolated to London, but affected tens of millions of investors, borrowers and taxpayers in our country as well,” Mr Brown added.

Libor Investigation Extended to US Mortgages, but What About TALF Loans?

by Yves Smith at naked capitalism

One area we hope will be investigated is the impact on TALF borrowing. Some of the loans were priced off Libor, raising the specter that the banks might have gamed the rates not just for advertising purposes, but to game these programs. From the Federal Reserve Bank of New York’s website:

The interest rate on TALF loans secured by ABS backed by federally guaranteed student loans will be 50 basis points over 1-month LIBOR. The interest rate on TALF loans secured by SBA Pool Certificates will be the federal funds target rate plus 75 basis points. The interest rate on TALF loans secured by SBA Development Company Participation Certificates will be 50 basis points over the 3-year LIBOR swap rate for three-year TALF loans and 50 basis points over the 5-year LIBOR swap rate for five-year TALF loans. For three-year TALF loans secured by other eligible fixed-rate ABS, the interest rate will be 100 basis points over the 1-year LIBOR swap rate for securities with a weighted average life less than one year, 100 basis points over the 2-year LIBOR swap rate for securities with a weighted average life greater than or equal to one year and less than two years, or 100 basis points over the 3-year LIBOR swap rate for securities with a weighted average life of two years or greater. For TALF loans secured by private student loan ABS bearing a prime-based coupon, the interest rate will be the higher of 1 percent and the rate equal to “Prime Rate” (as defined in the MLSA) minus 175 basis points. For other TALF loans secured by other eligible floating-rate ABS, the interest rate will be 100 basis points over 1-month LIBOR.

Note again that some of the loans were priced off one-month Libor, which per the Barclays disclosures, were among the maturities manipulated; these are clearly a place to start [..]

The Market Has Spoken, and It Is Rigged

by Simon Johnson at The New York Times

In the aftermath of the Barclays rate-fixing scandal, the most surprising reaction has been from people in the financial sector who fully understand the awfulness of what has happened. Rather than seeing this as an issue of law and order, some well-informed people have been drawn toward arguments that excuse or justify the behavior of the Barclays employees.

This is a big mistake, in terms of the economics at stake and the likely political impact.

The behavior at Barclays has all the hallmarks of fraud – intentional deception for personal gain, causing significant damage to others.

The Commodity Futures Trading Commission nailed the detailed mechanics of this deception in plain English in its Order Instituting Proceedings (which is also a settlement and series of admissions by Barclays). Most of the compelling quotes from traders involved in this scandal come from the commission’s order, but too few commentators seem to have read the full document. Please look at it now, if you have not done so already.

The commission’s order portrays a wide-ranging conspiracy (or perhaps a set of conspiracies) to rig markets, including, but not limited to, any securities for which the price is linked to a particular set of short-term interest rates.

This past weekend on Up with Chris Hayes, Chris and his panel guests discuss the rate rigging scandal.